|

| By Marija Matic |

The latest regulatory crackdown — this time on Binance USD (BUSD, Stablecoin) — has shaken the broad market.

Almost all cryptos are trading deeply in the red since learning that Paxos Trust Company is about to halt the issuance of new BUSD stablecoins amid the ongoing probe by the New York State Department of Financial Services.

NYSDFS released a statement — that was sparse on details — explaining their issue was with BUSD issued by Binance on the Binance chain. The Ethereum-basedversion issued by Paxos is regulated by their department, but Binance's version is not. NYSDFS views this as an "unresolved issue" between the two issuers, and that Paxos' management of the stablecoin left it vulnerable to use by bad actors.

So, the regulators decided to ask Paxos to halt new issuance and break ties with Binance, and in response, Paxos has announced that it will end its relationship with Binance officially starting today.

There is some good news in all this: Existing BUSD tokens are fully-backed — by fiat and U.S. Treasury bills — and are redeemable through Paxos through at least February 2024, based on the company's assurances.

Customers can redeem their funds in U.S. dollars or convert their BUSD for Pax Dollar (PUSD), another Paxos-issued stablecoin.

On the other side, Binance CEO Changpeng Zhao — who goes by CZ — has said that Binance will continue to support BUSD "for the foreseeable future." He does, however, acknowledge the likelihood of users migrating to other stablecoins over time.

Binance plans on making product adjustments accordingly, namely by moving away from using BUSD as the main pair for trading.

But regulators apparently aren't quite done with BUSD. Cointelegraph reports that the Securities and Exchange Commission has also issued a Wells Notice — a letter the regulator uses to tell companies of planned enforcement — to Paxos, alleging that Binance USD is an unregistered security.

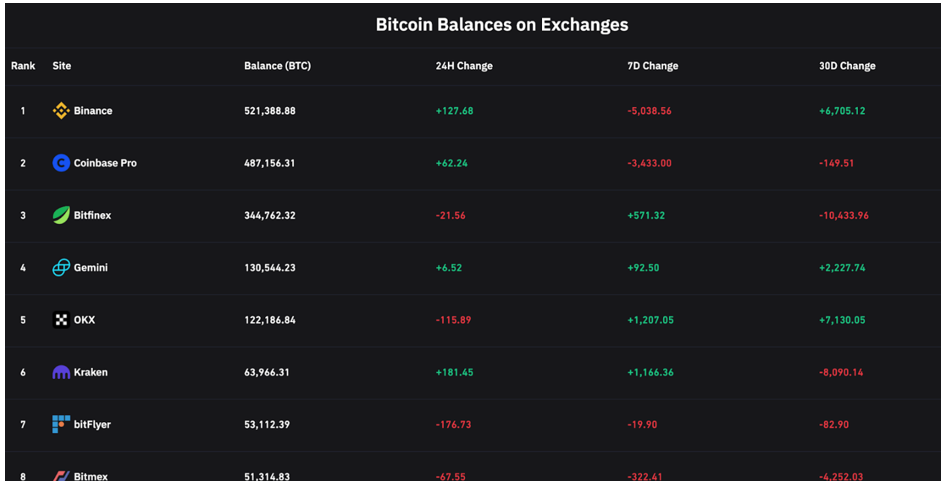

Despite this and apart from the broad selling pressure, however, crypto users don't seem to be panicking when it comes to Binance. There is no bank run on exchanges as of writing, based on Coinglass data:

Click here to view full-sized image.

Similarly, there was no bank run on Kraken exchange after it saw a crackdown on its staking services a few days ago.

Even taking short-term selling pressure into account, this broad resilience is a positive silver lining that speaks to the strength of the industry.

Notable News, Notes & Tweets

- Let's dive into what Kraken's SEC settlement means for crypto staking.

- Tether (USDT, Stablecoin) nears 50% of stablecoin market, its highest in 14 months.

What's Next

I am interested to see if the SEC will truly start a lawsuit based on the idea that BUSD is an unregistered security. The result of such a trial would have negative implications for other stablecoins as well, such as USD Coin (USDC, Stablecoin).

It's no wonder that non-U.S. based stablecoins, like USDT, are gaining dominance today.

But to be clear, people do not buy BUSD or other stablecoins for that matter, to profit from them as an investment. After all, their value should always be $1.

So, based on the Howey test — a four-prong test used in determining whether an "investment contract" exists — BUSD is not a security.

But the Securities Act of 1933 has much broader scope and under it, almost anything can become security if the SEC decides to play mental gymnastics. And based on the serious crusade against crypto SEC Chair Gary Gensler has been on for the past few days, that may not be out of the realm of believability.

Some are even speculating whether this could be somehow related to Gensler's connection to Sam Bankman-Fried, the founder of the collapsed FTX exchange. But that remains speculation for now.

I'll be keeping an eye on this developing situation as it unfolds, so stay posted for more updates.

Best,

Marija