|

| By Bruce Ng |

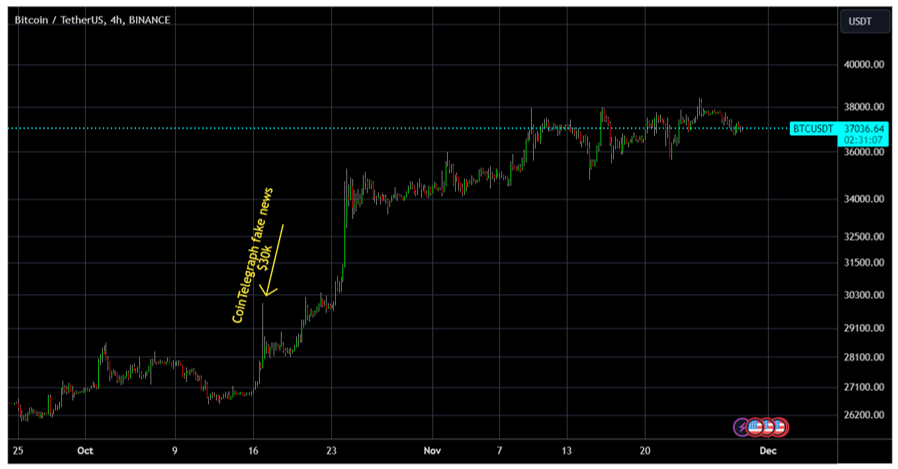

In the past week, Bitcoin (BTC, “A”) hit and managed to cross resistance at $38,000. However, it failed to hold above it and quickly retreated.

At the time of writing, BTC is trading sideways at the $37,000 level, with overhead resistance at $38,000 still strong.

The perp basis, which measures whether perpetual futures are higher or lower than spot prices, is negative. That tells me that this recent push up was a spot price-driven push, rather than from futures.

That’s healthy for the market, but it means we shouldn’t expect futures to drive Bitcoin over that resistance just yet.

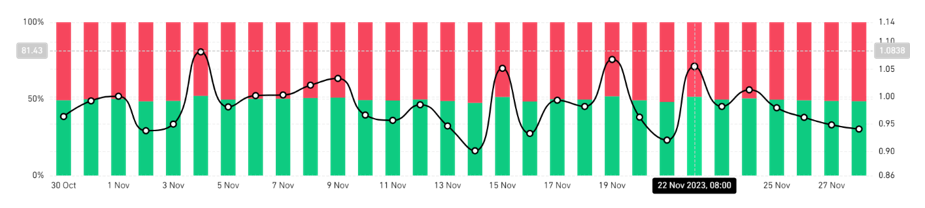

Looking at our long/short ratio, we see a similar story.

The long/short ratio is 48.5%/51.5%. As it’s leaning slightly more to the short side, we may get a small short squeeze upward above $38,000 … but the move may not be strong enough to hold and stay above it.

But I’m not worried about any of this. Bitcoin is finally showing signs of cooling down after a rally that lasted roughly 60 days. Remember, the latter half of any crypto market cycle is going to be a correction or cooldown phase.

And that’s what will set Bitcoin up for its next run. Well, that, and likely a few key macroeconomic factors.

When will that happen?

No one can say for sure. But we’ll likely start seeing signs in early 2024. We anticipate volatility will spike at the end of this year through the beginning of the next, as it does every year at this time. And that volatility could grow more pronounced if the next ETF approval deadline — scheduled for Jan. 1, 2024 — yields any exciting news.

In the meantime, however, the altcoin sector has been catching my attention.

It’s no secret alts have been on a tear recently, with top performers like Solana (SOL, “C+”) and Polygon (MATIC, “B”) making impressive gains since the start of October.

That’s just the beginning. Now that we’re at the start of the brand-new bull market, there are even more opportunities in small-cap altcoins. These new crypto projects have the potential to see massive gains if they have the right mix of fundamentals, narrative and adoption.

My colleague Juan Villaverde recently sat down with Weiss Ratings Founder Dr. Martin Weiss to break down what makes a small-cap opportunity so appealing, revealing a few of the ones that have caught his eye.

They’ve recorded this timely conversation and have decided to share it with you. You can watch it now, and I urge you do so, as it’ll be taken offline tonight.

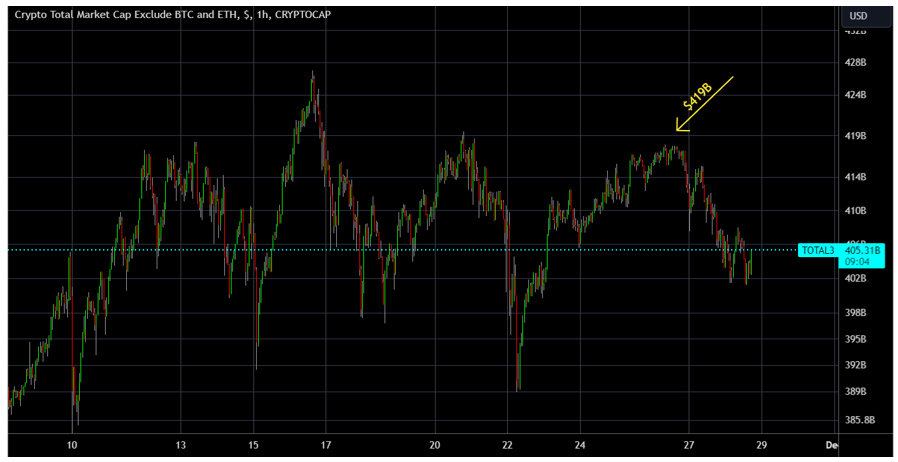

And it really is timely, as altcoins are now at a small discount due to Sunday’s pullback.

If you were still sleeping off your Thanksgiving feast, then you may have missed the market-wide correction that pushed prices down across the board on Sunday as Bitcoin’s cooling off chilled the alts, as well.

Indeed, the total market cap of the altcoin sector — which is crypto’s total market cap minus Bitcoin and Ethereum (ETH, “B+”) — dropped from $419 billion to $405 billion.

Let me be clear on this: If the alt you are holding dropped in tandem with the entire market, it means there is nothing fundamentally wrong with it. It just followed the ebb and flow of the entire market.

And that means any altcoins you want but aren’t yet invested in are trading at a discount. This is exactly why our team always reminds you that, in a bull market, corrections are opportunities.

I urge you to use this time wisely. That means loading up on well-performing, top Weiss-rated discounted altcoins. It means setting alerts right here on our Weiss Ratings website, so you get an email the moment an asset you like dips into your buying range or shoots up to where you’d like to take profits.

It also means moving any assets you purchase on a centralized exchange to your own self-custody wallet for additional security.

And always remember that all investing carries risk, especially in crypto. So never invest more than you can afford to lose.

Best,

Bruce