|

| By Jurica Dujmovic |

A viral claim has gripped financial markets.

We’re in a bubble that’s 17x larger than the Dot-Com Crash … and 4x the subprime meltdown.

The statistic ricocheted across Bloomberg terminals, tech Twitter and CNBC chyrons over the past few days.

This claim originated with MacroStrategy Partnership, a UK research firm advising institutions managing over $5 trillion.

Those are the kind of numbers that make CFOs sweat, and journalists reach for historical analogies.

There's just one problem.

The math is completely misleading.

The claim isn't technically wrong — artificial intelligence, by classic definitions, indeed appears to be in a bubble.

But while the media obsesses over whether we're headed for a 2000-style wipeout, a far more interesting story is unfolding.

The AI bubble isn't about to pop.

It's already popping.

You just haven't noticed yet.

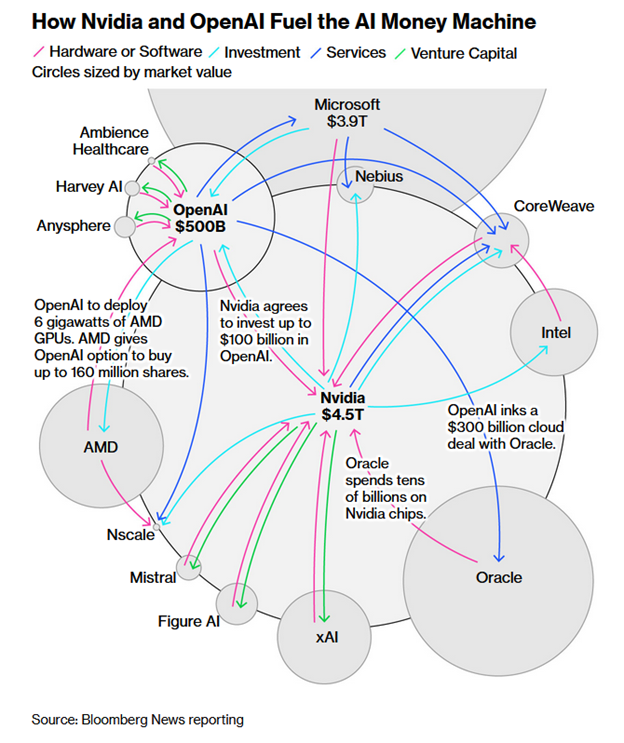

The companies making headlines with record fundraising rounds and $300 billion spending sprees? They're fine.

It's the thousands of others quietly shutting down, slashing valuations and abandoning AI projects that tell the real story.

The AI bubble isn’t one that explodes. Rather, it's one that deflates selectively.

One that … unlike previous bubbles where all boats rose and sank in tandem …

Separates survivors from casualties in ways that will reshape the entire technology landscape by 2027.

Here's how to read the real signals beneath the noise.

The 17x Claim Decoded:

What You're Actually Comparing

Julien Garran didn't just wake up and decide to compare today's market to 1999.

The former head of global commodity strategy at UBS, now a partner at MacroStrategy, deployed a specific — and controversial — framework: the Wicksellian differential.

What the heck is Wicksellian?

In plain terms, a “Wicksellian misallocation” is what happens when money is too cheap for too long.

If the cost of borrowing is kept below the true return that capital could earn, businesses and investors pile into projects that wouldn’t look attractive under normal conditions.

After years of exceptionally low interest rates, MacroStrategy estimates a Wicksellian “misallocation” equal to ~65% of U.S. GDP —about $19T at today’s GDP —spread across AI, real estate, venture and NFTs.

Not just AI.

Everything.

The subprime crisis peaked at 18% of GDP. Boom — there's your 4x multiplier.

The 17x Dot-Com comparison uses similar logic, benchmarked against late-1990s excesses.

So, when you see "AI bubble is 17x Dot-Com," what it actually means is:

"The total capital misallocation enabled by monetary policy across all asset classes is 17x larger than the dotcom-era misallocation, measured as a percentage of GDP, using a century-old Swedish economic framework."

Not quite as catchy, is it?

This doesn't mean Garran is wrong.

His evidence points to real concerns:

- Training costs at the frontier have exploded from GPT-3's ~$5 million to GPT-4's estimated $100+ million to GPT-5's projected range of $500 million to $1 billion.

- And that's just the final pre-training run, not the full development cost.

Sam Altman himself said models "of GPT-5 size or beyond could cost around $1 billion to train."

That's a 200x cost increase for improvements that, while meaningful, aren't remotely proportional.

Performance at one major software company plateaued at 34% task completion.

And here's the kicker — adoption rates at large enterprises are declining. That’s according to the Commerce Department data analyzed by Apollo's chief economist.

But the comparison itself is apples to oranges.

You can't fight the math on its own terms because the terms themselves are designed to produce a shocking number.

It's financial clickbait wrapped in academic legitimacy.

The real question isn't whether Garran's multiplier is accurate.

Rather, it's whether the AI market is actually behaving like a bubble that's about to violently correct.

That's where things get interesting.

While everyone's debating the 17x claim, the actual correction has already started.

The Quiet Apocalypse You're Not Seeing … Yet

While financial media obsesses over whether we're headed for a 2000-style crash, the bodies are already piling up.

The AI bubble isn't waiting for some future catalyst to pop.

It's deflating right now. In ways that don't make headlines but will reshape the entire landscape.

But first, let's talk about why this isn't 2000 — and why that matters for understanding what's actually breaking.

The Valuation Paradox:

Expensive but Not Insane

The price-to-earnings ratio measures how many years of current profits you're paying for upfront when you buy a stock.

A P/E of 20 means you're betting on 20 years of current earnings to justify today's price.

The higher the P/E, the more you're banking on explosive future growth.

