|

| By Marija Matic |

The cryptocurrency market is a wild ride. Prices can swing wildly, leaving even seasoned investors feeling disoriented.

In this environment, finding a safe and effective investment strategy is crucial.

Enter dollar-cost averaging, or DCA.

This is a simple method that's been around for decades in the TradFi market. And it’s showing no signs of going out of fashion in the crypto world, either.

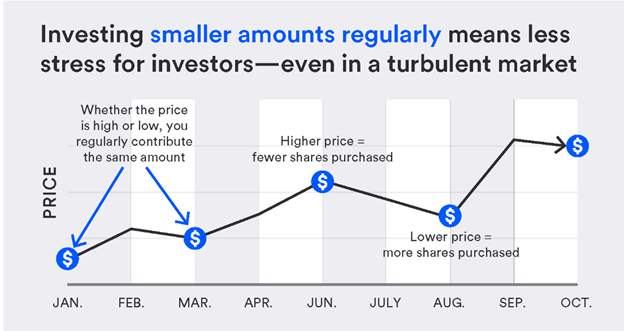

Simply put, it involves buying a set amount of an asset in steady amounts to give yourself a lower average entry price over time. This way, you can mitigate the impact of short-term price volatility for your long-term investments.

This removes emotion from the equation, preventing you from buying high and selling low due to market whims.

As crypto pioneer Michael Saylor aptly puts it, "The key to winning the game is not timing the market, it is time in the market."

Think of DCA as building a brick wall. Individual bricks might be expensive during peak periods and cheaper during market downturns. But by consistently adding bricks, you gradually build a sturdy wall regardless of short-term price fluctuations.

And there are three key reasons why DCA is a strong contender for one of the safest strategies in crypto:

- Reduces Risk: By averaging your cost per coin over time, DCA mitigates the impact of short-term price volatility. You buy more coins when prices are low and fewer when they're high, evening out your overall investment.

- Promotes Discipline: DCA instills a sense of discipline. You commit to a set plan, avoiding the temptation to chase quick gains or panic sell during downturns.

- Focus on the Long Game: DCA encourages a long-term perspective. You're not aiming for immediate returns but building wealth over time, which aligns perfectly with the potential of many cryptocurrencies.

DCA in Action: Proof That Patience Pays in Crypto

I quoted Michael Saylor before, so now let's take a closer look at his corporate Bitcoin (BTC, “A”) accumulation strategy. After all, it is a prime example of DCA in action.

Under Saylor’s leadership, business intelligence company MicroStrategy (MSTR) has been consistently buying Bitcoin since 2020.

By consistently investing at regular intervals during both bull and bear markets, it has been able to average out its purchase price.

Presently, the dollar-cost average for their Bitcoin investment stands at around $35,380.

With Bitcoin's current value hovering around $65,500, Saylor's initial investment has ascended 85.62% to $14 billion.

This demonstrates the power of DCA, especially when applied over a longer time horizon.

MicroStrategy is already the largest public company holder of Bitcoin, and it has yet to show any signs of stopping. Its commitment to DCA highlights the strategy’s effectiveness for long-term investments.

For both beginners and experienced investors, DCA removes the pressure of timing the market perfectly, allowing you to focus on other aspects of your crypto portfolio.

This is especially helpful in the face of the crypto market’s innate volatility. DCA offers a powerful and safe way to navigate these ups and downs, building wealth over time.

By focusing on consistency and discipline, as Michael Saylor suggests, you can leverage "time in the market" to capitalize on crypto's long-term potential.

Consider the recent surge in Bitcoin ETF inflows: A staggering $15.6 billion poured into these funds in just five months — a feat that took gold ETFs a whopping four years to achieve!

With DCA as a strategy, you won’t have to worry about catching the biggest wave of inflows. Instead, you sacrifice some gains to coast to shore without fighting the tide.

And there are even more developments already building the next wave of positive sentiment:

-

Slow and Steady Wins the Race: Despite wariness of the Bitcoin ETFs, financial advisors are on a gradual adoption journey, according to BlackRock.

This suggests a wave of more risk-averse investors will be entering the crypto market through these ETFs.

-

Digital Gold & Oil: The Industrial and Commercial Bank of China, or ICBC, is the world's largest bank with $6.6 trillion assets under management. And it recently praised crypto in its June 6 report.

According to that report, the ICBC views Bitcoin as digital gold, explaining that “Bitcoin retains the scarcity similar to gold through mathematical consensus, while solving its problem of being difficult to divide, difficult to identify authenticity and inconvenient to carry.”

Ethereum (ETH, “A-”), on the other hand, is considered digital oil, highlighting both top cryptos’ potential as valuable assets.

This surprising embrace by institutions speaks to the growing mainstream acceptance of cryptocurrency, paving the way for further price appreciation in the long run.

So, how can you leverage this potential, especially during a corrective market phase?

As I mentioned above, DCA remains a powerful tool. By consistently investing a fixed amount, you average out your cost per coin over time, capturing gains during the next bull run.

However, if you're an experienced investor seeking amplified returns, consider diversifying by exploring strategies like market making on DeFi platforms.

These yield-earning strategies can benefit from both expected volatility and price rises, making your crypto work harder for you.

In fact, I recently showed Weiss Ratings founder Dr. Martin Weiss how to do exactly that in our Superyield Conference. And the best part is the entire presentation has been recorded, so you can learn alongside Martin.

But I urge you to do so sooner than later. We’ll be taking it offline this week.

Best,

Marija Matić