|

| By Jurica Dujmovic |

As our society accelerates toward a cashless economy, we must confront the privacy risks and potential for governmental overreach inherent in Central Bank Digital Currencies, or CBDCs.

You may have heard of this asset type referred to as a cryptocurrency before. Let me be very clear now that CBDCs are NOT cryptos.

True cryptos are decentralized and trustless. CBDCs are controlled by the same central authority that controls the fiat currency, meaning you have to trust their management.

That is not to say they’re without benefits. CBDCs are a path toward seamless, digital-only transactions. And that allure is understandable and undeniable.

But we must remain vigilant about the significant threats they pose. Not only to our privacy and security, but also to the most vulnerable members of society.

Threat 1: Privacy Concerns in a Cashless Society

One of the most pressing concerns with moving to a cashless society is the potential loss of financial privacy.

Digital transactions leave a comprehensive footprint. That means financial institutions, corporations and governments can monitor your personal spending patterns.

This potential surveillance severely threatens our personal privacy and autonomy.

Think about the last time you bought something on Amazon. Did you notice your Facebook ads began reflecting that purchase and suggesting related items soon after?

Creepy, right? Well, imagine that phenomenon gets supercharged. And this time, Big Brother can get in, too. Governments can exploit the same data to monitor and control citizen behavior.

Look no further than Operation Choke Point in the United States. That was a regulatory enforcement initiative which aimed to cut off banking access for legally operating businesses … that were deemed to be at a high risk for fraud and money laundering.

The operation officially ended in August 2017 after the FDIC settled multiple lawsuits by promising additional training for its examiners and to cease issuing "informal" and "unwritten suggestions" to banks.

Or consider the 2022 "Freedom Convoy" protests in Canada, where the government invoked the Emergencies Act to freeze accounts of participants without a court order.

These examples starkly illustrate the potential for abuse in a cashless society.

And they underscore the pressing need for stringent checks and balances to prevent governmental overreach in financial surveillance and control.

Risks that will only escalate if CBDCs are wildly adopted.

Threat 2: The Risks of Data Breaches and Cyber Attacks

A cashless economy, reliant on digital transactions, becomes a prime target for cybercriminals.

That’s a main concern for TradFi talking heads about crypto, right? That it’s a lawless ecosystem rife with bad actors.

But the key difference is that true crypto networks and platforms are decentralized. That means there is no single point of attack for hackers. And because crypto is trustless, there are always validators and white-hat hackers on the lookout for trouble and ready to sound the alarm.

So, hackers would have to work harder and faster to have a significant impact. At the same time, crypto security features are getting better with each cycle.

What happens, then, if our TradFi system goes cashless with CBDCs?

Well, the dependence on digital transactions combined with a centralized system means that any breach can have widespread and immediate repercussions. A single data breach could expose the financial details of millions, leading to significant financial losses and identity theft.

In 2023, the average cost of a data breach globally was $4.45 million. The U.S. saw even higher costs, reaching $5.09 million per breach.

And that’s only going to get worse as cybercriminals become increasingly sophisticated and ransomware attacks rise. Last year, 72.7% of organizations globally were affected by ransomware, with the average cost of such attacks hitting $4.54 million.

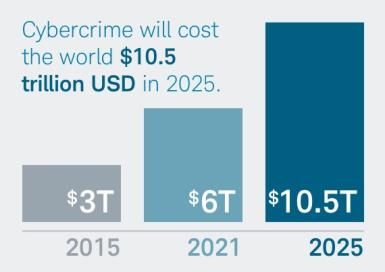

The financial implications are staggering, with global cybercrime costs projected to reach $10.5 trillion annually by 2025.

Ensuring the availability of physical cash as an option can help mitigate these risks. That offers a layer of protection and autonomy that digital systems alone cannot provide.

But that’s also why the idea of cryptocurrency, specifically the decentralized finance market, is so appealing. It is completely disconnected from this centralized authority, providing the most protection.

And, not for nothing, some of the opportunities you can find in DeFi blow their TradFi counterparts out of the water.

Take your average savings account. The yield is so low that, with inflation factored in, you basically get nothing. But in DeFi, you can go for yields up to 17% APY on your savings and even up to 169% APY on investment funds. All without the fear of Big Brother stepping in and freezing your assets.

My colleague and DeFi expert Marija Matić recorded a briefing with Weiss Ratings founder Dr. Martin Weiss to show how she finds these opportunities … and how he can benefit.

I suggest you give it a watch to learn how you can do more with DeFi.

But it’s not just DeFi that is better than a cashless TradFi system. Even the old cash-based system offers more protection for vulnerable groups.

Threat 3: Impact on Vulnerable Populations

The transition to a cashless TradFi system risks marginalizing vulnerable populations who rely on cash for their daily transactions.

Many individuals, particularly those without access to banking services or digital technologies, could find themselves excluded from essential services. This exclusion can deepen existing socio-economic disparities and create new forms of financial discrimination.

That may sound far-fetched. But sadly, it isn’t. Just look at India’s demonetization in 2016. The sudden removal of high denomination notes disproportionately impacted the poor and those without bank accounts. These groups struggled to access basic necessities without cash and had little recourse to enter the new, digital economy.

Similarly, in more developed economies, the move toward cashless transactions can leave behind those who lack digital literacy or the necessary hardware to adapt to new payment systems.

Mitigate the Risks

To effectively mitigate these risks, it is essential to implement measures that ensure financial autonomy and protect individual freedoms. Key strategies include:

- Maintaining Cash Availability: Keeping physical cash as an option is crucial to protect and preserve individual freedoms.

Cash transactions offer anonymity. They cannot be easily tracked or controlled by governments or corporations. This physical form of currency acts as a safeguard against potential overreach and ensures that individuals have an alternative means of conducting transactions.

- Limiting Government Control: This would involve resisting legislative efforts to centralize and automate control over individual financial activities. Ensuring robust checks and balances, along with transparent governance, can help prevent abuse of power.

Advocacy and public awareness are critical in resisting measures that could infringe on financial autonomy and privacy.

- Robust Privacy Policies and Data Protection: Implementing strong privacy policies and data protection regulations is important … but they don’t offer a comprehensive solution.

Frameworks like the General Data Protection Regulation in Europe grant individuals’ rights over their personal data and require organizations to handle data responsibly. But while these regulations offer a level of security, they do not address the core issue of preventing governmental overreach and control, which can still occur within the boundaries of such regulations.

In short, removing cash from society would grant governments unprecedented control over individual finances, enabling potential abuse and the violation of fundamental human rights.

And while DeFi can offer a safe haven for some, the current complex nature of navigating DeFi networks and platforms can be a significant barrier to entry. It also does not cover those who lack technical literacy or who don’t have the means to buy the hardware needed.

Therefore, the availability of cash should be a non-negotiable point in any society that values individual freedoms and democratic principles.

This isn't merely about economics. It's about protecting our personal autonomy and our very way of life. Our freedom to choose how we spend our money, without being watched or controlled, is a cornerstone of what it means to be truly free.

I say we hold onto that freedom with everything we've got.

But I’d love to hear what you have to say on going cashless, CBDCs and DeFi! So go ahead and tag @WeissCrypto on X and let me know where you stand on this issue.

Best,

Jurica Dujmovic