Pudgy Penguins Waddle from Portfolio Pick to Wall Street

|

| By Jurica Dujmovic |

There's a special kind of satisfaction that comes from watching one of your early recommendations break out from the crypto community to gain mainstream attention.

In July 2023, I told members about Pudgy Penguins — an NFT collection inspired by the likes of CryptoPunks and Bored Ape Yacht Club.

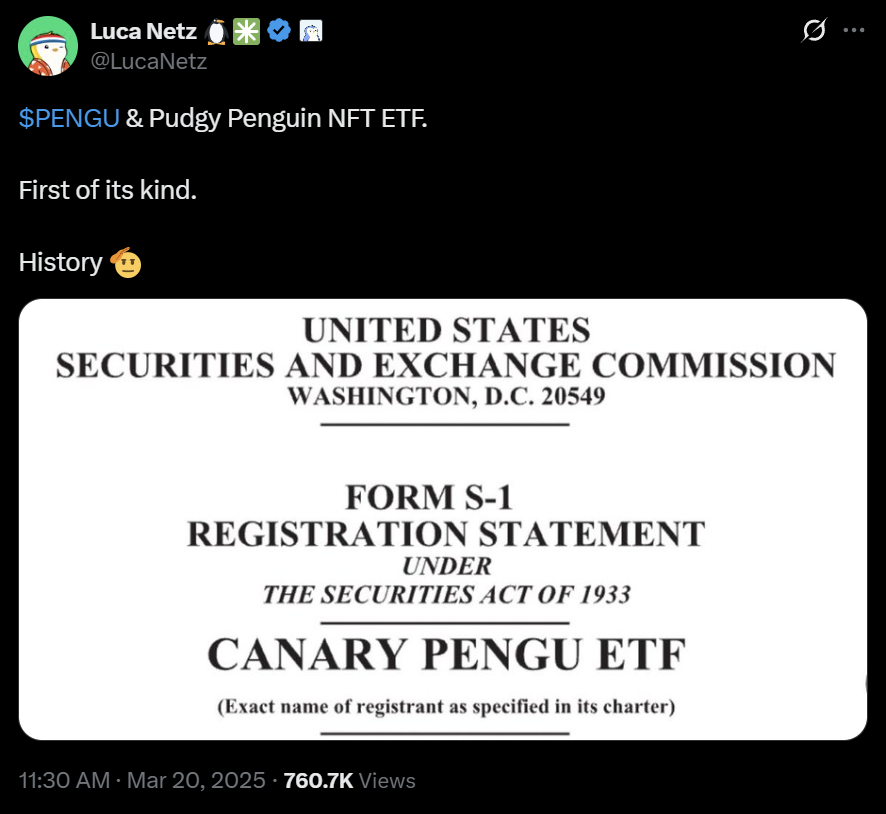

And now, this speculative digital collectible is the subject of Wall Street's first-ever NFT ETF filing.

As someone who's been tracking the NFT wealth-building space since its early days, seeing Pudgy Penguins make this leap feels surreal. Especially with the NFT narrative still flying under the radar following its meteoric rise in the last bull cycle.

But before we get carried away with the historic nature of this development, let's dive deep into what this actually means.

And whether it's the brilliant innovation it appears to be … or nothing more than an elaborate publicity stunt wrapped in regulatory paperwork.

The Pudgy Penguins Phenomenon: More Than Just Memes

For those unfamiliar with the Pudgy Penguins story, it reads like a classic redemption arc in the often chaotic world of NFTs.

Originally launched in 2021 as 8,888 cute cartoon penguin avatars on the Ethereum (ETH, “B+”) network, the project nearly collapsed under early founder drama and community abandonment.

Enter Luca Netz and his team, who acquired the project in 2022 and transformed it from a failing NFT collection into something approaching a legitimate intellectual property franchise.

What sets Pudgy Penguins apart from the thousands of dead NFT projects is its aggressive push into real-world brand building.

These aren't just profile pictures for crypto Twitter; they're plushie toys now selling in Walmart, viral GIFs with billions of views and a growing entertainment brand that bridges web3 with mainstream consumer markets.

The introduction of the PENGU token in late 2024 was another strategic masterstroke. It created utility and governance mechanisms while airdropping tokens to existing NFT holders.

It's this kind of thoughtful ecosystem development that caught my attention in the early Weiss NFT Wealth Builder recommendations.

And apparently, it caught Canary Capital's attention, too.

The Canary Capital Strategy: First-Mover Advantage or Spray-and-Pray?

Canary Capital, led by former Valkyrie Investments CIO Steven McClurg, has been on an absolute tear with ETF filings lately.

PENGU joins applications for a portfolio of filings that suggests either brilliant strategic positioning or a "throw everything at the wall and see what sticks" approach.

These include …

- Hedera (HBAR, “B”),

- Axelar (AXL, Not Yet Rated),

- Sui (SUI, “B-”),

- LiteCoin (LTC, “C+”),

- XRP (XRP, “B-”), and

- Solana (SOL, “B”)

The reality is probably somewhere in between.

Canary seems to have bet that the current crypto-friendly regulatory environment — helped along by the new presidential administration's pro-crypto stance — creates a narrow window for approval of novel products.

