|

| By Chris Coney |

Yield farming can be a great way to passively earn rewards on crypto that you already own.

Traditionally, the way to maximize returns for a yield farm is to pay liquidity providers their share of fees, then enhance that yield by printing and distributing the project’s governance token.

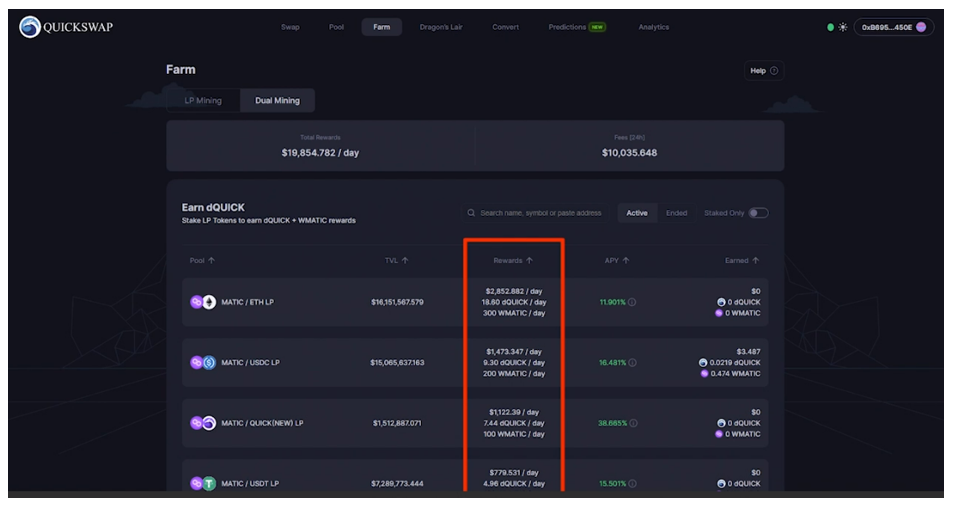

For example, many QuickSwap (QUICK, Unrated) yield farms pay out an amount of QUICK on top of the fees paid to liquidity providers. This can enhance their yield.

Similarly, when you lend money out on Compound, part of the yield is paid in Compound Coin (COMP, Tech/Adoption Grade “D+”).

This model became the industry standard and it’s how most yield farms work today.

On the positive side, this system provides a way to fairly distribute a new token to a broad group of investors.

One major problem, though, is the rewards are often being enhanced with inflationary tokens.

What happens when the rewards pool dries up and rewards drop to their true level?

The most likely scenario is that all the mercenaries who were initially attracted to high annual percentage yields leave for the next newest app … and the process starts all over again.

This is usually the case because most yield farmers would just claim their rewards and then immediately swap the project token into a blue chip like Bitcoin (BTC, Tech/Adoption Grade “A-”), Ethereum (ETH, Tech/Adoption Grade “A”) or a stablecoin.

Even worse, printing new tokens is often how new projects are able to fund themselves.

So, if they don’t have sustainable revenue by the time their incentive pool runs out, they’re prone to running out of business … and out of users.

For an in-depth analysis of this concept, check out my previous interview with Marija Matić on the topic of mercenary capital.

After considering the risks, most decentralized finance users are starting to look at yields with a lot more scrutiny.

Maximizing yield used to be the only thing that mattered …

But now, it seems like high yield alone isn’t enough.

To avoid complications, the most important factors to consider are:

1. The DeFi app you’re using solves a real problem

2. It’s well developed

3. It’s essential to the DeFi space

For an app to have reliable revenue, it needs to be so practical that investors use it all the time.

As a result, these parameters have sparked momentum and increased demand for real yield.

This trend is to pay rewards in the native protocol token rather than the project token.

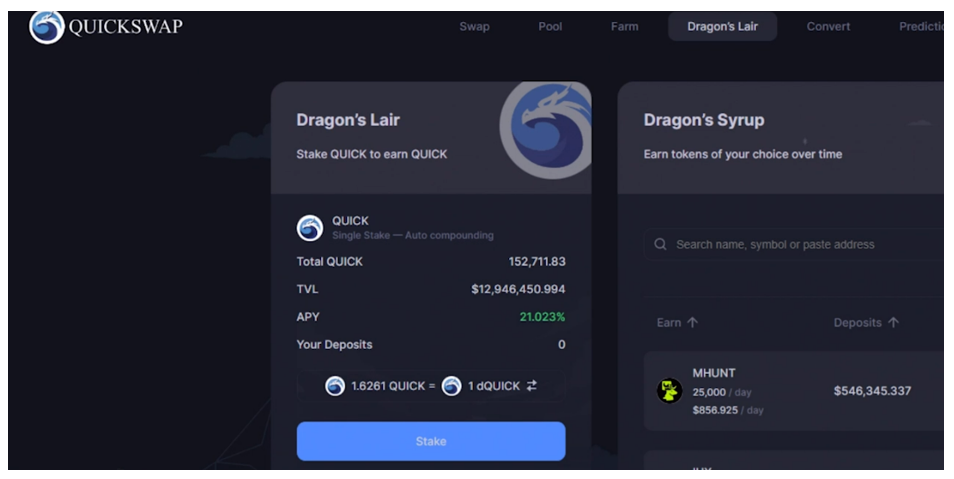

An example would be if you staked QUICK tokens.

When you do this now, you get a share of QuickSwap trading revenues.

But instead of earning more QUICK tokens as yield, they may pay you in Polygon (MATIC, Tech/Adoption Grade “B”). That’s because MATIC is the native token of the network you’re using.

