|

| By Sam Blumenfeld |

• Bitcoin (BTC, Tech/Adoption Grade “A-”) is down about 2% so far today, as it hovers around the critical $40,000 price level.

• Ethereum (ETH, Tech/Adoption Grade “A”) is trading 3% lower, as it looks to hold itself above $2,800.

• Bitcoin’s crypto market dominance lost 30 basis points to 42.4% after peaking near 43.5% earlier in the week.

Bitcoin and the broader crypto market have struggled over the past week. They face three key challenges:

1. The Federal Reserve’s tightening fiscal policy,

2. Geopolitical risks, and …

3. Worsening sentiment from regulatory action.

With the greater possibility that the relief rally fizzles out, it’s possible that the Bitcoin could test its late-January low.

Reports indicate that the Biden Administration will likely issue an executive order targeting broader regulations for digital assets, and the market sold off on the news. It doesn’t help that crypto is still correlated to the equity markets, which continue selling off from concerns of interest rate increases and Russia invading Ukraine.

Bitcoin has fallen below its 21-day moving average again, which is a negative sign for short-term price action. The market leader tried to extend its relief rally, but its chart formed a double top before tumbling lower.

It’s looking increasingly likely that this relief bounce will be short-lived given the cycle’s shift and worsening sentiment.

Here’s Bitcoin’s price in U.S. dollars via Coinbase Global (COIN):

Ethereum and other altcoins have also lost their momentum and could face additional weakness if prices aren’t able to rebound soon. Ethereum crossed below its 21-day moving average, signaling the possibility of a continued slide.

The asset is down 36% over the past three months, but it still tracks a yearly gain of 43%. So, $2,700 should act as a support level, with $2,550 below that.

As the leader of altcoins, Ethereum’s direction will be important for the less-established projects.

Here’s Ethereum’s price in U.S. dollars via Coinbase:

Index Roundup

The broader crypto market struggled this week as traditional financial markets sold off and investors weighed the additional risks. Large-cap cryptocurrencies held their value better than more speculative projects.

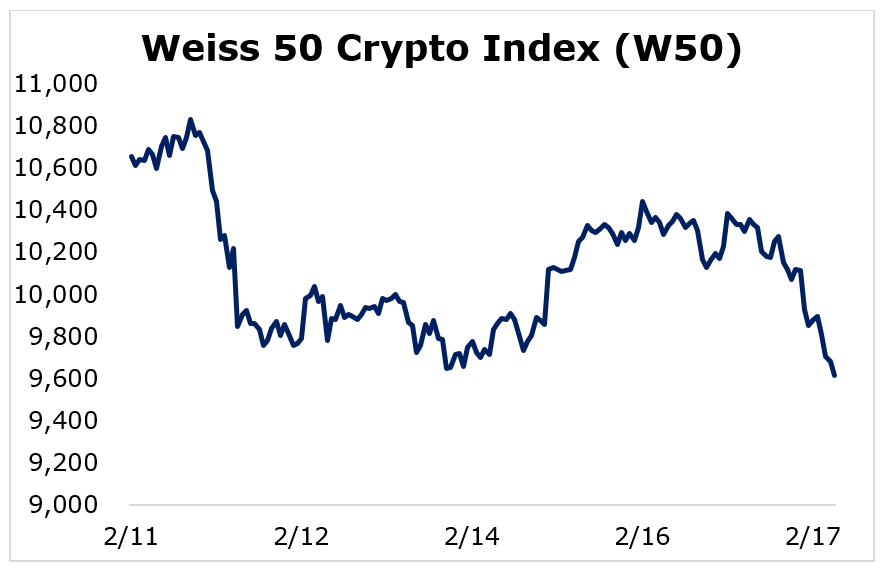

The Weiss 50 Crypto Index (W50) slid 9.74% as the broader market sold off.

