|

| By Chris Coney |

In the past, I have publicly praised the way that crypto is taxed in the U.K. You see, the tax is essentially based on how you were using it at the time.

This goes back to the debate that has been raging since the dawn of crypto: What is it?

To keep things simple, let’s use Bitcoin (BTC, “A-”) as an example.

So, is Bitcoin a currency, commodity, store of value or something else entirely?

Well, the U.K. tax law says, “it depends.”

For instance, if you bought some BTC and sold it later at a higher price — like you would a gold bar — then the U.K. tax law states that Bitcoin was acting like a commodity.

Consequently, it would be charged as capital gains.

Now, let’s look at another situation.

Let’s say you bought an online course from me and paid in Bitcoin. In this situation, the U.K. tax law states that BTC was acting like a currency.

So, this transaction would be charged at the income tax rate, and the value would be the market price of BTC at the moment I received the payment.

Crypto Assets Are What People Use Them For

As the market matures, various crypto assets are starting to find their niche.

After much experimentation, it seems that large groups are now coalescing around certain cryptos for the same reason.

From my perspective, this is moving certain cryptos away from their dynamic nature, and they are finding more of a natural home.

Essentially, the majority use of cryptos is becoming clearer, so it’s becoming less of a “it depends how you use them” situation.

However, these niches do not preclude these assets from being used in other ways. After all, you can still pay for goods with gold coins if you want to.

Bitcoin: The Crypto Safe Haven

Now, I’m not saying that Bitcoin is currently considered a safe haven asset by the majority.

But it is definitely a safe haven asset within crypto itself.

Indeed, BTC has the greatest price stability and the most liquidity outside of stablecoins.

At the time of writing, BTC has double the 24-hour trading volume of Ethereum (ETH, “B”) across all spot markets.

So, personally, I see Bitcoin occupying the role of digital gold.

Ethereum: Digital Bonds

If you recall, last year, Ethereum moved from a proof-of-work to a proof-of-stake consensus mechanism. This allowed the network to use less energy and enhanced its ability to implement new scaling solutions.

Additionally, Ethereum’s shift to PoS introduced EIP-1559, which altered its fee market mechanism.

Essentially, this proposal means that a majority of the gas fee in a transaction will be destroyed, making ETH more scarce. In this way, reducing the supply should increase the value of ETH and make it a deflationary asset.

Overall, this helps prevent the token supply from moving in one direction.

Although Ethereum 2.0 introduced a variety of impressive upgrades, one of the most important changes is that it flung the market wide open. Now anyone can tap into the yield generated through Ethereum’s transaction fees and token inflation.

So, the ability to participate in Ethereum staking means there is now an on-chain, decentralized yield available for staking ETH.

Currently, most people are choosing to use Liquid Staking Derivatives like Lido (LDO, Not Yet Rated) because they are relatively simple to use.

At the time of writing, Lido quotes the yield on staked ETH at a reasonable 3.9%.

The Crypto “Risk-Free Rate”

In my mind, this is turning ETH into the crypto equivalent of the bond market. After all, the mechanics are quite similar (i.e., you can invest some capital for a low-risk yield).

If you invest in U.S. Treasury bonds, it’s a relatively safe bet: You receive the yield on that debt, you get your capital back and you know it’s nearly impossible for the U.S. government to go bust and default on you.

Similarly, if you invest in ETH and stake it, you can earn a guaranteed yield, you can get your capital back and you know it's almost impossible for the Ethereum network to go bust and lose your money.

This is why I’m seeing ETH becoming an emergent bond market within crypto.

What is superior about this model, though, is that the yield is generated via the consumption of gas fees (i.e., transaction fees) on the Ethereum network that are paid in exchange for the smart contract services the network provides.

And it’s totally transparent.

There is no central bank meeting where officials decide if the base interest rate is going to go up or down. In the crypto bond market, all of that is set and automatically adjusted by market forces.

So, if more people use the network, more gas is burned, and more is paid out in yield.

Alternatively, if fewer people use the network, less gas is burned and less is paid out in yield.

However, one downside is that the crypto bond market can’t guarantee you will receive the same amount of capital back denominated in U.S. dollars.

For instance, if you stake 5 ETH, you retain the right to unstake that 5 ETH.

But if you are measuring the value of your capital in U.S. dollars, the value of your 5 ETH upon staking may differ from the value of your 5 ETH upon unstaking.

This is why I believe Ethereum staking is more suitable for long-term ETH holdings you already have.

Or if you are engaging in a dollar cost averaging strategy, it makes sense to put your idle ETH stack to work to lean on the scales a bit.

Conclusion

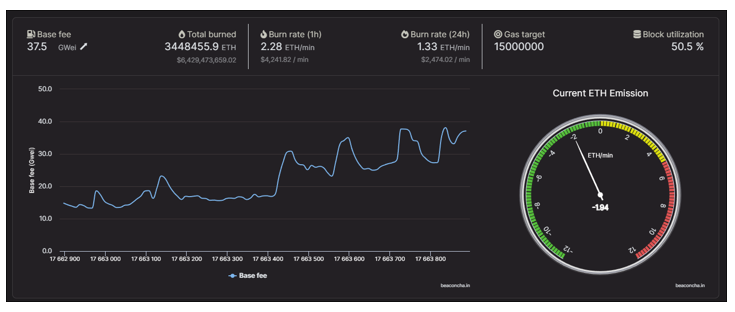

At the time of writing, Beaconcha.in is reporting that the ETH emission rate is currently deflationary at a rate of 2 ETH per minute.

Based on a 30-day view of ETH issuance, it is currently deflationary by 0.1% per year.

By contrast, U.S. Treasury issuance stands at around $24 trillion. This represents a 4.4% year-over-year increase.

To be clear, I am not suggesting that the Ethereum network will somehow take over U.S. Social Security liabilities or anything of that sort.

But from an investing perspective, I believe it’s helpful to compare staked ETH to government bonds to understand the economics behind them.

As a final note, here’s an opportunity for those DeFi people who like the idea of crypto bonds but dislike their U.S. dollar-denominated value fluctuating wildly.

You might want to check out the new Dai (DAI, Stablecoin) savings rate, which has just been increased to 3.5%.

Since DAI is a stablecoin, it can be staked with no capital value risk. Even better, you can earn 3.5% from the MakerDAO treasury.

You see, MakerDAO is the closest thing we have to a decentralized crypto bank right now. And you can learn more about it here.

But that’s all I’ve got for you today. Let me know what you think about this Ethereum bond market analogy by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me Chris Coney saying, bye for now.