|

| By Marija Matic |

Political shake ups have sent aftershocks through the crypto markets over the past weeks.

My colleague Juan Villaverde touched on the market’s impressive rally following the assassination attempt on former President and current presidential candidate Donald Trump. But that’s already old news.

Yesterday brought new shockwaves as sitting President Joe Biden announced his withdrawal from the upcoming presidential race. This initially triggered a brief $2,000 dip in Bitcoin's (BTC, “A”) value due to the uncertainty, erasing millions in long positions.

The decline was quickly reversed once Biden endorsed Vice President Kamala Harris as the Democratic nominee, leading Bitcoin to surge to around $68,400 — its highest level since mid-June — before settling back down. It’s trading near $67,000 at the time of writing.

As Juan explained, the Trump-focused news caused a wave of bullish sentiment because Trump is seen as a more crypto-friendly candidate.

However, Vice President Harris’s stance on crypto remains unclear. That has fueled speculation that yesterday’s market rally might be driven by insider knowledge or the belief that she could have a weaker chance against Trump compared to Biden.

But I like to stick to facts, not speculation. So, what do we actually know?

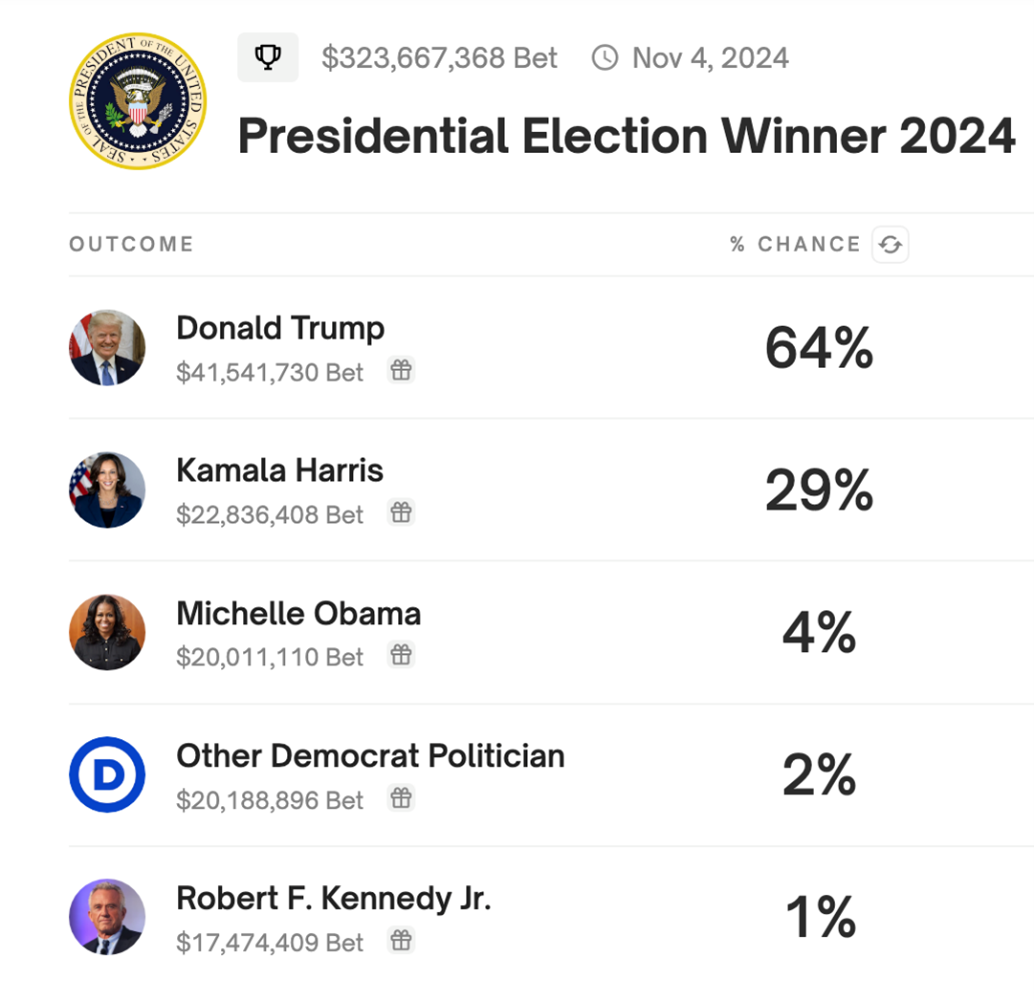

Well, let’s start with the fact that on the crypto betting app Polymarket, Biden's withdrawal dropped the odds of a Trump victory from 71% on Sunday to 64% on Monday.

