|

| By Chris Coney |

Decentralized finance's main claim to fame is that it's a universal financial system accessible to anyone with an internet connection.

Now, DeFi has many amazing capabilities and uses … but it's not perfect.

The decentralized nature of DeFi introduces somewhat of a fragmented structure in the way capital is deployed.

This problem is apparent just by looking at Uniswap (UNI, Tech/Adoption Grade "B"), but extends across the entire DeFi sector.

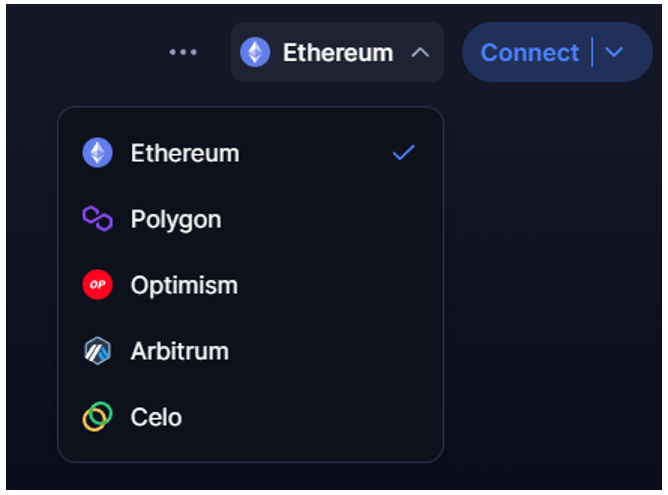

For instance, the network selection drop-down at the top of the Uniswap interface shows that the decentralized exchange now operates across five different DeFi networks:

I personally find myself doing about 80% of my Uniswap activity on Polygon (MATIC, Tech/Adoption Grade "B+") and the remaining 20% on Arbitrum.

For the most part, this works just fine for me. However, the problem arises when it comes to liquidity.

Each time Uniswap deploys its smart contracts on a new network, that version of the DEX features no trading pairs until someone creates the pools. And there's no liquidity until some investors put capital into these pools.

This means overall liquidity for, say, the ETH/USDC pair is fragmented across the five networks in individual silos.

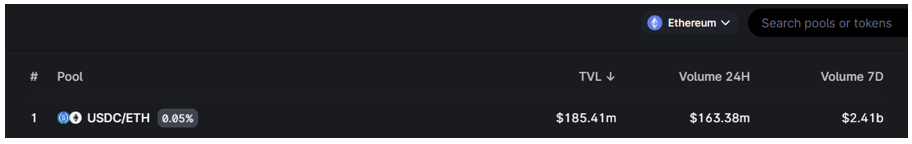

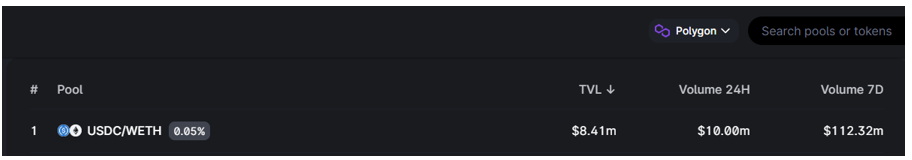

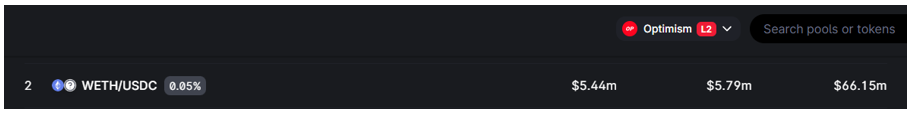

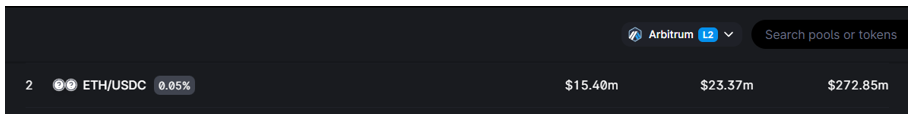

There's no ETH/USDC pool on the Celo (CELO, Tech/Adoption Grade "D+") network, but here's a snapshot of the fragmented liquidity across the other four:

Click here to view full-sized image.

Click here to view full-sized image.

Click here to view full-sized image.

Click here to view full-sized image.

Technically, Uniswap has $214.66 million of total capital locked up in its various smart-contract deployments. It's just fragmented across four different networks.

As you would imagine, the Ethereum (ETH, Tech/Adoption Grade "B") network version of Uniswap has the lion's share of liquidity since it's the original DeFi network and has the most adoption.

However, while ETH may be popular, it's not always the best option.

