The Cheapest, Simplest Way to Start Buying Blue-Chip NFTs Right Now

|

| By Nilus Mattive |

Picture if you will: It’s 1990.

The fine art market is crashing. Investors are discouraged. And bargains are everywhere.

In a timely feature story, The New York Times explained it this way: “The growth of the art market through the 1980s reflected a money-obsessed decade when billionaires replaced millionaires in business magazine pantheons. There seemed to be no limits. Prices went ever higher, and the boom offered the once-unimaginable prospect of a $100 million painting. It nearly came to pass.

“But then the economy slowed. The weak results from the fall auctions at Christie’s and Sotheby’s in New York and London indicate the once white-hot market for Impressionist, modern and contemporary art has cooled. About 20% of the Impressionist and modern works failed to sell in New York, and no more than 50% of the contemporary works moved.”

But as it turned out, it was a rare opportunity for investors, creating new millionaires and billionaires.

Now, a similar turning point is approaching in the digital world.

After posting stratospheric gains, non-fungible tokens (NFTs) have fallen in value. Buyer interest has waned. And as with Bitcoin (BTC, Tech/Adoption Grade “A-”), we predict a historic big bottom ahead.

So, again this opens up a rare opportunity for investors: The chance to acquire the crypto world’s version of Picassos and Warhols at huge discounts.

Better yet, there’s a little-known way for you to get involved in the world of fine digital art with as little as $2.50.

As you’ll see, this particular method is less risky than buying NFTs the usual way on the biggest NFT marketplaces, like OpenSea ...

You can complete your transactions without the need for crypto of any kind!

Of course, if you do wish to simply buy various NFTs outright, Joel Kruger can actually help you do that through his NFT Wealth Builder service.

In fact, he’s a proven expert at identifying up-and-coming NFT collections that have tremendous upside and are available at attainable prices.

But what if you want to invest some money in a wide variety of collections like CryptoPunks, Bored Apes and other wildly expensive blue-chip NFTs?

Even at today’s depressed prices, doing so could cost you hundreds of thousands of dollars — or even millions, in some cases.

That’s where the idea of fractional ownership comes in.

The way it works is pretty much the same as a traditional stock investment: You own a certain percentage of a larger asset with all the proportional benefits.

While you can use the crypto space directly to obtain fractional ownership of NFTs — including through decentralized autonomous organizations — I’ve found an even easier way for you to get in the blue-chip NFT game … with extra benefits and protections.

In fact, I’ve already used it to get stakes in a CryptoPunk and a Bored Ape.

It’s called the Rally platform.

Rally originally started as a way for investors to get fractional ownership of sports cars and other luxury vehicles. But it has since expanded into a platform for all sorts of collectibles — everything from baseball cards to fossils to the best digital assets.

This concept has proven to be extremely popular, with the platform growing to now approximately 500,000 users.

Essentially, Rally uses a special Securities and Exchange Commission rule called Regulation A+ to convert collectibles into individual securities.

It chooses its listings based on a number of criteria, including condition, provenance, rarity and a whole slew of other factors.

Then, it creates a subsidiary company that owns each individual asset. That means you own shares in the specific subcompany that owns the underlying item, whether it’s a comic book or a Ferrari.

This gives you a lot more investor protection than you’d get through other avenues.

It also ensures you get your share of any dividends or other benefits that the underlying asset produces. In fact, I’ve personally seen evidence of this — twice — with the Bored Ape I own through Rally.

The first instance came on March 22, when Yuga Labs — the company behind the Bored Ape collection — distributed ApeCoin tokens to Bored Ape owners. Rally collected those tokens, cashed them in and distributed the proceeds as cash dividends for each share of the individual Bored Ape.

Then, for the second instance in May, Bored Ape owners also became eligible to receive plots of digital land in a metaverse world that Yuga Labs is creating. After conducting a shareholder vote, Rally chose to distribute proportional shares of these metaverse plots to Bored Ape owners as well.

Speaking of which, the people behind Rally put their skin in the game and invest right alongside other users. That should provide a little extra peace of mind.

