|

| By Chris Coney |

In traditional finance, index funds offer a relatively safe way to achieve a diversified portfolio by mirroring a benchmark index, such as the Nasdaq or the S&P 500.

But did you know there’s a crypto version of indexes?

According to DeFi Llama, there’s already a few dozen decentralized finance platforms offering crypto-based index products.

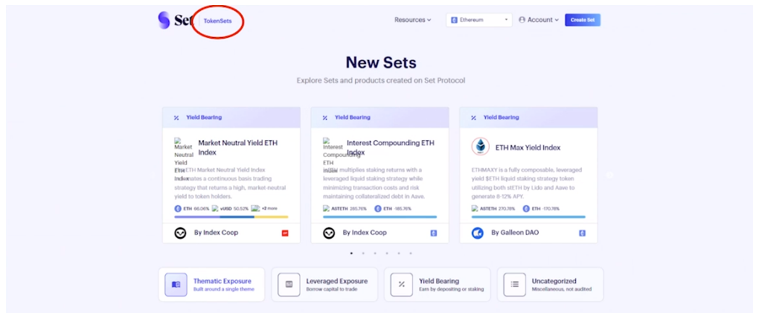

But the one with the largest total value locked at $114 million is called Set Protocol, which we’ll use as an example for demonstration purposes today.

Set Protocol offers the opportunity to invest in TokenSets — essentially, the crypto equivalent of an index fund.

There are three main categories of investments to choose from, including:

- Sets that are centered around a certain theme, such as DeFi or the metaverse …

- Sets that invest in a fund centered around leverage …

- And sets that are calibrated for yield.

Each set is produced by a set creator.

Anyone can become a set creator and earn annual management fees based on the fund’s market cap.

But before we touch on that topic, let’s take a look at indexes from an investor’s perspective.

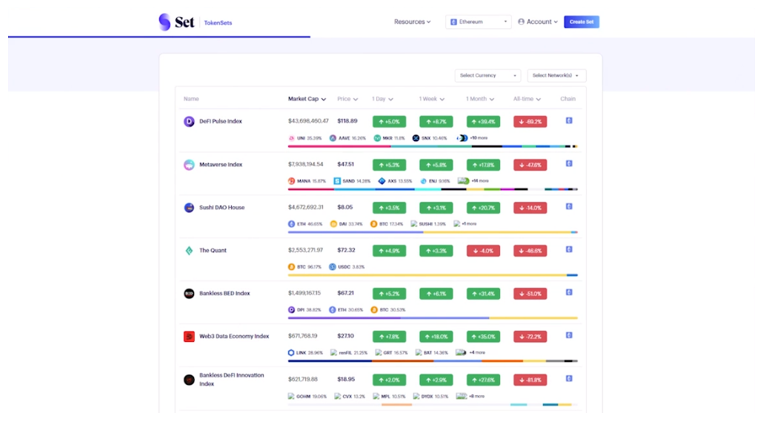

Here’s a list of sets organized by market cap, with each row giving an instant overview of the set:

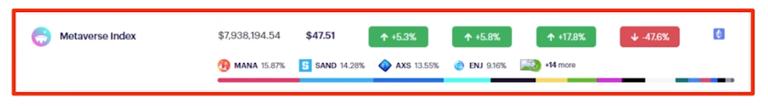

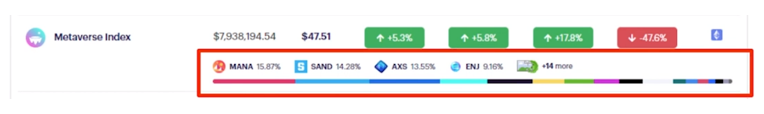

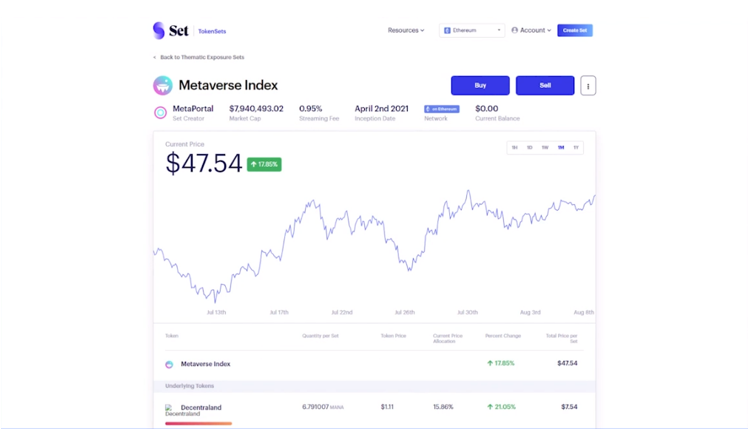

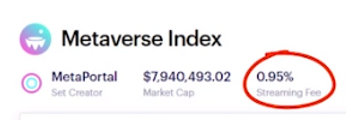

Zooming in on the Metaverse Index, it has a market cap of about $8 million; a share in the index currently trades for $47.51; it’s based on the Ethereum (ETH, Tech/Adoption Grade “A”) network; and there’s an overview of the major holdings in the set.

