|

| By Mark Gough |

On Oct. 23, President Trump pardoned Changpeng Zhao, the Binance founder who had pled guilty to enabling money laundering as the head of the exchange.

The news immediately triggered near-term bullish momentum for BNB (BNB, “C+”), as I explained at the time.

Now, it seems, another infamous crypto founder — Sam Bankman-Fried — is looking for his own redemption arc.

But whether he succeeds or fails is about more than one man.

It’s the canary in the coal mine for how crypto fraud cases will be handled going forward.

And whether crypto has really earned the legitimacy its received over the past year.

The Appeal That Fell Flat

Sam-Bankman Fried — often called SBF in the crypto community — was once considered crypto royalty.

That is, until the collapse of his FTX exchange in 2022. Prior to it, FTX was the third-largest exchange by volume and boasted over 1 million users.

A collapse that big would be tough enough for a founder to survive. But the nail in the coffin came a year later. That’s when Bankman-Fried was convicted on seven counts of fraud and conspiracy.

He was sentenced to 25 years in prison and ordered to pay $11 billion in restitution.

And that was where his story ended … until yesterday.

While most were watching the markets with bated breath, SBF made a play he hoped would start the process of getting his 25-year prison sentence thrown out.

And it went about as well as you’d expect when someone’s main argument is, “I never did anything wrong.”

Put simply, Sam Bankman-Fried’s legal team appeared before a three-judge panel at the Second Circuit Court of Appeals in Manhattan.

Their appeal argument was that SBF’s fraud trial was “fundamentally unfair” and he deserved a do-over.

His attorney, Alexandra Shapiro, claimed the jury “only got to hear one side of the story,” and that trial judge Lewis Kaplan made rulings that unfairly favored prosecutors.

Bankman-Fried’s appeal rests on three main claims. And all are centered on the idea that he was “presumed guilty” before the trial began:

-

Blocked Defense Strategy:

In the initial trial, Judge Kaplan allegedly prevented SBF from explaining that FTX’s lawyers helped structure the company in ways prosecutors later claimed were fraudulent.

Shapiro argued this barred Bankman-Fried from presenting an “advice-of-counsel” defense. In essence, his claim is that he thought everything was above board because the lawyers approved it.

-

FTX Was Solvent (Supposedly):

The defense claims Judge Kaplan refused to let them argue that FTX wasn’t actually insolvent and that this fact undermined the entire fraud narrative.

SBF insists that if customers could have been repaid, there was no fraud.

-

Judicial Bias:

The appeal accuses Judge Kaplan of showing bias via mocking SBF’s testimony, ridiculing the defense, and allegedly pressuring jurors to reach a verdict by offering dinner and transport incentives.