Meanwhile, Kamala Harris' odds rose from 16% to 29%. For context, this crypto betting market is worth over $323 million:

To be clear, Polymarket isn’t an official poll. But it does give you a snapshot of sentiment among crypto enthusiasts when it comes to the U.S. presidential race.

No matter which side of the political spectrum you fall on, there’s no denying that the election will be adding near-term volatility to the market. So, keeping your thumb on the pulse is key to making sound, informed decisions between now and November.

Apart from overheated betting, political memecoins are experiencing a resurgence in response to the latest news.

The community is using this novel sector to either mock the political chaos or express their “endorsements.” In addition to the ones Jurica Dujmovic mentioned last week, new tokens themed around Kamala Harris, Michelle Obama and Hillary Clinton have recently launched and started to gain traction.

Moreover, this political turmoil has helped some large tokens break through significant resistance levels. For instance, Solana (SOL, “B”) has surpassed $173, and dogwifhat (WIF, “E+”) has broken through $2.50.

But I foresee more volatility ahead. Not from political headlines, but because of the next crucial event set to unfold tomorrow: the launch of the spot Ethereum (ETH, “A-”) ETFs.

To gauge their performance and determine how bullish they are for the second largest cryptocurrency, it’s essential to compare them with the wildly successful BTC spot ETFs.

The BTC spot ETFs are the most successful in ETF history. As of last week, they had attracted $16.2 billion in inflows since their launch in January, with assets under management reaching a record 891,000 BTC.

That’s 4.52% of the current BTC supply!

Given that Ethereum's market cap is approximately 31.5% of Bitcoin's, a 30% share of BTC ETF inflows sounds like the logical benchmark we can hope for.

In reality, though, the percentage is likely to be lower than that due to the lack of awareness about Ethereum. See, even people outside of the crypto community have likely heard about Bitcoin. But that same group is generally unaware of other cryptocurrencies, including Ethereum, despite the fact that Ethereum is the backbone of web3.

Additionally, Ethereum ETFs will not offer the staking option that provides extra yield and comparative advantage of ETH over BTC, though this might change in the future.

Therefore, I would consider anything above 20% of Bitcoin’s ETF flows as a success. That means, I’m hoping to see the Ethereum ETF inflow hit above $130 million.

A potential complication is the Grayscale Ethereum Trust (ETHE), which has a high fee of 2.5%. This might lead to some initial selling pressure, just like we saw with Grayscale’s Bitcoin trust when it converted to a spot ETF.

Additionally, 10% of ETHE will be used to seed Grayscale’s new mini-ETF, which has the lowest fee. For example, if an investor holds $1,000 in ETHE, $900 will remain in ETHE and $100 will be allocated to the new mini-ETF.

All this to say, I expect a lot of churn when the ETH ETFs are finally listed.

Together with the continued election season, that could spell more volatility for crypto in the months ahead. After all, there’s still plenty of time until Election Day. I expect more political headlines to move the market in the meantime.

For example, we still have Trump's speech at the Bitcoin 2024 conference in Nashville next week. Other notable speakers include fellow presidential candidate Robert F. Kennedy Jr. and ARK founder and CEO Cathie Wood.

Trump will also host a private VIP crypto fundraiser before the conference, with roundtable seats priced at $844,600. He has already garnered endorsements and major donations from Bitcoin investors, such as the Winklevoss twins. His speech might influence the markets big time.

And as a new front-runner for the Democratic Party, any comments made by Vice President Harris on crypto are sure to echo through the market as well.

As the political climate continues to evolve ahead of elections, so too will the strategies and sentiments within the crypto space. Politics will remain to be a critical area to watch leading into November, with each development potentially altering market conditions and opportunities.

Only time will tell if the net shift will be for good or ill, but I believe it’ll likely be for the better. After all, November is historically the most bullish month for crypto.

We just need to get through the roller-coaster ride first. So, keep up with your Weiss Crypto Daily updates for the latest on the market’s shake-ups. And for strategies to navigate them.

Best,

Marija Matić