|

| By Chris Coney |

The fact that we’re experiencing one of the longest-running drops in crypto market history has caused some debate as to whether crypto and/or decentralized finance is dead.

My answer to that is absolutely not.

That would suggest that the nearly 100-year trend DeFi was born out of has suddenly changed direction.

Having been in crypto for over seven years, I often take for granted how comprehensive my understanding is. I tend to forget that most don’t share that same level of understanding.

That’s why I get surprised when people go crazy on Twitter in response to market drops and start asking if DeFi is dead — as if DeFi were some passing fad.

Times like these remind me how much people still need to learn about the space.

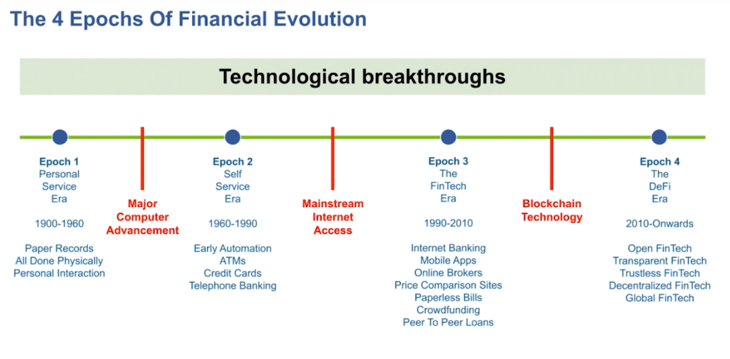

So that’s what I’m going to do today. I’ll try to dispel fear by putting DeFi in a much broader context — through the four epochs of financial evolution.

Then, you’ll see that the seemingly catastrophic market conditions aren’t as bad as they appear.

Let’s begin more than 100 years ago, in 1900.

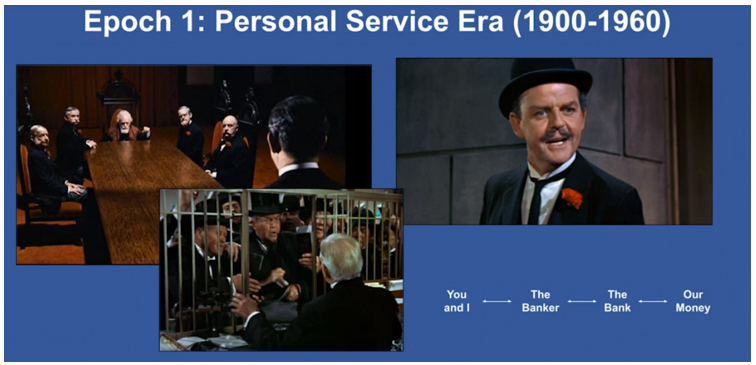

Epoch 1: The Personal Service Era

If you’ve seen the original Mary Poppins movie, you’ll get a glimpse of how the banking system was back then.

The bank would hold your money physically at a local branch. Then you would be assigned an actual banker who would be your primary resource for all your banking needs.

In this era, pretty much everything was done in physical form: The banker was an actual person, the bank was an actual building with a vault, all the records were kept on paper and all the money was in cash.

That was the system until around 1960, when banking took its first major steps toward automation.

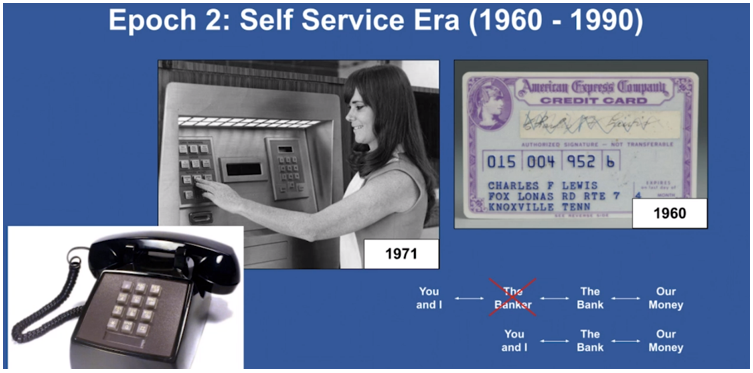

Epoch 2: The Self-Service Era

This is when technological advances introduced services like ATMs, credit cards and telephone banking to the finance world.

In response, efficiency increased and costs were reduced … by removing the banker from the equation.

