|

| By Jurica Dujmovic |

Something is revolutionizing how cryptocurrency holders optimize their returns.

Restaking is a concept that emerged in early 2023. It has experienced a remarkable resurgence in 2024.

And right now, all signs point toward this becoming a pivotal strategy within the decentralized finance ecosystem.

At the forefront of this evolution stands EigenLayer. This platform pioneered the restaking concept. And now, it’s back in the spotlight after achieving a significant milestone.

In June, its Total Value Locked surpassed the $20 billion mark for the first time. This was attributed to a surge in deposits and Ethereum (ETH, “A-”) going higher.

This impressive surge has solidified EigenLayer's position as the second-largest DeFi protocol. It only trails the industry behemoth, Lido.

This meteoric rise underscores the increasing importance of restaking in the world of DeFi.

It also signals a shift in how investors approach yield optimization in the cryptocurrency space.

So today, let's dive deep into why EigenLayer is seeing such phenomenal growth.

We’ll also look at what this means for savvy investors looking to capitalize on the next big thing in DeFi.

More Bang for Your Ether

First, let’s go back to the basics. Staking vs. restaking.

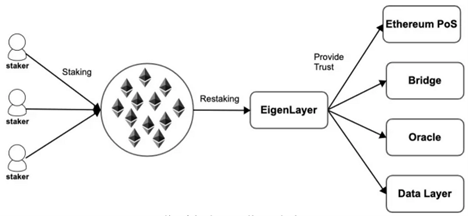

Traditional staking involves locking up cryptocurrencies to support blockchain operations in exchange for rewards.

EigenLayer takes this a step further, allowing users to reuse their staked assets to secure multiple networks simultaneously.

In other words, imagine being able to put your money to work in multiple places at once, earning compound returns across various protocols.

That's the promise of restaking. And EigenLayer is at the forefront of this innovation.

The numbers speak volumes about EigenLayer's explosive growth …

At the dawn of 2024, EigenLayer's TVL stood at a respectable $1.4 billion. Fast-forward to June, and we were looking at a staggering $20.09 billion.

This represents over 5.8 million Ether locked in the protocol.

It’s also a testament to the growing confidence investors are placing in EigenLayer's model.

What's Driving This Surge?

A perfect storm of factors has contributed to EigenLayer's success.

In early 2024, the protocol made a strategic decision to temporarily remove caps on Ethereum staking.

This bold move opened the floodgates. It attracted a significant influx of deposits from yield-hungry investors eager to maximize their returns.

As Ethereum's value climbed throughout the year, so did the value of assets staked on EigenLayer.

This relationship between Ethereum's market performance and EigenLayer's growth propelled the protocol to new heights.

April 2024 marked a crucial milestone in EigenLayer's journey with its deployment on Ethereum's mainnet.

This launch wasn't just a technical upgrade. It was a coming-of-age moment for the protocol.

With EigenLayer now fully operational on Ethereum's primary network, users could finally experience the full potential of restaking in a live, high-stakes environment.

The mainnet launch sent a powerful signal to the market.

EigenLayer was ready for prime time. And for investors, this was a green light to dive in.

Meanwhile, potential competitors are starting to come out of the woodwork with their own restaking solutions.

As those protocols vie for users' attention and capital, we're likely to see even more innovation when it comes to yield optimization strategies.

4 Potential Risks

EigenLayer's growth story is exciting. But restaking comes with its own set of risks, like:

- Smart Contract Vulnerabilities — These remain a persistent concern in DeFi. As EigenLayer's TVL grows, so does the potential for security threats. So, the protocol’s team must audit and upgrade its system regularly.

- Market Volatility —Restaking can help mitigate some risks through diversification. But the value of staked assets is still subject to the whims of the broader crypto market. A big dip in Ethereum's price could have a cascading effect on EigenLayer's TVL.

- Regulatory Scrutiny — In 2024, the SEC brought more DeFi activities — like those involving EigenLayer — under closer examination. This, combined with Europe's evolving MiCA framework, signals a shift toward stricter controls that could impact how platforms operate globally.

- Complexity & Implementation — Education will be key to ensuring that investors fully understand the mechanics and risks involved before committing their capital.

4 Value Propositions

(Plus a Couple More)

That said, EigenLayer's trajectory seems poised for continued growth.

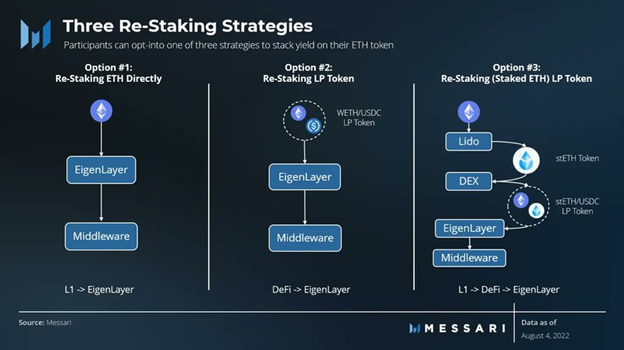

- Cross-chain compatibility is becoming a major focus for EigenLayer. The platform is actively expanding its capabilities to support restaking across multiple blockchain networks.

- This move is expected to open up new opportunities for yield optimization, particularly through innovations like Liquid Restaking Tokens (LRT) and cross-chain bridging.

- These advancements are likely to further solidify EigenLayer's position as a leader in DeFi space, enabling it to offer enhanced security and flexibility across various blockchain ecosystems.

- As the protocol matures, we can expect to see efforts to enhance scalability. That should attract more user activity and an even larger TVL.

We're also likely to see the development of new use cases leveraging EigenLayer's restaking capabilities.

Innovative DeFi applications built on top of the protocol could create additional value for users and attract even more capital into the ecosystem.

For investors looking to stay ahead of the curve in DeFi, EigenLayer presents a compelling opportunity.

As we look to the future, one thing is clear: EigenLayer's impact on the DeFi landscape in 2024 is undeniable.

The enhanced yield potential offered by restaking is particularly attractive in today's market environment.

As traditional finance continues to offer low yields, the ability to maximize returns through innovative DeFi strategies — like those offered by EigenLayer — becomes increasingly appealing.

For investors and enthusiasts alike, EigenLayer is definitely a project worth watching closely in the months — and, I believe, years — to come.

Best,

Jurica Dujmovic