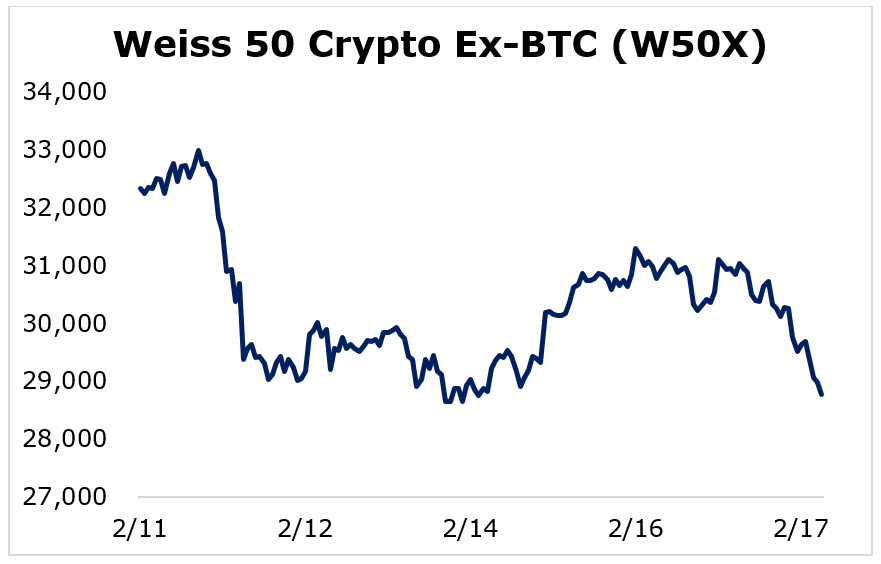

The Weiss 50 Crypto Ex-BTC Index (W50X) fell 11.02%, highlighting Bitcoin’s slight outperformance relative to altcoins.

