The Runes Revolution Could Solve This Big Bitcoin Problem

Have you ever imagined being part of Bitcoin's inception?

Can you imagine witnessing and participating in the growth of a technology that would revolutionize financial paradigms around the globe?

If you’re a regular reader of our newsletters, you know that the Bitcoin halving finally took place late last week.

But hidden behind all the price speculation surrounding the event was the debut of a new protocol for the Bitcoin blockchain called Runes.

And thanks to this, you may be able to get the chance to join the second wave of the Bitcoin revolution.

My colleague Marija Matić explained on Monday how Runes will work.

Here’s a quick recap: Runes is expected to revolutionize how we use Bitcoin's blockchain for tokenization. In English, Runes streamlines token creation and trading directly on the Bitcoin blockchain.

Marija also touched on the dissent within the Bitcoin community. Some members happily welcome the opportunity for additional token development on the blockchain.

But Bitcoin maximalists are against these new tokens … or any change to the Bitcoin protocol, for that matter. They believe Bitcoin should be kept as a standalone utility for storing and transferring value to keep the network pure from congestion.

While I can see some merit to that argument, I don’t agree with it. New tokens can introduce new problems — such as network congestion, increased fees and transaction confirmation time and lack functionalities like smart contract abilities. But those concerns are outweighed by the reality that these tokens serve as the testbed for future Bitcoin blockchain development.

Simply put, creating these tokens allows for the development of more sophisticated financial instruments beyond simple transactions, expanding Bitcoin's utility and network effect.

I have been a Bitcoin enthusiast for over a decade. As such, I’m incredibly familiar with the core values of cryptocurrency — decentralization and financial independence. And if you’ve been following us here at Weiss Crypto Daily, you’ll be familiar with them, as well.

So I find it ironic that some Bitcoin maximalists want to dictate how others should use their "freedom money." Then again, some maximalists have a problem with people using Bitcoin for speculative purposes … but they have no issue with institutional ETFs that hold Bitcoin in a ring-fenced institutional box.

Bitcoin is supposed to be decentralized and out of the control of governments and institutions. While ETFs are great for Bitcoin's short to medium-term price, they don't improve its utility. And over time, decreasing utility causes a decrease in price.

But the bigger problem with locking up BTC in ETFs is that it also reduces the miner's earnings, making mining less attractive. And without miners, we would lose the security of the network.

And that’s where my fundamental issue with the maximalist position lies. See, because of the halving, the mining reward is already cut in half every four years.

Eventually, there won’t be any BTC to mine … even if nothing changes on the Bitcoin network.

To ensure the future security of the Bitcoin blockchain, we need to increase transaction fees through Bitcoin protocols. Losing utility ultimately leads to a degrading price, so we need to act now to maintain Bitcoin's utility and value.

And you don’t need to just take my word for it. The hard data supports my case.

Franklin Templeton's behemoth investor fund, with $1.60 trillion AUM, recently issued a report on Runes. It stated that a widely accepted fungible standard is necessary for DeFi on Bitcoin to experience the exponential growth that many in the industry predict.

MicroStrategy’s (MSTR) Michael Saylor agrees. He has stated on numerous occasions he wants to see a plethora of apps working on top of Bitcoin.

MicroStrategy has a substantial BTC holding thanks to Saylor’s leadership. If this works out in his favor, my take is that MSTR could cover the cost of any loan or bond issued for the purchase of Bitcoin through revenue from this added utility.

The old adage when it comes to investing is to “follow the smart money.” Well, that smart money is talking. And I’m listening.

But another core tenant of cryptocurrency ideology is trustlessness. Engaging with the crypto market means not needing to trust the person at the other end of your transaction.

That’s why I want to turn your attention to the hard data. Because it’s supporting what I and others in the space are saying.

The Growth of BRC-20

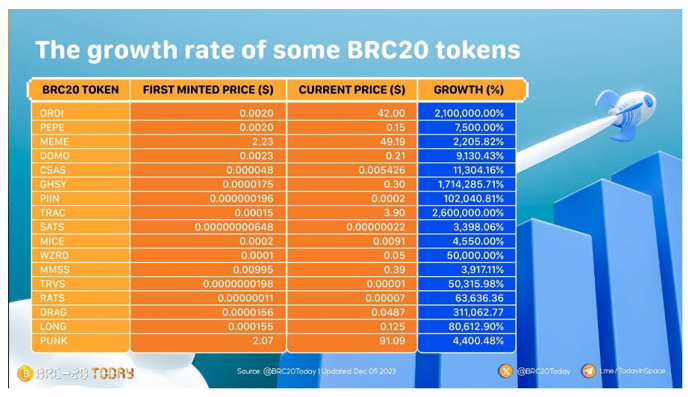

Before Runes, there was some token creation functionality on the Bitcoin blockchain thanks to a protocol called BRC-20. Looking at those coins’ performance, we can get a hint of how tokens created under Runes could perform.

