|

| By Jurica Dujmovic |

Last week, I brought you an interesting and insightful interview with Marija Matić, one of our brilliant cryptocurrency analysts here at Weiss Ratings. The topic was the crash of Terra (LUNA, Tech/Adoption Grade "D-") and its stablecoin, TerraUSD (UST).

In the interview, Marija made clear that the details were still rolling out, and we didn't yet have the full picture of what exactly happened. This week, while we have more details, we don't necessarily have more answers:

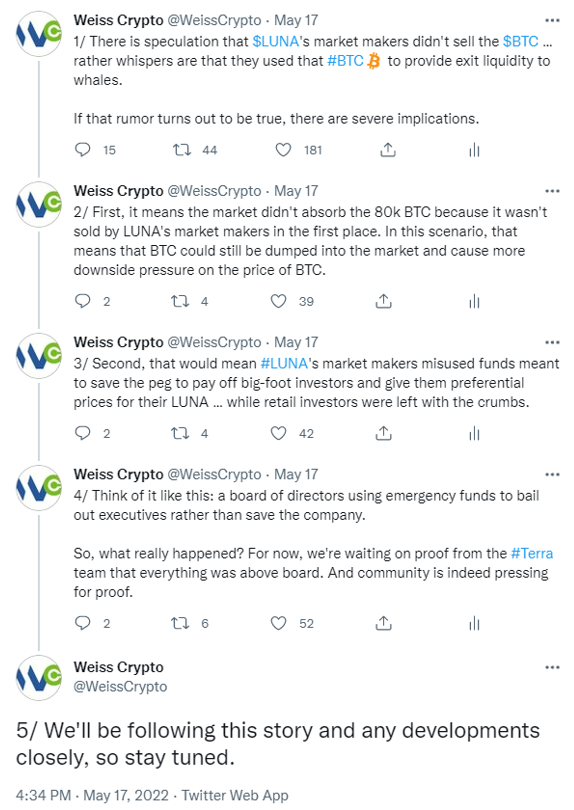

Fraudulent behavior, as described in this thread, isn't uncommon in the world of crypto. But it's usually tied to smaller, lesser-known and unvetted projects.

It seems the 80,000 BTC that failed to push the price of Bitcoin down may not be a bullish signal but rather a smoking gun, potentially pointed at Terra insiders.

As my favorite detective would say, the plot thickens …

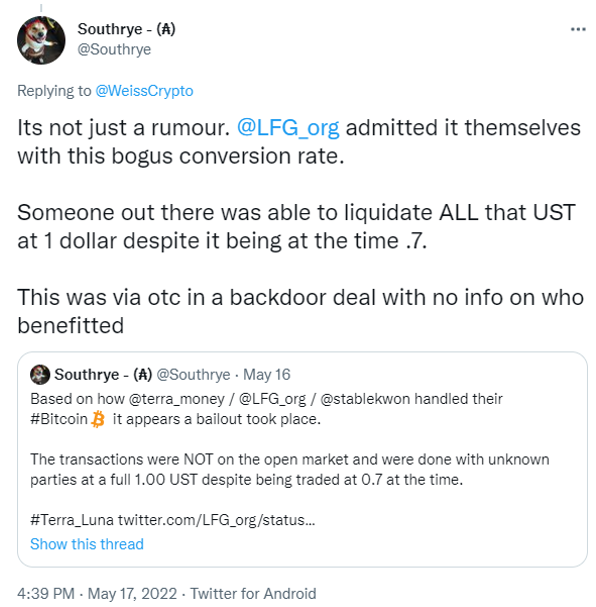

Our fans contributed to the story with their own insights from on-chain data:

Regardless of where the fault really lies, though, it seems the consequences of the crash have caught up with Terra's founder, Do Kwon. Whether he's the culprit or a scapegoat remains to be seen. For now, it doesn't matter — the court of public opinion has ruled him to be fully accountable for whatever transpired during the crash:

And that's not the end of the bad news for TerraForm Labs, the firm behind the smart-contract protocol. The Singapore-based company was recently fined a $78 million tax evasion penalty.

