|

| By Juan Villaverde & Alex Benfield |

Juan and I have been harping on the banking crisis for two weeks now, and for good reason.

There are direct parallels between Operation Choke Point 2.0, crypto regulation and the current banking crisis.

If you want to read more on Operation Choke Point 2.0 — i.e., the crusade on crypto — please check out Nic Carter’s most recent piece.

We have talked about it before, but the first three banks to go down were all crypto-friendly banks.

Contrary to other opinions you might hear on TV, however, they did not fail due to bad investments in crypto companies. They failed because of bad investments in the safest investment vehicle of all time: U.S. Treasurys.

More important, those banks are not even close to the only banks that have the same such problem.

For more on that situation, let’s turn to Juan.

The Consequences Are Still Unknown

Future historians will one day look back and identify March 8, 2023 — the day Silvergate Bank decided to wind down operations — as the day the Federal Reserve lost control.

After a year of rate hikes, aggressive rhetoric and historic market moves on the bond market, the chickens finally came home to roost.

After Silvergate came Silicon Valley Bank, which has since filed for bankruptcy. Then, another crypto-friendly bank called Signature Bank was also taken over by regulators and forced to sell most of its operation to Flagstar.

It is worth noting Signature’s crypto operations were shut down permanently, as were Silvergate’s. It is safe to say Washington is not a fan of crypto.

The panic spread offshore, too.

For instance, Credit Suisse Group (CS) was taken over by UBS Group (UBS) over the weekend. But only after a massive injection of liquidity by the Swiss National Bank — a de facto bailout.

The high priests of global finance quietly convened to tinker with the Fed’s swap arrangements with foreign central banks. These authorize the Fed to shovel unlimited amounts of freshly printed greenbacks to foreign central banks weekly upon request.

Only now the Fed can send money daily instead of just weekly, as previously scheduled.

What else have we learned since last week?

Assets on the Fed’s Balance Sheet Surge Again

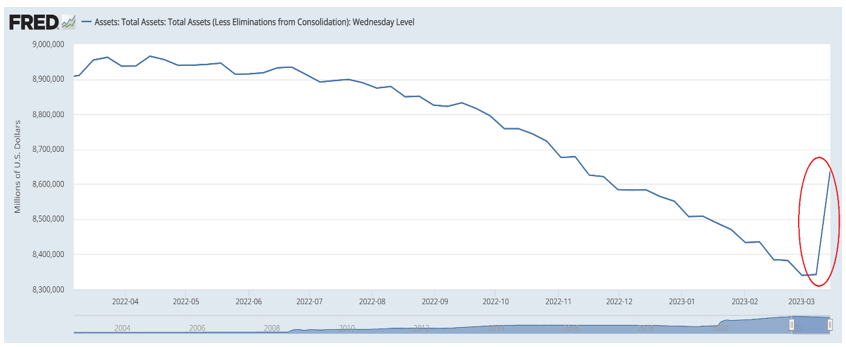

Click here to see full-sized image.

See the red oval at the far right-hand side?

That is over $300 billion freshly printed dollars in a week! Enough to reverse several months of quantitative tightening.

• Remember how Fed Chair Jerome Powell told us the QT program was on “autopilot”?

• Remember how he swore the Fed was committed to selling off assets on the balance sheet, sucking money out of the economy come hell or high water?

Well, all that talk, all that rhetoric, all that posturing has now been completely undone … in just a week!

And what you have seen so far is just the tip of the iceberg.

Fed officials have lost control of the narrative. And they are being forced to print money to bail out the financial system yet again.

What’s more, everything they have done since Silvergate is barely a drop in the bucket compared to what’s going to be required.

So far, Fed officials have guaranteed deposits on a few banks that failed, opened a few lines of credit and provided more frequent dollar funding to foreign central banks should they need it.

That is about it.

The credulous public is being told the situation is confined to a few bad actors who did a poor job of managing their “interest rate risk.”

What a steaming pile of equestrian fewmets!

There are already reports that some 190 banks across the U.S. face basically the same problems as Silicon Valley Bank.

Moreover, this should not come as a surprise. Because the problems facing American banks are global and systemic.

Virtually all over the world, governments are addicted to borrowing money. Every year the deficits grow larger and the spending programs become more ambitious.

Every election cycle, politicians make bigger and bigger promises they cannot possibly meet. And it is all funded by dumping ever-increasing amounts of debt onto the market.

Who is buying all those IOUs?

Well, the banks. And the Fed. All of which are deeply underwater now.

As the Fed is forced to print money to prevent systemic failure, more and more people will flee to the safety of bearer assets with no counterparty risk, and zero risk of debasement.

This is why you need to own hard assets like gold, Bitcoin (BTC, “A-”), Ethereum (ETH, “B”) and others.

As the financial system crumbles, more will turn to DeFi and crypto as a new, safer financial system.

That is going to drive crypto asset prices through the roof.

Mark my words: You ain’t seen nothin’ yet.

But for more on that, I’ll turn things back to Alex …

The Quest for a Better Financial Future

“Oh, you ain’t seen nothing yet. Baby, you ain’t seen nothing yet …”

Sorry, I couldn’t help myself.

We have been going on and on about this issue because this has everything to do with the state of international finance. The ongoing debt crisis started as an emergency measure to alleviate the pain of the 2008 Global Financial Crisis, but slowly developed into an addiction.

That addiction grows stronger every year, and that yearning can only be satisfied by more and more debt. Debt is the opioid crisis of governments and central banks, and the dope sickness continues to worsen and spread.

The financial system of today is a toxic mix of fractional reserve banking, fluctuating interest rates, bad debts and overspending.

There is a way out of that downward spiral, though, and we have been trying to lead you there for some time.

Cryptocurrency offers economic freedom and an escape from the debt-addicted centralized powers that be.

DeFi is the future, and the building blocks have already been created. The old guard will not go down without a fight, but we will continue to build the crypto future while they kick and scream.

We will continue covering the latest developments in the quest for a better financial future, so stay tuned to Weiss Crypto Daily.

Best,

Juan & Alex