And BRC-20 tokens have seen remarkable value increases so far. ORDI (ORDI, Not Yet Rated) for example, saw a spike of 4,200,000%, and Trac (TRAC, Not Yet Rated) saw an even more impressive 5,200,000% gain from their respective launches to their all-time highs.

Today, the total market cap for BRC-20 tokens is around $2.6 billion, though the all-time high is around $5.5 billion.

These gains highlight Bitcoin's expanded potential and versatility.

Additionally, this surge in activity generated an extra 3,500 BTC in transaction fees for Bitcoin miners.

Although many of these tokens will inevitably suffer the same fate as most tokens in the market and eventually fade away, their performance so far underscores the economic benefits of this new utility in the Bitcoin ecosystem.

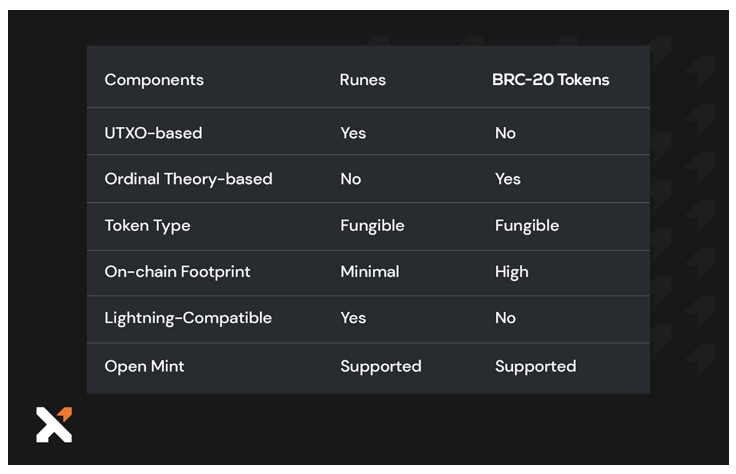

Advantages of Runes Over BRC-20

Runes offers several improvements over the BRC-20 protocol, focusing on efficiency, scalability and utility:

Efficiency and Cost-Effectiveness: Runes optimizes the use of blockchain space and reduces transaction fees by minimizing the data required for token transactions.

This contrasts sharply with BRC-20 tokens, which can consume extensive blockchain space and incur higher fees.

Scalability: Runes can handle a larger volume of transactions more smoothly and efficiently than its predecessor, enhancing the protocol’s scalability.

Flexibility and Broader Use Cases: Runes is designed to support a wider range of token types, including NFTs, fungible tokens, governance tokens and more. This enables a variety of new applications on Bitcoin’s blockchain.

With all these changes, Runes still maintains Bitcoin’s core principles by ensuring that its approach to tokenization does not compromise the network’s decentralized nature or security.

These features make Runes a promising advancement for everyone, from individual users and investors to developers looking to innovate within the Bitcoin ecosystem.

Embrace the Future of Crypto with Runes

Many market analysts predict that Runes could usher in a new era of cryptocurrency innovation, much like Ethereum's transformative impact.

According to runesmarketcap.com, the total market capitalization for Runes tokens is currently at $447 million. Although it has a long way to go to reach the $5.5 billion market cap high of its BRC-20s predecessor, the possibility is definitely there.

Which makes Runes tokens an interesting opportunity for investors looking for growth opportunities.

That said, it is important to remember that these tokens can be volatile and unpredictable. That's why we're here to help you navigate this exciting and rapidly changing world of cryptocurrency.

In fact, my colleague Juan Villaverde recently sat down with Weiss Ratings founder Dr. Martin Weiss to break down his strategy for targeting small cryptos with outsized growth opportunities just like this.

And he revealed a backdoor buying method that helps him maximize those potential returns.

Juan and Martin recorded that conversation and have made it available for you to watch for free, as a thank you for being a loyal Weiss Ratings reader.

With the Bitcoin halving behind us, history says that the next bull market rally is now ahead of us. And the time to prepare for it is now.

Use this urgent, actionable briefing as your first step toward that goal. And I suggest you do so soon. We’re taking it offline tonight.

Best,

Mark Gough