|

| By Nilus Mattive |

You’ve probably heard of Bitcoin (BTC, Tech/Adoption Grade “A-”) ATMs, which are popping up all over the streets.

They look like traditional ATMs, and most people assume they work the same way, too.

But instead of allowing you to withdraw amounts of cash based on your crypto holdings, they only allow you to buy crypto with new money.

By contrast, I’d like to introduce you to a different type of machine: a Bitcoin mining rig.

This Bitcoin is yours the minute it’s produced. You can keep holding your crypto directly, move it to another wallet … or convert it to something else right away.

The best part? The value of the machine itself can soar in price the whole time you’re using it!

In fact, based on what’s happening right now, a relatively small investment in your own Bitcoin ATM could easily hand you hundreds or thousands of dollars in Bitcoin every single month, while the machine itself might end up tripling in value.

It’s a lot like dollar-cost averaging: The basic idea is putting a fixed amount of money into an investment at regular intervals. In doing so, you’re buying more of that investment at lower prices and less at higher prices. Then, over longer periods of time, that growing stake can become more and more valuable.

Dollar-cost averaging is especially good with volatile assets like crypto. And while Bitcoin mining isn’t exactly the same thing, it works in much the same way. In fact, it’s even better in some ways.

Say you have $10,000 to invest in Bitcoin right now. Let’s walk through three scenarios.

In the first scenario, you just invest the full amount in one day.

With prices at $20,000, you end up with half a Bitcoin. That’s great if Bitcoin is near a bottom, but bad if it drops further and stays down for a while.

In the second scenario, you invest $1,000 into Bitcoin in each of the next 10 months.

This is true dollar-cost averaging.

If Bitcoin’s price rises and falls over the next 10 months, you’ll be buying more of it when prices are low and less of it when prices are high.

And given Bitcoin’s big price swings, there’s a good chance you’ll actually end up with more Bitcoin overall at the end of the 10 months. If it happens to take off like a rocket, though, you may miss out on some of the upside.

In the third scenario, you use the $10,000 to buy a good Bitcoin mining rig and pay for the electricity needed to run it.

At current prices, you could easily buy a brand-new 100 TH/s machine and have enough money to pay for three years’ worth of electricity and upkeep.

Given current difficulty rates and other factors, you may expect your machine to produce about $9 worth of Bitcoin every day.

Multiply that out over three years, and you’re looking at mining about $9,855 worth of Bitcoin.

So, you end up with the same amount of Bitcoin as you’d have bought in the first scenario. But your machine can keep producing more Bitcoin past that. Maybe for many years past that.

In addition, if prices fluctuate, you’ll benefit as if you were dollar-cost averaging. And if they start rising steadily, you’ll be generating more and more revenue from the same overall investment.

What You Need to Start Mining Bitcoin

You technically need three things to mine Bitcoin:

1. A fast, efficient machine running on the right software

2. Specialized care and maintenance

3. Cheap electricity

Seems easy, right?

Well, it can be. In fact, your rig can be set up, monitored and run from your home.

But there are a few drawbacks:

For starters, those fast, efficient machines generate a lot of heat and noise. There are definitely ways to reduce or contain those byproducts of the process ... but they may make home mining rigs less appealing to you.

And if your machine overheats, it could break down. Then, you’d be responsible for troubleshooting and repairing your setup. If you’re not familiar with computer repair, this could be a huge sticking point.

In addition, energy costs might be unattractively high depending on where you live. And most Bitcoin mining rigs require anywhere from 220- to 240-volt lines … which could necessitate the need for an electrician and other up-front installation costs. Not to mention other maintenance or upkeep issues that could arise.

Fortunately, there are now several companies that remove all these barriers in one fell swoop.

Compass was founded in 2020 with a simple goal: make Bitcoin mining more accessible to regular people. The company offers several different ways to make that happen.

While they do offer brand-new rigs delivered to your home, that would still come with the challenges above. That’s why Compass can also sell you a new machine that comes with bundled hosting.

Under this option, you buy a machine and Compass places it with a contracted hosting facility. You pay for the machine and a monthly hosting charge. The latter includes your machine’s energy costs, 24/7 security and monitoring to make sure your rig stays up and running.