During the Dot-Com peak, the tech sector’s P/E hit 55+. Cisco's reached triple digits.

Over half of tech companies had no earnings at all. That means their P/E ratios were literally incalculable.

Investors were paying infinite multiples for companies with no path to profitability, valued on "eyeballs" and "mindshare" rather than revenue.

Today?

- The S&P 500 trades at a forward P/E of 23.

- Tech sector average: 30.

- Even Nvidia, at the epicenter of AI mania, carries a trailing P/E of 52.

These are elevated valuations, yes. But they're attached to companies generating massive actual profits.

- Nvidia posted $165 billion in trailing 12-month revenue with a 52% net margin.

- Microsoft's Azure generated over $75 billion in fiscal year 2025 revenue.

These aren't speculative plays burning venture capital.

The Bank for International Settlements analyzed this specifically in September 2024. It found that, while tech valuations are stretched,

"The profitability and balance sheet strength of today's tech leaders differs markedly from the dot-com era."

But here's where it gets interesting: the aggregate numbers mask extreme bifurcation.

- Palantir trades at a trailing P/E of 632 and a forward P/E of 215-250, with a price-to-sales ratio exceeding 123.

- OpenAI now carries a $500 billion private valuation — the world’s most valuable startup. But at the same time, it remains unprofitable and projects roughly $12 billion–$20 billion of 2025 revenue (after $4.3 billion in the first half).

That implies roughly a 20x–40× sales multiple on expectations rather than realized revenue.

So, we have both things simultaneously:

- Broadly reasonable valuations for profitable giants, and

- Dot-Com-style insanity in select pockets.

The market isn't uniformly overvalued. It's selectively deranged.

And this selective derangement is precisely where the correction is concentrating.

Startup shutdowns surged 25%-56% in 2024 depending which dataset you trust.

Carta tracked 966 shutdowns versus 769 the prior year.

AngelList recorded 364 winddowns versus 233.

AI-specific signals point to stress beneath the headline funding boom.

Even as AI captured a record share of venture dollars in 2025, S&P Global Market Intelligence reports project abandonment surged.

Some 42% of companies scrapped most AI initiatives before production (up from 17% a year earlier).

And approximately 46% of AI projects were dropped between proof-of-concept and rollout.

The High-Profile Casualties Tell the Story

- Inflection AI raised $1.3 billion in June 2023 in a round led by Microsoft. Nine months later, most of its staff were "acqui-hired" for $650 million — a fire sale after the company admitted it couldn't compete despite possessing 22,000 of Nvidia's coveted H100 GPUs.

- Stability AI's CEO resigned in March 2024 amid $8 million monthly burn rates and a failed $4 billion fundraising attempt, triggering mass talent departures.

- Ghost Autonomy shut down in April 2024 despite raising $238.8 million and filing 49 patents.

These aren't fringe players. These are companies that were supposed to be the future.

But in reality, they couldn’t get off the ground.

‘Fewer Deals, Bigger Checks’

Venture bifurcation is stark.

AI startups pulled in $192.7 billion through Q3 2025 — the first year AI is set to take over half of all VC dollars.

Yet beneath the headline boom, early stage activity has thinned out: For AI specifically, seed/angel/pre-seed rounds fell 43% from 1,095 (Q3 2023) to 627 (Q3 2024).

In Q3 2025, overall VC dollars jumped to $97 billion (+38% year-over-year), but much of that was concentrated in a handful of mega AI rounds — classic “fewer deals, bigger checks.”

Translation:

A handful of mega-rounds masks an extinction event at the bottom of the market.

Just 18 companies that raised $500 million+ captured nearly one-third of Q3 investment.

If you're not in that elite tier, good luck finding capital.

Down rounds — when companies raise money at lower valuations than their previous round — reached a decade high at 15.9% of all venture-backed deals in 2025.

AI/Machine Language companies comprised 29.3% of those down rounds. That’s despite representing a smaller share of total deals.

Extension rounds and flat valuations proliferate among companies unable to demonstrate progress.

The exit environment remains frozen: 2024 saw 1,259 exits worth $149 billion compared to 2021's 2,040 exits worth $842 billion.

The Crypto AI Route

Crypto offers a decentralized alternative to TradFi AI investments.

Rather than a single, centralized entity, these projects rely on the grassroots nature of blockchain technology to make AI accessible to everyone.

For a fraction of the cost.

Platforms like Render (RENDER, “B-”), Bittensor (TAO, “E-”) and others rely on users to lend their liquidity and idle computer processing power.

That, in turn, is used to build and train AI models … for a fraction of what the largest TradFi firms pay. And with no need for physical storage or maintenance, these crypto AI projects can keep costs way down.

It’s a solid system. And one that’s self-reinforcing. In return for their liquidity and GPU, those users get rewards and access to that AI for pennies on the dollar.

This isn’t to say that crypto AI will be insulated when the AI bubble pops.

But it is likely we’ll see a higher survival rate among smaller decentralized AI projects.

Next week, I plan to dive into how I believe the bubble pop will play out. And I’ll detail how much risk I see in different AI opportunities.

In the meantime, I strongly recommend you check out some crypto AI opportunities.

If you’re interested in the future of the AI space, you’ll want to know about all the benefits decentralized AI can offer on the blockchain.

Best,

Jurica Dujmovic

P.S. One AI benefit you don’t want to miss is Juan Villaverde’s upgraded Crypto Timing Model 2.0.

Juan’s timing model was already strong. It pinpointed the start and end of the past three crypto bull cycles with precision.

But the market has grown. So, Juan added AI and fine-tuned his algorithm to account for these changes.

Now, testing shows his model has the power to generate AVERAGE gains of 6,630% for each crypto asset.

To see how it can help your crypto strategy, click here.