The “FTX Was Never Insolvent” Bombshell

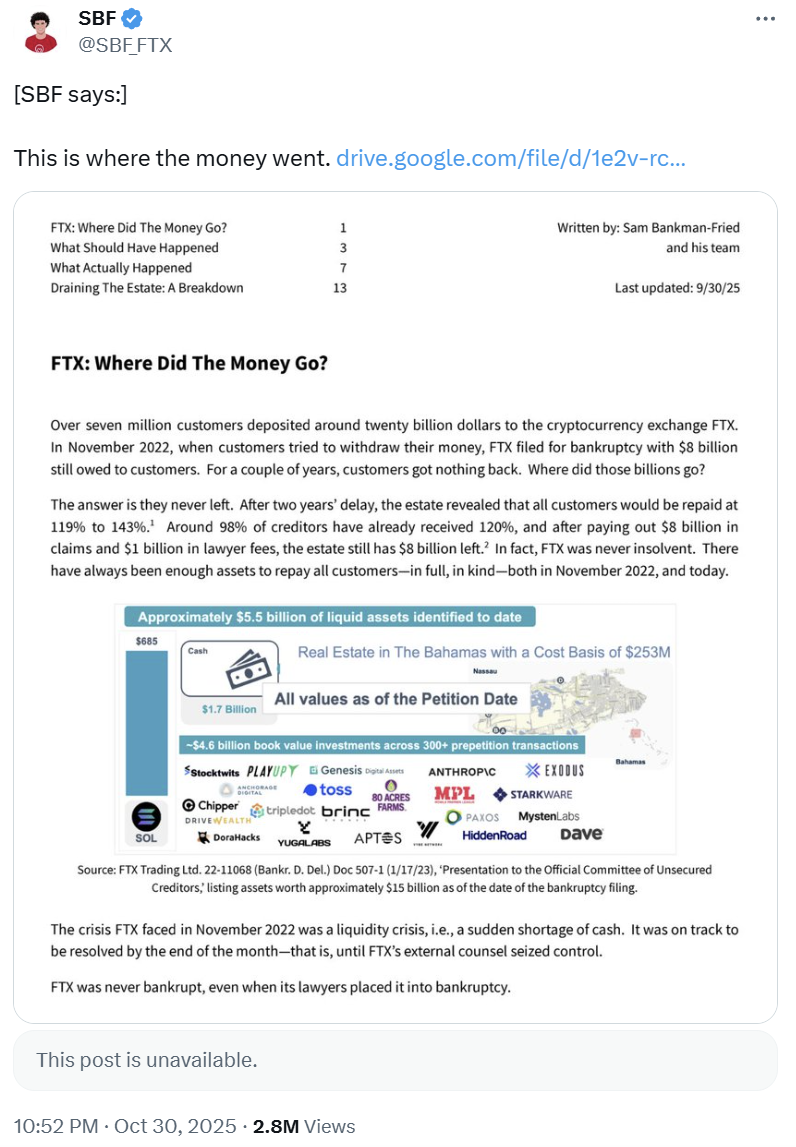

Perhaps the boldest of these claims is the second one. Bankman-Fried maintains FTX wasn’t bankrupt at all when it collapsed in November 2022.

In a recent X post, he argued that FTX had $25 billion in assets against $8 billion in withdrawals. Meaning that FTX was facing a liquidity mismatch, not insolvency.

He blames outside bankruptcy lawyers for destroying what remained, alleging they:

- Dumped $7 billion in FTT tokens,

- Sold assets below market value and

- Racked up nearly $1 billion in legal fees.

Had they stayed out of the way, he claims, FTX “could have been solvent again by the end of November.”

Why the Judges Aren’t Convinced

Prosecutors countered that the evidence of fraud was overwhelming.

Assistant U.S. Attorney Nathan Rehn reminded the panel that three of Bankman-Fried’s closest associates — including ex-girlfriend Caroline Ellison — testified they conspired with him to steal billions in customer funds.

Prosecutors also pointed out that Kaplan actually gave SBF extra leeway — including an unusual “preview” hearing that let him rehearse testimony out of the jury’s earshot.

Instead of bias, they said it showed judicial caution.

As for the solvency argument, prosecutors dismissed it outright.

SBF wasn’t convicted for mismanaging liquidity. He was convicted of stealing $8 billion in customer deposits to fund Alameda Research — his crypto trading firm — to buy luxury properties and make political donations.

The appeal panel didn’t seem impressed.

Judge Barrington Parker delivered the line of the day: “Based on my review of the record, there is substantial evidence indicating guilt.”

What Happens Next

The appeals panel will now deliberate and issue a written ruling, likely in a few months.

Their options:

- Uphold the conviction,

- Order a new trial,

- Reduce the sentence or

- Send the case back to Judge Kaplan with instructions.

Based on the tone in court, legal analysts say an overturned conviction is highly unlikely.

The judges’ repeated skepticism — and their references to “substantial evidence of guilt” — suggest SBF’s arguments fell flat.

Why It Matters

This isn’t just about one man’s downfall.

Bankman-Fried’s appeal could shape how future crypto fraud cases are prosecuted. Especially when you consider his appeal arguments.

Going forward, regulatory experts will pay careful attention to …

- The “advice-of-counsel” defense in complex financial crimes,

- The relevance of exchange solvency to fraud charges, and

- The judiciary’s approach to high-profile crypto defendants.

Still, based on Tuesday’s hearing, it seems the courts aren’t buying his redemption story.

Unless the panel surprises everyone, Sam Bankman-Fried will be spending the next two decades reflecting on his choices … from behind bars.

Ultimately, that could end up benefiting the broad market more than you’d think. Namely, as it would reinforce the legitimacy crypto has fought for in the eyes of an increasingly crypto-curious population.

Still, this is a classic, loud crypto headline. One that can move an already susceptible and volatile market on FUD — fear, uncertainty and doubt — and speculation.

As such, I’ll be keeping a close eye on how Bankman-Fried’s last attempt at redemption plays out.

Best,

Mark Gough