Deals and pricing change frequently, but I’ve been watching the site and have regularly seen new Antminer S19j Pro 100 TH/s machines available around the $4,000 mark and several recent offerings in Texas with monthly hosting costs around $166.

How does that pencil out in the real world?

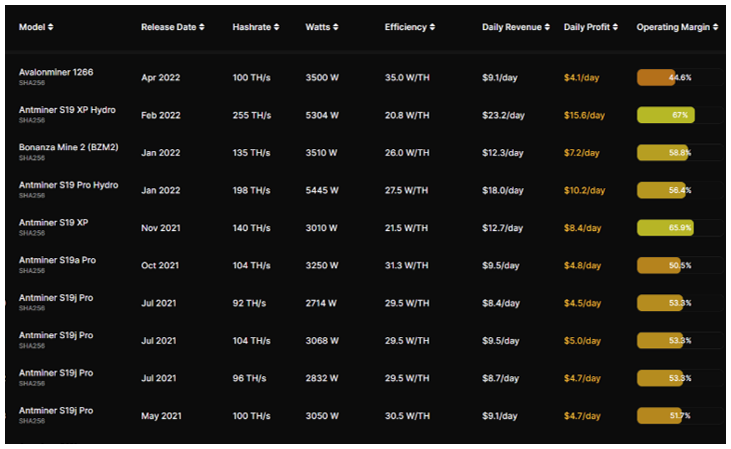

The table below shows recent data from Hashrate Index. It indicates how much daily revenue many higher-end machines are generating right now and how much of that money is profit above typical electricity costs.

I’ve been talking about Antminer S19j Pro machines, so let’s stick with that ...

Given that type of machine and a Bitcoin price of $20,000, you may produce $9 a day in revenue. With $166 in monthly hosting costs, that would amount to $3.75 a day above your operating costs.

At $116.25 a month in profits, it would take you about 34 months to break even on the cost of your machine. From there, you may have another couple of years of the same daily profits free and clear.

Much depends on how long your machine stays functional, of course. Many people cite a five-year life span for high-quality machines operated correctly in proper environmental conditions.

That means you could easily double your initial investment … without factoring in any appreciation in Bitcoin or the machine itself.

Meanwhile, should Bitcoin simply return to its previous high from earlier this year, you could quickly go from making $3.75 a day in profits to making 10 times that amount.

This is precisely why the value of your machine would also rise sharply.

And if you wanted to cash out at any point, Compass also allows you to buy or sell hosted machines on their secondary exchange quickly and easily.

Of course, although Compass is largely focused on retail customers, it’s not the only choice to consider.

Wattum Management is another reputable company that provides both machines for home delivery and hosted bundles.

While its website doesn’t list current inventory, I’ve found Wattum’s sales team to be very responsive. So, it’s definitely worth reaching out to see what they have available.

A third option is Blockware Solutions. The company has traditionally focused more on institutional customers and high-net-worth individuals, but it has several unique aspects to its business.

The first is that Blockware owns and operates its own hosting facilities in Pennsylvania, Kentucky and West Virginia. (Other companies typically contract with third-party hosting facilities.)

In addition, Blockware has its own mining pool.

Mining pools consolidate resources from large numbers of mining rigs and then distribute the proceeds that the collective group generates. That helps smooth out the ups and downs a small miner would experience individually. In return, mining pools typically take a percentage of the group’s total earnings. Blockware’s pool, for example, carries a 2% fee.

Connecting to a mining pool is typically a matter of downloading some software and providing a wallet address to the pool. Other popular mining pools include Slush Pool, Poolin, F2Pool and Antpool.

Bottom line: Anyone looking to put more money into Bitcoin should seriously consider mining.

I’ve only covered the basics here. But hopefully you can see how mining may open up a whole new way to stack Bitcoin ... especially given today’s depressed prices for rigs.

If you want to play around with the numbers a little bit more, there are many good websites to work with ...

For example, CryptoCompare.com has a great section on mining, as well as a calculator that can determine how profitable a particular mining setup is. Another similar resource is whattomine.com.

Meanwhile, MiningPoolStats.stream can show you the implications of using different mining pools.

While there are no guarantees, I think it’s definitely worth using these resources to explore the opportunity further.

Best,

Nilus Mattive