At a glance, I can see this set is mostly composed of Decentraland (MANA, Tech/Adoption Grade “B”), Sandbox (SAND, Tech/Adoption Grade “B”), Axie Infinity (AXS, Unrated) and Enjin Coin (ENJ, Tech/Adoption Grade “B-”). But there are also 14 other smaller holdings.

Clicking on a set provides more details, such as historical share price performance, the name of the set creator, the annual management fee, when the set was created, as well as a full breakdown of assets in the set and their allocations.

Investing in the set is as simple as buying any other crypto asset.

You can click Buy …

Which will lead to a pop-up window that will allow you to purchase the index shares with either Tether (USDT), USDCoin (USDC), Bitcoin (BTC, Tech/Adoption Grade “A-”), Ethereum or Dai (DAI).

And that’s it.

From there, we can just hold those shares and sell them later for a profit or loss depending on the performance of the fund and the time we choose to exit.

Before you invest, though, you may want deeper insight into the underlying strategy used by the set to gain a better understanding of what you’re putting your money into.

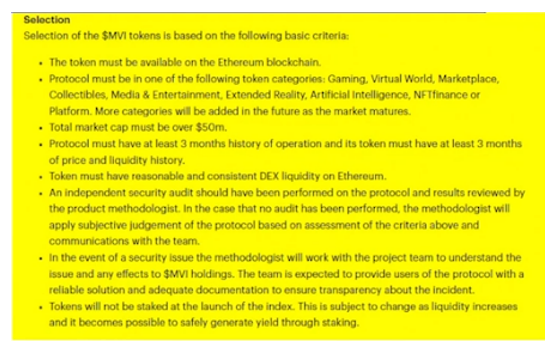

This information can be found underneath the asset allocation table and is split up into several interesting sections.

One of which is the selection criteria the set uses for investing in assets:

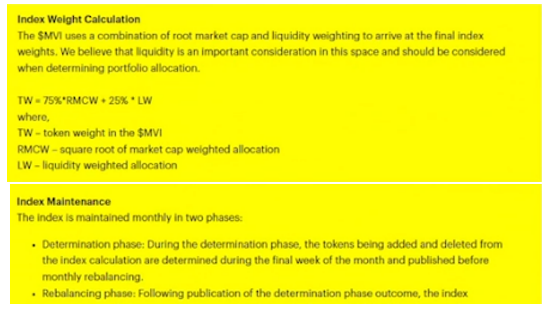

Then there’s a section on how assets are weighted, as well as a section detailing when and how the set is updated and rebalanced:

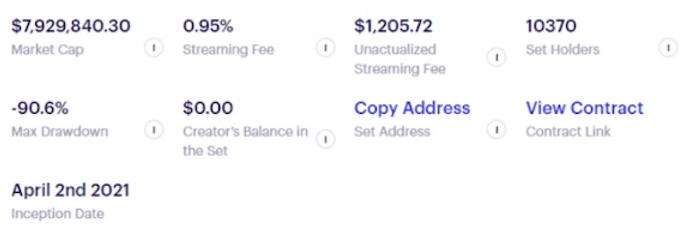

But perhaps the most interesting is the area that displays the raw numbers.

This is where we can find out stats like how many wallets are holding shares in the index, if there are any management fees that are yet to be claimed by the Set Creator and how much the creator has invested in the fund.

In this particular case, the creator has none of their own funds invested. Make of that what you will.

If you’re worried about the safety of your money, the good news is this process is all done on-chain.

When a Set Creator deploys a new set, it’s a brand-new smart contract specifically deployed (in this case, on Ethereum) for that purpose. That smart contract then acts as the custodian for all the assets in the set.

This means that neither the TokenSets app developers nor the set creator has access to the deposited funds.

The agreement is solely between you and the smart contract, which is the way it should be in DeFi.

The only call on your assets the set creator has is the annual fee that you agree to upon purchase, which the smart contract enforces.

This method also allows you to save money on all the trading and transaction fees that you would otherwise incur, because with an index, you’re just holding a share token.

All the trading and transaction fees are borne by the fund as a whole, so you don’t have to do a thing.

So, there you have it …

A new way to greatly simplify your crypto investing endeavors by outsourcing all the heavy lifting to third-party asset managers.

Let me know your thoughts on investing in crypto indexes by tweeting @WeissCrypto.

And make sure to pop back in next week for my next crypto update.

Until then,

Chris Coney