|

| By Chris Coney |

Here’s what I find most frustrating about the current state of the market: Right now, there are basically no low-risk investments.

Back when inflation was at a low 2%, crypto was considered the risky option, while Treasurys were a safe bet. But now the tables have turned.

With sky-high inflation and incredibly low interest rates on savings, letting your money sit in a savings account is almost guaranteed to erode your wealth. Gone are the days where a savings account or low-risk investment could earn you a sufficient return to preserve your wealth.

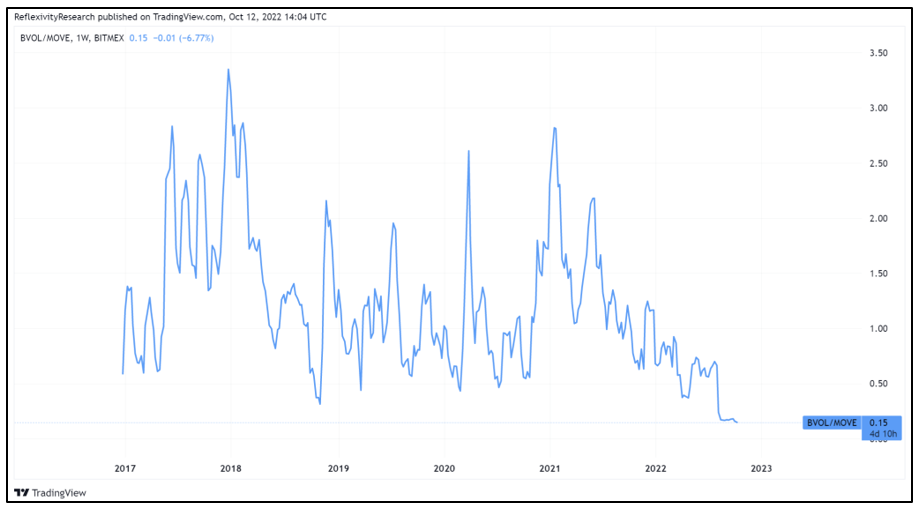

To see what I mean, check out this chart showing the volatility of Bitcoin (BTC, Tech/Adoption Grade “A-”) atan all-time low when compared to the volatility of bonds:

The harsh reality is inflation is so high that it’s forcing us to invest … just so we can attempt to preserve our capital.

It shouldn’t be this way.

Ideally, if we do nothing, we should be able to preserve capital. But if we do something, we can expect potential gain or loss.

This is no longer the case. Nowadays, we stand to lose capital if we do nothing, and potentially win or lose if we do something.

While this may seem like an unfortunate state of affairs, this could actually be considered a net positive for crypto.

This situation is narrowing the gap between the risk of investing in traditional finance and decentralized finance. And I believe DeFi is the only place that gives us an opportunity to outrun inflation.

Now, to underline exactly how difficult the investing landscape has become for everyone, let’s take a look at stablecoins.

About a year ago, we were jumping for joy at the notion of a 10% yield on stablecoins. But with the Consumer Price Index sitting at a baffling 7.7% in the U.S. and over 9% in the U.K., those high stablecoin yields can barely keep us up with inflation.

This is pushing investors to seek even higher-risk investments in an effort to stay ahead … and even the professionals are struggling.

Don't believe me? Here's what one Wall Street trader at JPMorgan Chase (JPM) had to say about the markets from the inside, courtesy of ZeroHedge:

"No one knows what to do right now. Not. A. Single. Person."

So, how do I intend to navigate this market? By not getting caught up in the chaos.

In complexity theory, the solution to every problem boils down to transcendence.

Put simply, this means thinking outside the box.

For example, how is Elon Musk solving the problem of telecom companies having a monopoly on internet service infrastructure?

He’s building the Starlink network of satellites to provide high-speed internet from space.

Musk is looking at the forest, not the trees, by realizing he doesn’t have to compete with telecom companies on Earth … he can quite literally aim for the stars.

So, how is the crypto community implementing this strategy to help solve structural problems within a TradFi system based around government currencies?

By creating blockchain monetary networks like Bitcoin that aren’t limited by geography and locked to a certain country.

Crypto is a universal asset that can be used worldwide, acting as a viable substitute or replacement for fiat currencies.

This is part of the reason why I became a crypto specialist. I see no way of solving the market problem by keeping the old system.

The only way out is to transform and evolve our financial system as we know it. To move forward into the future toward the DeFi world.

DeFi offers us not only the chance to make a rate of return that keeps up with inflation, but it also offers us the opportunity for better returns than were available in the TradFi system when inflation was under control.

Now, no one likes to be forced to do something. If we are doing something because we have to, there’s a certain level of resentment involved because we are acting against our will.

Even as a crypto investor, I somewhat feel this pressure to act against my wishes. Like I said at the outset, a year ago I would have had the option of putting all my crypto capital into a stablecoin and earning a 10% return during a bear market.

But with the current market environment, this barely breaks even with inflation, forcing me up the risk curve.

Fortunately, I have many other strategies to draw on, which allow me to consistently achieve 30%–50% returns.

Regardless, I’m still a bit unhappy about having the freedom to choose lower-risk investments taken away from me.

In investing terminology, a hurdle rate is the minimum required rate of return on a project or investment. In an environment where inflation is 2%, that hurdle is easy to overcome. But now, many investors are struggling to make it over with a running jump.

This may provide a perfect storm for crypto and DeFi, as traditional investors see the writing on the wall and realize they’re missing out by not joining the crypto community.

I await their arrival as their willing guide.

But that’s all I’ve got for you today. Let me know what you think about being forced to take on higher risk by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

Until then,

Chris Coney