|

| By Chris Coney |

Both Celsius (CEL, Tech/Adoption Grade “C-”) and FTX did something shocking before they went under.

They completely repaid their decentralized finance loans.

I’m going to use Celsius as an example here, but pretty much the exact same thing happened with FTX.

Celsius had an outstanding loan for hundreds of millions of dollars in the DAI (DAI) stablecoin. They took this loan out via the MakerDAO (DAI, Unrated) DeFi system.

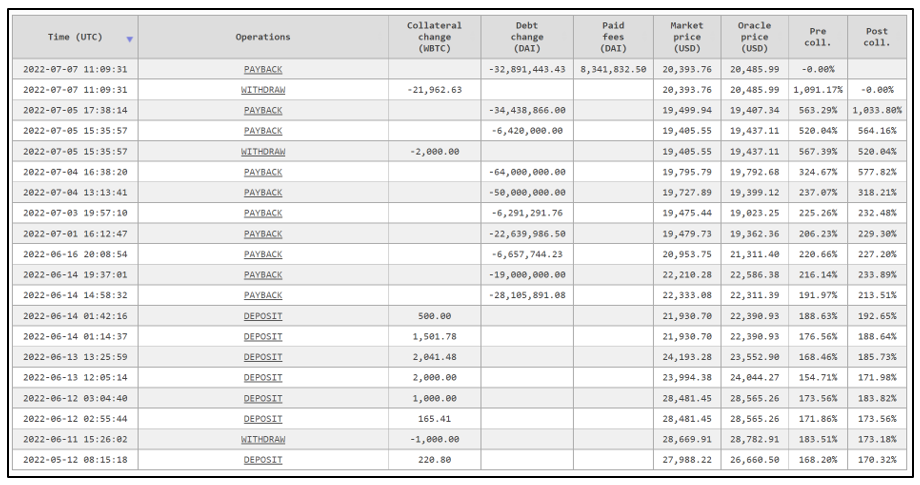

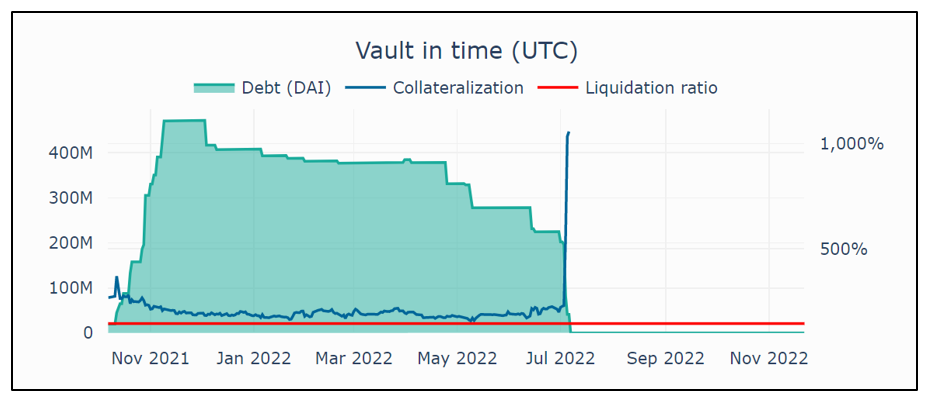

At the peak of its borrowing in November 2021, Celsius had an outstanding debt to MakerDAO of $471 million.

How do I know this?

All the data is publicly available on the Ethereum (ETH, Tech/Adoption Grade “B”) blockchain, along with a blow-by-blow history of when and how they paid it back. The loan was settled in full by July 7, 2022.

Six days later, Celsius Network LLC filed for chapter 11 bankruptcy protection.

In summary, Celsius settled its obligations to MakerDAO in full … and then proceeded to file for bankruptcy with its liability to its users left unfulfilled.

In traditional finance speak, MakerDAO would be considered a preferred creditor.

According to Investopedia.com, the definition of preferred creditor is:

“An individual or organization that has priority in being paid the money it is owed if the debtor declares bankruptcy.”

But it’s not quite that simple. The key word here is bankruptcy.

