|

| By Chris Coney |

We’re in uncertain economic times, and the state of play right now is extraordinary.

In times like these, adopting a more conservative investing strategy is prudent. The benefit is right in the name — it’s how we can conserve our wealth.

You may be wondering how we can approach crypto conservatively. After all, crypto markets are volatile almost by nature.

But that’s exactly where the opportunity for high gains comes from.

After all, volatility works in both directions.

Should we just sit on our hands and wait for the storm to pass?

Or should we look for safer bets that still give us an opportunity for growth, despite broad market conditions?

If you choose to sit on your hands, there’s not much else I can do for you here.

But if you want to hear about a new bet with less risk exposure I’ve discovered for the conservative investor, stick around.

This strategy falls into my favorite category of providing liquidity on a decentralized exchange.

That involves depositing a pair of assets, usually in a 50:50 split, in a pool on the platform. In exchange, you receive interest on your assets and a percentage of the trading fees collected by the DEX.

The biggest question when deploying this strategy is which pair of assets to stake.

The lowest-risk play is to stake one stablecoin against another. This way, you mitigate the risk of impermanent loss and preserve the value of your principal.

But because of the low risk, tons of people are already doing this, meaning the yield is relatively low.

“Relatively” is the key term there, as the yield you can earn from a stablecoin pair on a DEX still outperforms any yield opportunity in the traditional markets right now.

On the other end of the risk-exposure spectrum, you can stake one popular variable price asset against another, like Bitcoin (BTC, Tech/Adoption Grade “A-”) against Ethereum (ETH, Tech/Adoption Grade “A”).

The problem with this method is that you have the value of both of those assets moving around independently against the dollar. So not only does the value of your principal change, you’re also more exposed to impermanent loss.

My happy medium between these two strategies is staking stablecoin against gold.

Why?

Because gold is an asset with low volatility relative to Bitcoin and other popular variable price assets.

How stable is this trading pair compared to crypto?

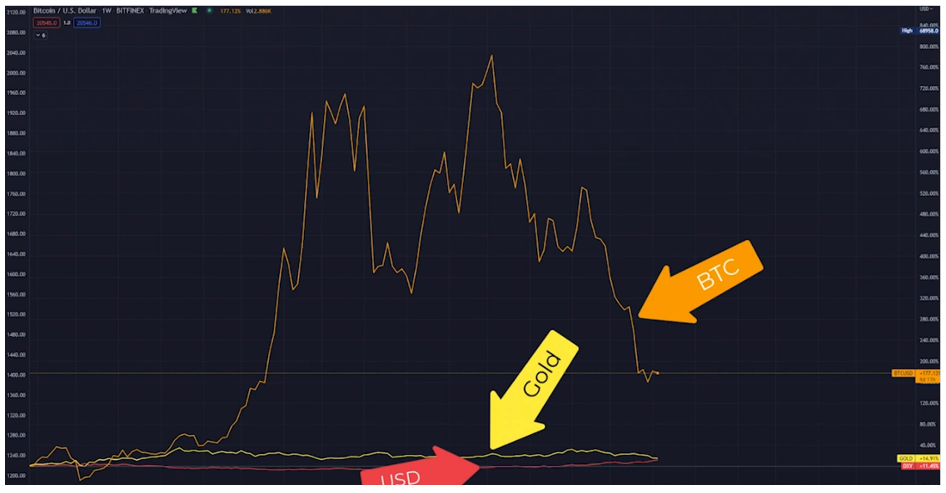

Let’s refer to the chart below, which shows the percentage price change of Bitcoin (orange line), gold (yellow line) and the U.S. dollar index (red line).

When the Federal Reserve increased the U.S. money supply by 40% at the beginning of 2020, a sequence of events was set in motion that has led to the mess the markets are in today.

But as you can see, despite market fluctuations, gold and the dollar were relatively stable compared to Bitcoin.

This strong stability is what we want for our conservative strategy.

Moving on, let’s cover which stablecoin we’re going to use.

The answer is USD Coin (USDC), a regulated stablecoin backed by U.S. dollars and U.S. treasuries in reserves and with client money reserves held in segregated accounts.

Now the biggest question is: How on Earth are we going to trade gold on a DEX?

We’re going to use PAX Gold (PAXG).

PAX Gold is a crypto asset where each token is backed by one fine troy ounce of a 400-oz London Good Delivery bar, stored in Brink’s vaults.

