|

| By Bruce Ng |

AI agents are the latest development in AI.

They operate autonomously to do tasks that previously required a human touch.

And our resident tech expert, Jurica Dujmovic, believes they will likely be the foundation of future growth in the AI sector for both TradFi and crypto.

As a growth investor, I am brimming with excitement at the opportunity AI agents present. That’s why I introduced you to cookie.fun last week.

It is the tool I use to find the best-performing projects that utilize AI agents in the last seven-day period.

But the key to crypto investing is selectivity. That’s true for newer, smaller crypto projects in general and is vital when it comes to AI agents.

That’s because anyone can create an AI agent. Heck, even an AI agent can create another AI agent!

With roughly 10 new projects listed each week, the market is flooded. And not all will succeed, which makes picking one to focus on difficult.

Because you don’t want to target projects that are just all right.

You should narrow your attention — and investments — to the ones that have the best potential to outperform.

And while the first strong mover will typically dominate, that isn’t always the case. That’s why I want to introduce a new criterion you can use to narrow down your options.

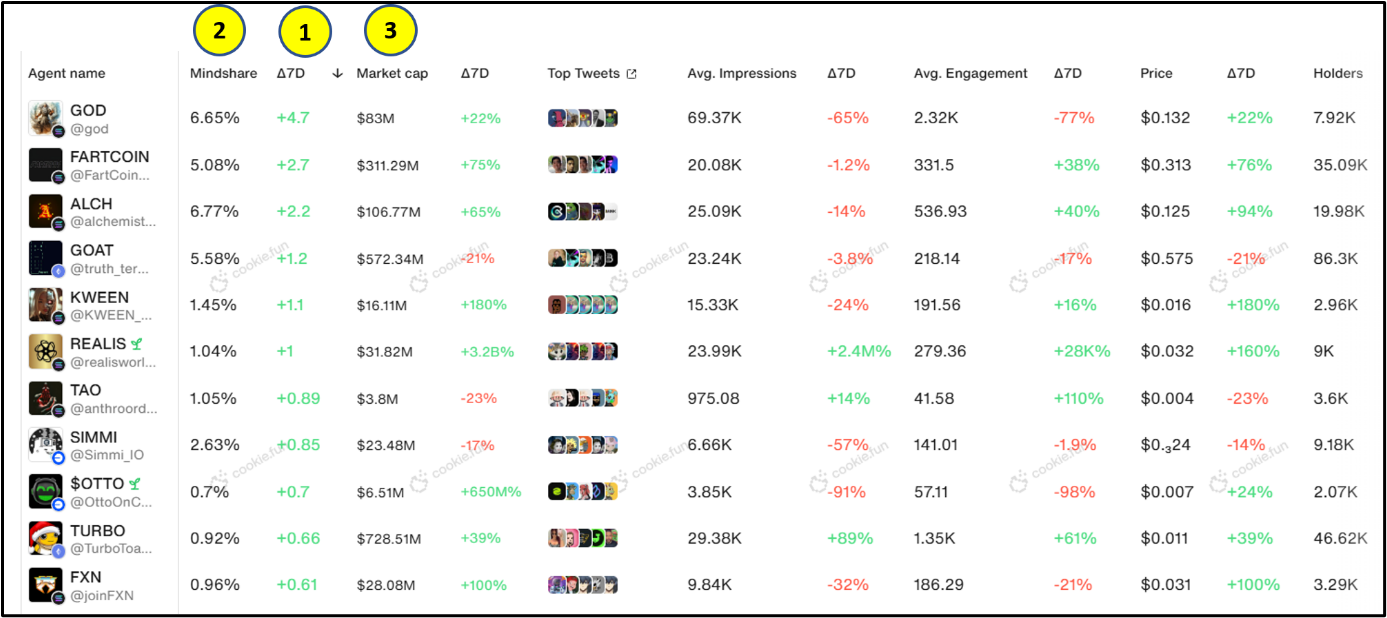

Let’s go back to cookie.fun for our dashboard:

Last week, I gave you two quick steps to get started.

- Sort the seven-day performance by descending order by clicking the 7D button, marked by the yellow 1.

- Look for the highest mindshare percentage of those top movers, marked by the yellow 2 above.

Remember, mindshare is a measure of social media engagement and popularity. And in the highly volatile and hype-driven crypto market, popularity is essential for continued growth.

Now, let’s add one last step …

- Sort the highest movers in the past seven-day period with the highest mindshare percentage by their market cap, marked by the yellow 3 above.

If you are looking for less risk exposure, you may want to select a project with a higher market cap. That means it is more established and, therefore, more stable than its competitors.

Alternatively, if you’re willing to take more risk for the potential to target greater returns, you may consider a project with a lower market cap. It’s less established … but has more room to grow.

In the chart above, I sorted the market cap field in descending order, so the largest and most established projects are on top.

Based on this approach, the coins God (GOD, Not Yet Rated), Fartcoin (FARTCOIN, Not Yet Rated), Alchemist AI (ALCH, Not Yet Rated) and Kween (KWEEN, Not Yet Rated) stand out.

Of course, this is just the start of your research.

Tools like cookie.fun and the criteria I listed can be valuable assets to help you sort real prospects from the noise.

But you will still need to look deeper into each project to determine if they are legitimate and have the fundamentals, tokenomics, team and vision to go the distance.

I took a close look at these coins, and I did see one with promise. In fact, I even recommended it to my New Crypto Wonders members.

I can’t say more here. But if you want to learn which one it is, why I chose it, and what other growth opportunities I believe will outperform in the next bull market rally, I urge you to watch my colleague Juan Villaverde’s latest briefing now.

In it, he breaks down our small-cap strategy to Weiss Ratings founder Dr. Martin Weiss. And he explains the four forces we believe will push this market even higher.

Then, he tells you how you can learn which coin here caught my attention … and which other cryptos I’ve told our members to buy now.

With the broad market taking a breath, this may be the last opportunity to get in before the bull market runs away from us.

So if you’ve been waiting to get into crypto, I suggest you watch the briefing now.

Best,

Dr. Bruce Ng