MakerDAO was not paid back first as a preferred creditor in a bankruptcy proceeding. Rather, Celsius voluntarily decided to pay back its DeFi loan BEFORE filing for bankruptcy.

Accountability

When a child or thief is about to do something they know is wrong, they typically look over both shoulders to see if anyone is watching.

For those without a moral code, it’s not the wrong act that prevents them from committing a bad deed — it’s the risk of them getting caught and having to face the consequences.

This is the concept of moral hazard.

Again from Investopedia.com:

“Any time a party in an agreement does not have to suffer the potential consequences of a risk, the likelihood of a moral hazard increases.”

This is perhaps the one of the best — or scariest, for shady companies — aspects about smart contracts: They demand absolute accountability.

And that’s exactly why Celsius paid off their DeFi loans before pausing user fund withdrawals and then filing for bankruptcy.

Smart contracts can’t be reasoned with …

Can’t be sweet-talked …

And can’t be given empty promises.

That’s because they aren’t controlled by any person or entity; they simply run as programmed.

This is how smart contracts hold you 100% accountable to the agreement you made, with zero exceptions.

Play Ball or Pay the Price

On July 7, when Celsius paid off the last $32 million of its DAI loan, it was able to withdraw the last of its collateral, consisting of 22,000 Bitcoin (BTC, Tech/Adoption Grade “A-”).

At that time, the market price of BTC was $20,393. Meaning, the 22,000 BTC collateral Celsius withdrew from the smart contract was worth $448 million.

Had it not paid its loan off, the MakerDAO smart contract would have refused to allow it to withdraw its collateral.

Those were the terms of the contract.

Worse still, the price of Bitcoin had been dropping and was getting close to its liquidation price.

Had Celsius not paid off its loan in short order, the MakerDAO smart contract would have automatically sold off its collateral to repay the investors who lent the DAI in the first place.

So, by default, being a lender of DAI via the MakerDAO smart contract created an incentive structure. These lenders knew they would get paid back first.

And it would have made absolutely no difference if Celsius had filed for bankruptcy before paying back their MakerDAO loan.

The liquidators would have found themselves in exactly the same position as Celsius before the bankruptcy filing: Pay the loan off and make the lenders whole … or the system will liquidate the collateral and do it for you.

And all of that would happen without the need for regulations, laws, judges, lawyers or court proceedings. The geography and legal jurisdiction are also irrelevant.

The agreement via smart contract is arranged and enforceable upon being established.

The data shown here happens to be a Celsius wallet.

As you can see, Celsius was able to withdraw its collateral only when its debt was settled.

But it doesn’t matter who the borrower was. The mechanics I’ve described here would still be the same.

DeFi is a global financial system that enforces responsible behavior … which causes the irresponsible to face the consequences and learn their lesson.

In TradFi, it seems like no matter how many times a big bank gets caught doing something illegal or immoral — and no matter how many times they get fined for it — the bad behavior doesn’t change.

Usually, these banks simply carry on as they were but in a slightly different fashion, hoping that will reduce the chances of getting caught again.

And this lack of accountability and transparency may be a big reason why DeFi adoption is being resisted.

A DeFi World

In a world where smart contracts are the standard for financial transactions, it wouldn’t matter if you’re JPMorgan Chase (JPM), Jamie Dimon or Aunt Ethel.

No one would receive special treatment, and every transaction would be held to the same standard of absolute accountability.

This would likely encourage many individuals — and businesses — to better plan their finances well into the future.

It could also greatly reduce the complex task faced by regulators.

Instead of having to figure out what rules should govern the behavior of financial institutions, all financial transactions could be coded up in a smart contract.

That way, the code can be the law.

No courts, no expensive lawyers and no drama. Just instant accountability based on the agreement made at the start.

While using DeFi may be more technically complex right now compared to a centralized finance platform, it’s better to be safe than sorry.

In my opinion, I would much rather put in the legwork to learn DeFi instead of dealing with certain risks TradFi presents.

But that’s all I’ve got for you today. Send along your thoughts, comments and questions about smart contracts by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

Until then,

Chris Coney