I have to admit, when I make recommendations in my Crypto Yield Hunter service, I rarely recommend using the Ethereum network. That's because transaction fees eat too deeply into the earnings. Instead, I prefer to find high-yield opportunities with much lower fees to maximize returns.

Bridges

Currently, the principal way capital moves from one network to another is through bridges.

These are effectively DEXes themselves. Except instead of swapping one asset for another on the same network, they allow us to swap the same asset on one network with a different network.

Since liquidity on DEXes like Uniswap is all provided by investors, it's up to them to decide which network they wish to provide liquidity on and how much.

Could we get to a stage where liquidity is automatically balanced across networks? Maybe.

I know of no such app that exists right now, but if you know of one, please write in.

A DeFi-Wide Problem

I've used Uniswap as an example here to specifically illustrate the capital fragmentation problem, but the same concept applies to all of DeFi.

Any app that deploys on multiple networks starts on that new network with zero total value locked.

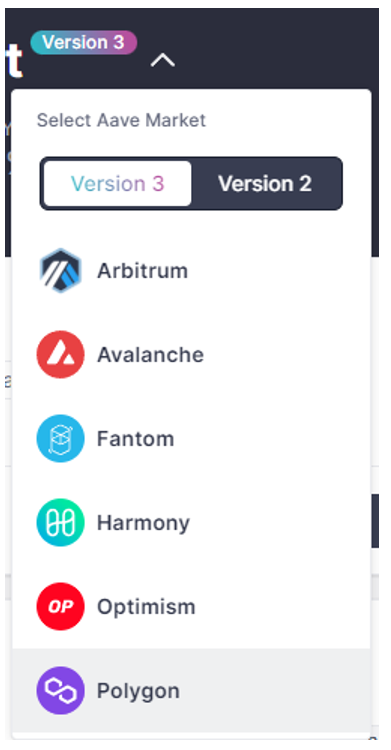

I'm thinking of apps like Aave (AAVE, Tech/Adoption Grade "B"), which operates across six networks:

Or Sushi Swap, which operates across 21 different networks:

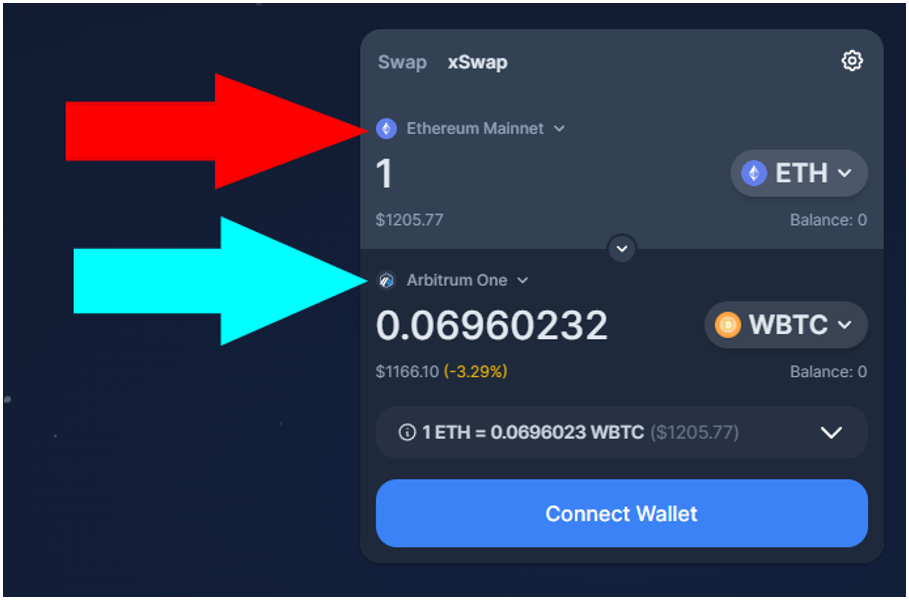

Although, to be fair to Sushi, it has an innovative feature that allows traders to swap assets on one network to another:

Conclusion

I have repeatedly referred to the fragmented capital in DeFi as a problem.

This is because having all the liquidity concentrated in one place tends to tighten spreads, allows for larger trade sizes and generally makes markets more efficient.

That's not to say these benefits aren't coming. Remember, this is DeFi. It's a radically open platform anyone can build on.

So, every problem presents an opportunity to the entrepreneurial mind … and this is exactly why DeFi continues to innovate at breakneck speed.

DeFi's open infrastructure allows it to adapt and evolve to the needs of its environment so fast that one day, it could leave traditional finance to the same fate as the dinosaurs.

That's all I've got for you today. Let me know your thoughts on capital fragmentation by tweeting @WeissCrypto. Be sure to use the hashtag #DeFi.

I'll catch you here next week with another update.

Until then,

Chris Coney