If you own PAXG, you own the underlying physical gold, held in custody by Paxos Trust Co.

If you’d like to conduct further research on Paxos Gold, you may do so here.

Now we’ve got all the ingredients, let’s get down to the process, which is just three steps.

Step 1.

The first step is to convert your dollars into USDC and withdraw them to your Polygon-compatible wallet.

Step 2.

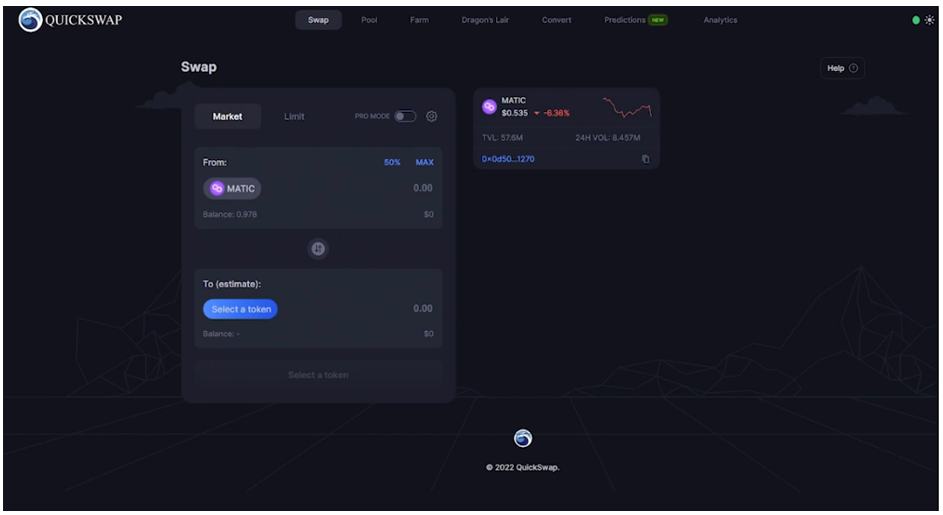

Next, go to QuickSwap.Exchange and swap half your USDC into PAXG by selecting USDC in the From field and PAXG in the To field.

You can enter the amount by clicking on the 50% button that QuickSwap provides immediately above the value field.

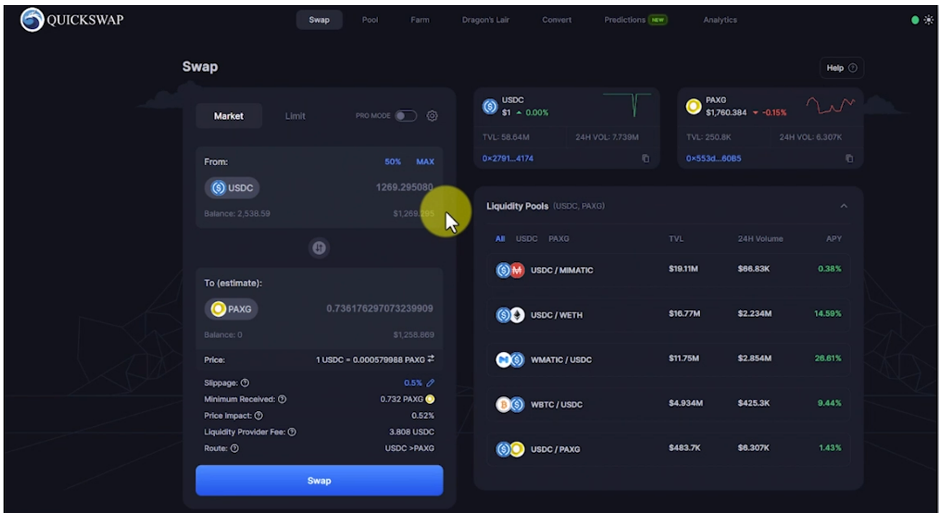

When I did this, QuickSwap didn’t automatically calculate how much gold I would get until I reduced the number of decimal places on the USDC amount, as seen below.

Once you’ve done that trade, you should have roughly the same value of USDC as gold in your wallet.

Step 3.

Click Swap on the bottom, then confirm the transaction to complete the swap.