To top it all off, the platform doesn’t charge management fees or commissions, either. It’s compensated from the seller side and outlines the details of each deal in circulars that are available ahead of new offerings.

In most cases, the goal is keeping assets on the platform for the long term.

However, if Rally receives an outside offer to purchase an item, it solicits shareholder opinions and then has a third-party advisory board make the final decision based on that input as well as current market prices.

Everything considered, Rally is an enticing platform with plenty of beneficial opportunities.

NFTs on Rally

So, what NFTs can you purchase on the platform right now, and how much do they cost?

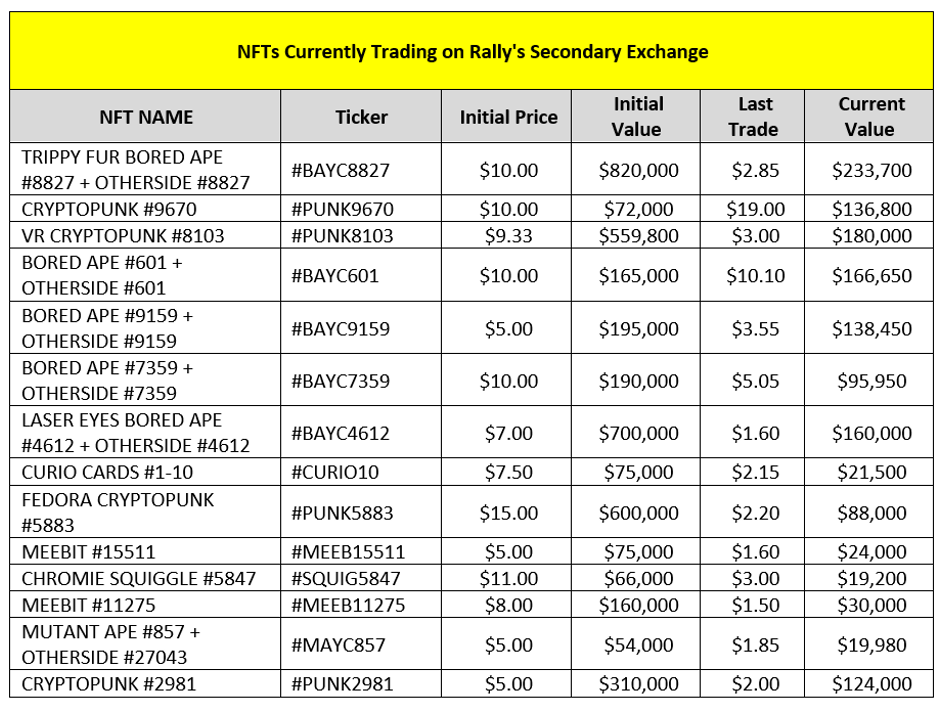

We did some research to give you a general sense. The following table shows all the NFTs currently trading on Rally’s secondary exchange along with pricing information as of Sept. 14:

Click here to see full-sized image.

As you can see, there were 14 different NFTs available on Rally. They spanned six different NFT collections, and most were trading at a substantial discount compared to their initial offering prices and values.

But there’s plenty more to come.

Rally has done initial offerings on 20 more NFTs that will open up for secondary trading in the near future.

With so many upcoming opportunities, users have plenty of ways to get involved in the NFT space. And Rally says 25,000 investors have already used its platform to do so.

To be clear, we don’t have a business relationship with Rally, nor do we receive any type of compensation for introducing readers to the platform.

We just happen to think it’s a convenient way to get started with NFTs, and one that we’ve even used and had good experiences with personally.

You can check it out for yourself here.

Of course, only you can decide if investing on Rally’s platform is right for you. And you’re in charge of determining what to buy and how much to commit to any of the assets you choose.

No matter what you decide to do, the important part is recognizing the investment potential of the NFT space. Not just now, but far into the future.

Because even if you choose not to buy CryptoPunks, Bored Apes or any other digital fine art at today’s discount prices, there is no doubt that NFTs — and the underlying technology itself — will continue to create new investment opportunities for years to come.

Best,

Nilus