Next, we removed the physical bank.

Epoch 3: The Fintech Era

The introduction of affordable, in-home computers and the widespread adoption of the internet brought about an explosion of innovation collectively known as FinTech, or financial technology.

This included everything from online banking, mobile apps, online brokers for investing, crowdfunding for startups, electronic utility bills, price comparison websites and so on.

With these upgrades, you didn’t even need to physically walk up to an ATM anymore. You could manage your finances from the comfort of your own home.

That era lasted until about 2009 when Bitcoin (BTC, Tech/Adoption Grade “A-”) was invented … and gave birth to DeFi.

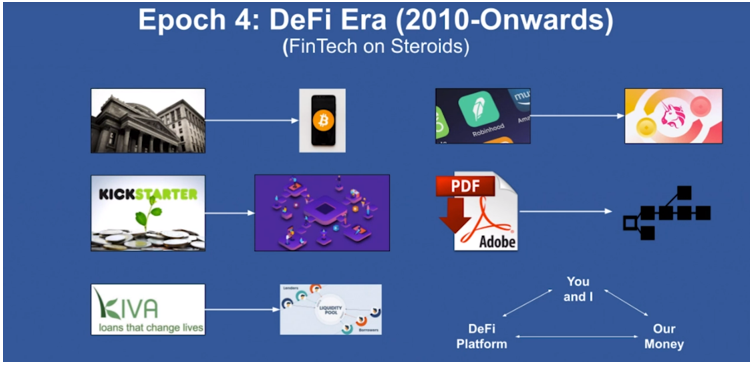

Epoch 4: The DeFi Era

While the FinTech era allowed us to complete our finances online, we were still accessing services that were owned and operated centrally by a company.

Once blockchain technology was invented — the last link tying finance to the physical realm was severed.

Physical bank vaults are being replaced with encrypted wallet apps, online brokers with decentralized exchanges, crowdfunding platforms by blockchain-based launchpads and peer-to-peer loan platforms are becoming decentralized money markets.

DeFi is basically all the great ideas from the FinTech era … but built on an infrastructure that no single entity owns or controls. This translates into a system without the need for trust and allows you complete custodianship of your own money.

No more trusting a bank to access what’s rightfully yours.

And here’s the best part …

Epoch 4 has just begun.

That’s the big picture around DeFi.

Look back at each previous era. They all started with the invention and adoption of some technological breakthrough that made the new system more appealing than the old.

That’s why I’m personally as hyped as I could be about DeFi — because we’ve just scratched the surface of mainstream adoption.

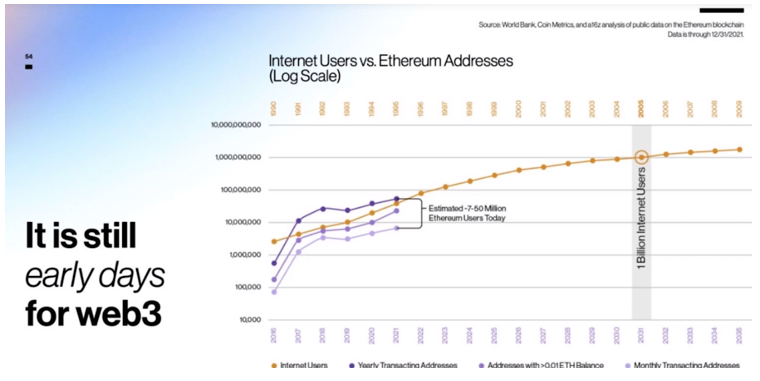

Just look at the hard data. Here’s a chart comparing the growth in the number of internet users and the growth in the number of Ethereum (ETH, Tech/Adoption Grade “A”) users:

Let’s be optimistic and look at the upper end of the range and say there’re 50 million Ethereum users today.

That’s how many users the internet had in 1995 — back in the days of its infancy!

That should give you some perspective on where we are in the growth of DeFi.

And that’s why I say there’s no way DeFi is done, despite the current market.

As an investor, you should still choose your opportunities carefully. But you shouldn’t let fear, uncertainty and doubt keep you out of DeFi, not when there’s so much growth in the space to come.

That’s all I’ve got for you today. Let me know what your thoughts are about DeFi growth and potential by tagging @WeissCrypto on Twitter.

I’ll be back next week.

Until then,

Chris Coney