These rules aren’t set in stone, but you get the idea.

Real yield involves being paid from real revenues and in a more-established asset rather than a new project token.

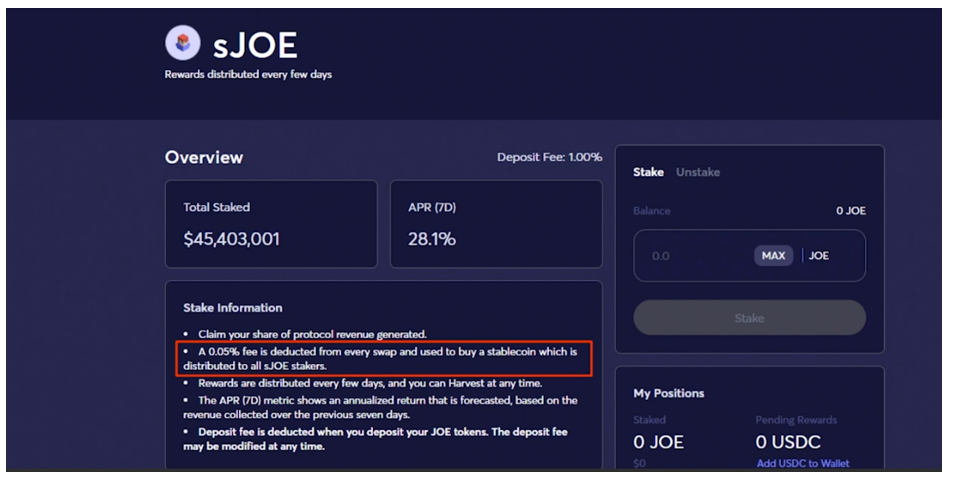

An example of this new model that’s currently in action is a decentralized exchange on the Avalanche (AVAX, Unrated) network called Trader Joe (JOE, Unrated).

A 0.05% fee is deducted from every swap, which is used to purchase stablecoins that are then distributed to investors who stake the JOE token.

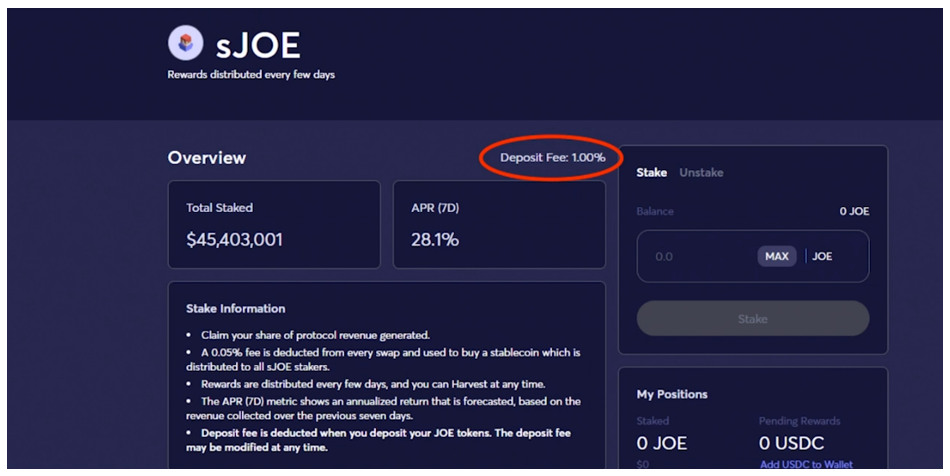

Additionally, Trader Joe charges a 1% deposit fee when staking, which punishes people who jump in and out while benefiting people who commit longer term.

This example is very clean because:

1. You know exactly where the yield is coming from and …

2. It’s coming from a product that’s in demand and essential.

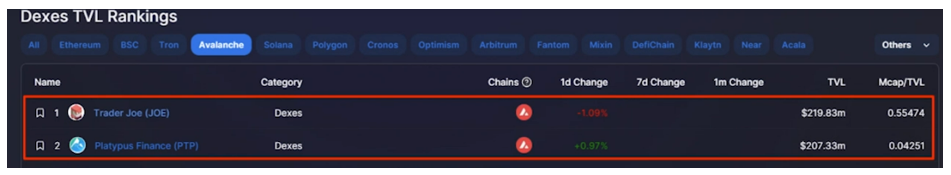

Trader Joe is currently the largest DEX on Avalanche, just ahead of Platypus Finance (PTP, Unrated).

Now, let’s throw some cold water on all this excitement.

What’s the obvious problem with this model?

It’s like buying a stock that pays dividends. Therefore, it runs the risk of being classified as a security by regulators.

That may be true for the token you stake, but any yields you earn should be safely tucked away in another token.

That way, if the staked token goes down in value because of a regulatory scare, you’ve got something to fall back on.

So that’s the basic story behind the real-yield trend in DeFi.

After an initial wave of greed and excitement, it’s back to basics, and back to sustainability as a priority.

In the past, I gave several options as to what you could potentially do with the yield you earned in a project's token.

If you chose to swap all your rewards into a blue-chip asset or a stablecoin, and you do that as part of your normal yield-farming process, then you’re already half operating on a real-yield standard.

The only difference going forward is that real yields will be handled by the app mechanics, and more of the revenue will be coming from sustainable sources.

And that’s all I’ve got for you today. Let me know your thoughts on real yields by tweeting @WeissCrypto.

I’ll be back next week with another crypto update.

Until then,

Chris Coney