By being first to file for various niche exposures, it positions itself to capture first-mover advantages if and when approvals come through.

The PENGU ETF specifically makes sense within this strategy because it's genuinely differentiated.

While other firms file for yet another Solana or XRP ETF, Canary chose to pursue uncharted territory with NFT inclusion.

Whether this differentiation translates to investor interest remains the million-dollar question.

Breaking New Ground: What Makes This ETF Different

Traditional ETFs are fairly straightforward affairs. They give you exposure to markets without needing to select individual stocks for yourself.

You want exposure to the S&P 500, for example? Just buy Vanguard S&P 500 ETF (VOO).

But when Canary Capital filed its S-1 with the SEC for the PENGU ETF, it wasn’t simply seeking permission to track another stock index or commodity.

It essentially asks regulators to let them create a fund that would hold actual JPEGs of cartoon penguins alongside cryptocurrency tokens.

Let that sink in for a moment.

The proposed structure is genuinely unprecedented: 80-95% of the fund would hold PENGU tokens. That is the Solana-based cryptocurrency that powers the Pudgy Penguins ecosystem. The remaining 5-15% would consist of actual Pudgy Penguins NFTs — the unique digital collectibles themselves.

Add small holdings of ETHand SOL for operational purposes, and you have what amounts to a hybrid crypto fund meets digital art gallery, all wrapped in the familiar bow of an exchange-traded product.

This isn't like those "NFT-themed" ETFs that popped up during the 2021 boom. Those merely held stocks of companies involved in the metaverse or blockchain gaming.

The PENGU ETF, on the other hand, would literally own the underlying digital assets — a first for the regulated investment world.

Market Reception: Enthusiasm Meets Skepticism

The announcement created predictable reactions across different communities.

Within the Pudgy Penguins ecosystem, the response was nothing short of euphoric. Luca Netz called it "history," community members shared rocket emojis and both PENGU token and NFT floor prices saw modest bumps on the news.

Outside the immediate community, reception was more measured.

Prominent crypto analyst Alex Krüger captured the broader market sentiment with his observation that "new ETFs for crypto assets have become an irrelevant joke" and that most will "fail to attract AUM and cost issuers money."

It's a harsh but potentially accurate assessment: The proliferation of niche crypto ETF filings may be outpacing actual investor demand.

The broader context matters here. NFT trading volumes in 2024 hit their lowest levels since 2020, and even "blue chip" collections like Pudgy Penguins have seen significant price declines from their peaks.

Launching an NFT-focused ETF into this environment requires either exceptional timing or exceptional conviction about an upcoming turnaround.

Investment Perspective: Revolutionary or Ridiculous

From a pure investment standpoint, the PENGU ETF occupies fascinating territory between innovation and speculation.

On the positive side, it offers exposure to digital assets that would otherwise require technical knowledge to acquire and store safely. For institutional investors with mandates preventing direct crypto holdings, it could provide regulated access to an emerging asset class.

The diversification within the Pudgy Penguins ecosystem is also noteworthy: you're not just betting on NFT appreciation or token performance, but on the overall success of the brand and community.

If Pudgy Penguins achieves their apparent goal of becoming the next Hello Kitty or Pokémon of the digital age, both the tokens and NFTs could see substantial appreciation.

However, the risks are equally substantial.

This is an incredibly concentrated bet on a single ecosystem within a volatile and nascent market. And the illiquidity concerns are real.

During market stress, the ETF's price could deviate significantly from its net asset value. And there's the fundamental question of whether enough investors actually want this exposure to make the fund viable long-term.

The fee structure (still undisclosed) will also be crucial.

Given the active management requirements and custody complexities, management fees are expected to be well above typical ETF standards. And that could eat into returns even if the underlying assets perform well.

As someone who recommended Pudgy Penguins in the early days, this evolution has been genuinely fascinating.

The project has consistently executed on building real value beyond mere speculation — a feat most NFT collections failed to accomplish.

However, whether the PENGU ETF ultimately succeeds depends on several factors, most of which are largely outside Canary Capital's control, such as

- Gaining SEC approval (far from guaranteed),

- Broader NFT market recovery and,

- Sustained mainstream interest in the Pudgy Penguins brand.

The Bigger Picture: Cultural Assets Meet Traditional Finance

Stepping back from the immediate investment considerations, the PENGU ETF represents something more significant: the potential legitimization of digital culture as an investable asset class.

We're witnessing the first serious attempt to package community-driven digital brands into traditional investment vehicles.

If successful, this could open the floodgates for similar products. In fact, we could be looking at the birth of an entirely new category of cultural investing.

The coming months will determine whether these adorable digital penguins can successfully waddle their way into mainstream investment portfolios …

Or whether they remain a fascinating footnote in the ongoing convergence of crypto innovation and traditional finance.

Either way, we're witnessing financial history in the making — one cartoon penguin at a time.

And I, for one, am eager to see how this plays out.

But if you’re looking for more immediate action to take in this market, I strongly suggest you watch our latest Crypto All-Access Summit.

In it, Juan Villaverde breaks down the three unstoppable forces he expects will push the crypto markets even higher in the coming months.

And he reveals several strategies you can use to make the most of them.

Best,

Jurica Dujmovic