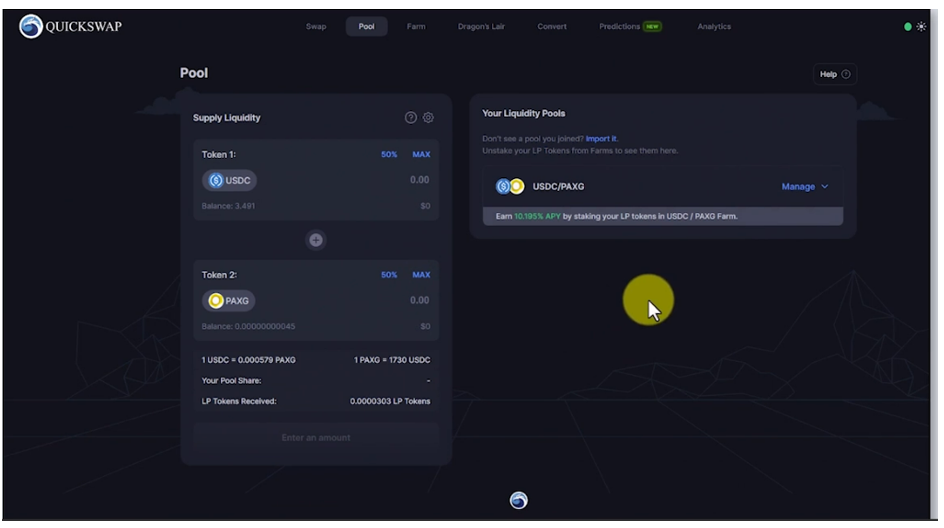

Click Pool at the top left of your screen. On the new page, select the two assets again as Token 1 and Token 2.

You can click Max for each if you want to deposit your full balance of each token into the pool.

From there, you can run that transaction to stake them by clicking Approve at the bottom of the transaction box

Once that transaction is confirmed, you’re all set.

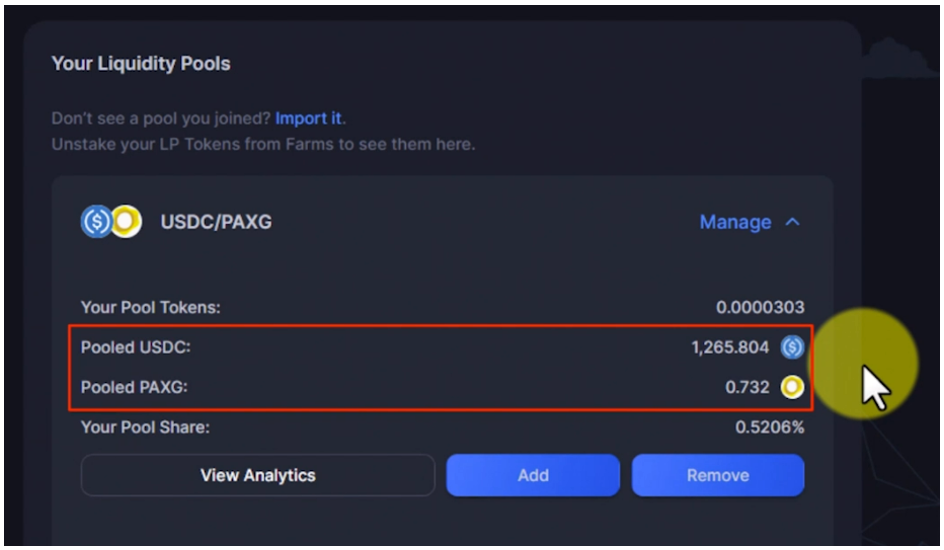

Now you can monitor your balances in the Pool section as they’re automatically managed by the QuickSwap trading algorithm.

The exact yield you’ll receive depends entirely on the trading volume between those two assets while you’re staking them and how much capital other people have staked in this same pool.

The more capital that’s staked, the more broadly the fees are diluted. But I think it’s reasonable to say the yield should be slightly higher than staking two stablecoins, since we’re taking a slight market risk by having exposure to the price of gold.

But like I said at the outset, in the current climate, the volatility of gold should be far less than crypto.

So, there we have it. A perfect blend of traditional financial assets with decentralized finance rails to earn some fees.

That’s all I’ve got for you today. Let me know what you thought of staking stablecoin against gold by tweeting at @WeissCrypto.

Be sure to check in next week for more of my crypto tips and tricks.

Until then,

Chris Coney