Based on reports, it's likely the company wanted to avoid taxation, perhaps to make up for the losses it incurred on Anchor Protocol. But the operation failed to fly under the radar, incurring the wrath of South Korean government, as well as the Grim Reapers of Yeouido — a special crime investigation unit.

Meanwhile, TerraForm Lab's internal legal team has resigned, with a source inside the company confirming that all legal matters have been outsourced.

While the tax evasion could be real event, I can't but notice how the timing of it all was so impeccable. It's as if everything conspired to bring down LUNA and UST — both previously top-performing cryptos that saw rapid massive growth. Even after the initial crash, these last few licks are almost salt in the wound, piling on the network even after many already consider LUNA to be a dead project.

We'll keep bringing you details as they emerge. After all, it's important to understand how a network this big could be undone so quickly if we want to move forward as smarter, more savvy investors.

And one thing we want to make clear in the aftermath is that this event was targeted at UST. While there's always risk that other stablecoins could depeg in the right conditions, those conditions aren't present.

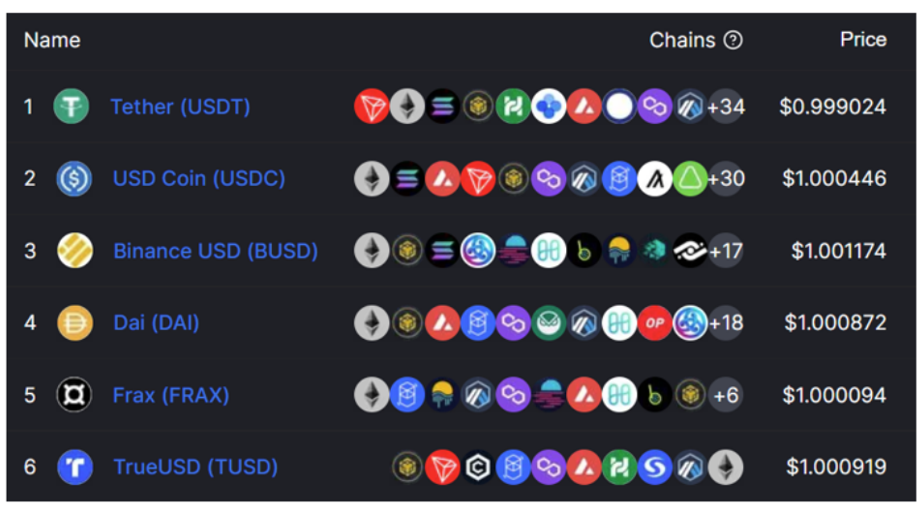

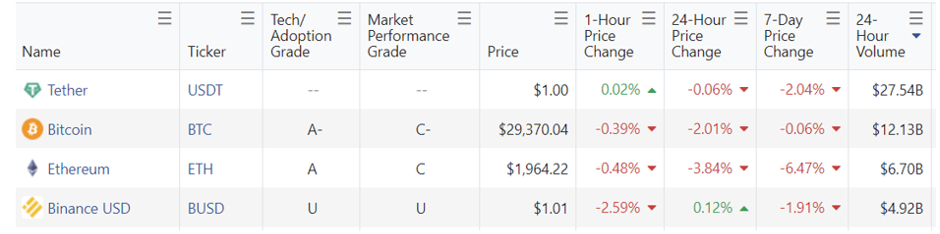

Just take a look at the other top stablecoins:

They're all maintaining their peg. Even better, take a look at crypto trading volume over the past 24 hours:

That's right, the asset with the highest trading volume for the past day has been Tether (USDT), the largest stablecoin according to market cap.

This tells us that stablecoins are still an active and solid part of the broad crypto market. Of course, as with every investment, you should always do your due diligence as different stablecoins will have different risks and reward opportunities. But we have no reason to believe UST's crash will shake the rest of the stablecoin market.

Speaking of the broader market, let's take a look at what's been happening outside the Terra turmoil.

The metaverse is increasingly becoming a ubiquitous term, and finally the biggest players in the world of finance are taking heed:

If you want to learn more about metaverse — the good, the bad and the ugly — check out my article on MarketWatch to see what happens when physical and virtual worlds collide..

That's it for this week. Join me next week for more news and insights. Until then, stay safe and trade well.

Best,

Jurica Dujmovic