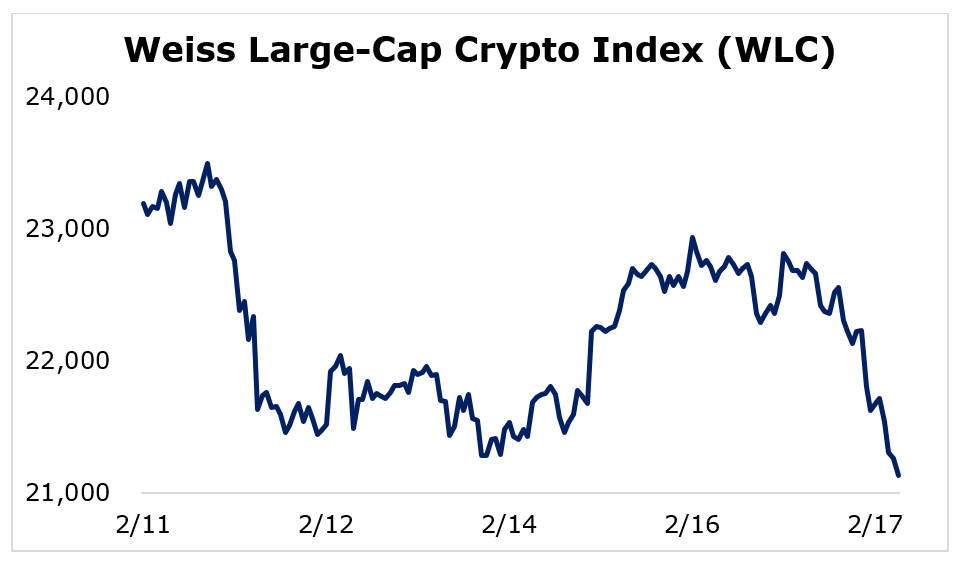

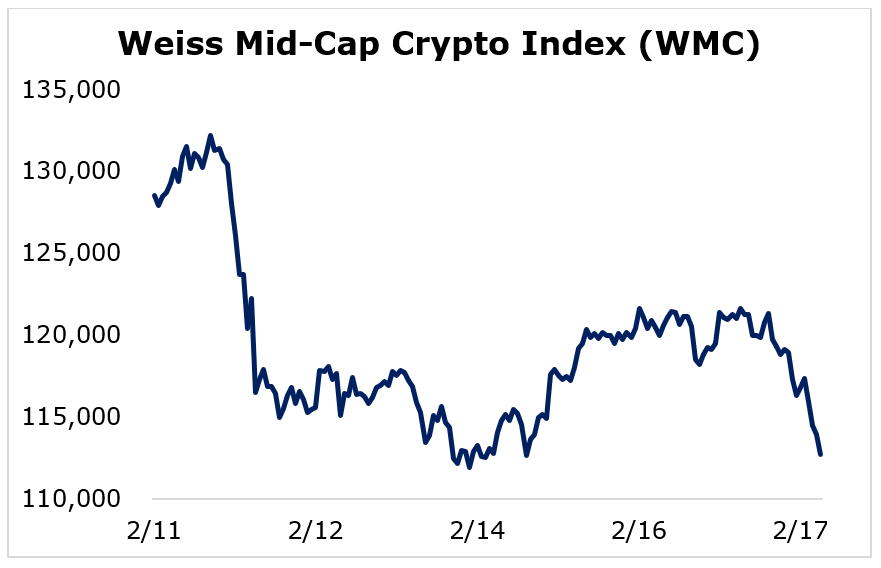

Breaking down performance this week by market capitalization, we see that the largest cryptocurrencies slipped less than their smaller- and mid-sized counterparts.

The large-caps held their ground the best due to their perceived safety, as the Weiss Large-Cap Crypto Index (WLC) dropped 8.88%.

Mid-cap cryptocurrencies had a tough week, with the Weiss Mid-Cap Crypto Index (WMC) losing 12.31%.

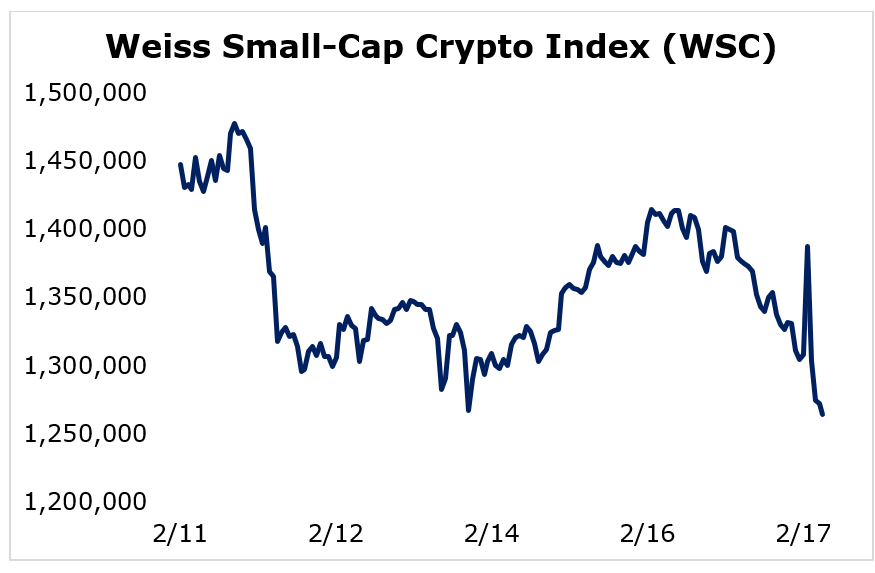

The small-caps were the worst performers this week by a slight margin. The Weiss Small-Cap Crypto Index (WSC) tumbled 12.65%.

The most established cryptocurrencies usually hold their value the best during periods of weakness, meaning the large caps will likely continue outperforming if this pullback extends.

Notable News, Notes and Tweets

• Pomp emphasizes Bitcoin’s unprecedented annual growth over a 10-year period.

• Wyoming lawmakers have proposed a bill that would lead the way for a state-backed stablecoin.

• JPMorgan Chase (JPM) is entering the metaverse by creating a lounge on the Decentraland platform.

What’s Next

The crypto market is facing significant headwinds from the Federal Reserve’s policy, regulatory risks and a potential Russian invasion of Ukraine.

These challenges have prompted investors to target “safer” asset classes, and they are contributors to the increase in correlation between crypto and growth stocks.

And that selling has had an immediate effect. Both market leaders — BTC and ETH — fell below their 21-day moving averages, which could potentially signal the end of the recent rally, according to our Crypto Timing Model. This could send cryptocurrencies sliding back to January’s low. From there, they could face additional weakness if the market continues sliding.

But while investors will likely see greater volatility over the short- to medium-term, these factors shouldn’t impact the long-term viability of crypto (keep an eye out for our Monday edition for more insight into why that is).

It may be a bumpy ride, but crypto investors in it for the long haul should benefit from the growing adoption.

Best,

Sam