|

| By Chris Coney |

Crypto markets may be incredibly close to a turning point for 2023.

I say this because our Crypto Timing Model has signaled a significant point in the market happening in mid-to-late May … which is right about now.

Generally speaking, the big fish to look out for in our timing model is the 320-day cycle.

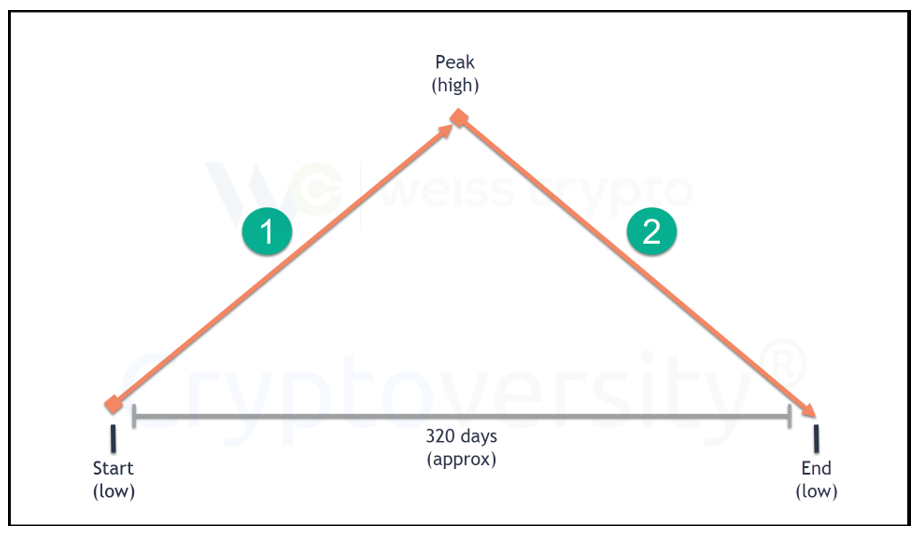

A cycle is defined as starting at a low and ending at a low, with a high peak somewhere roughly in the middle.

Usually, these cycles tend to rally in the first half and pull back in the second.

For the sake of brevity, I’m going to keep it general here.

However, if you would like a more detailed breakdown of this analysis, you can find it in my Crypto Yield Hunter newsletter.

In fact, I recently released my Superyield Conference all about the strategy I use in Crypto Yield Hunter to target DeFi yields in any market.

I suggest you watch it now before it’s taken offline.

The Anatomy of a Cycle

Here is my personal illustration of the 320-day cycle:

Typically, we start on a certain date at a low price. Then, as illustrated by point 1, we spend roughly half the cycle moving up toward a peak.

After that, we spend the second half of the cycle moving down toward another low, as shown by point 2.

Now, what I have drawn here is a diagram of a neutral 320-day cycle. This means it ends at a price close to where it started.

Three other types of the 320-day cycle exist, but they are beyond the scope of this article.

Additionally, I would like to emphasize that the Crypto Timing Model is a model.

My personal definition of a model is: “A simplification of reality to promote understanding.”

In general, reality is far too complex to model in its entirety. But that doesn’t stop us from creating diagrams to illustrate a concept and guide our actions.

With that being said, I will continue to explain the 320-day cycle in the most straightforward way possible so, that it’s easy to understand.

A Tale of 2 Halves

Theoretically, a 320-day cycle that moves in two phases would mean each phase is roughly equal in length. So, about 160 days each.

While it is rarely that exact, this is a useful guide.

If we know when the cycle began, then we can roughly estimate when the peak will be.

Although we may not know exactly where the peak will be (i.e., the price), knowing the general timeline can be incredibly helpful.

To put real numbers to this, I have Dec. 19, 2022, as the start of the current 320-day cycle. And 160 days out from there is May 28, 2023.

This means now would be the time to pay extremely close attention to the markets in the interest of looking for a peak.

Conclusion

If the analysis I have laid out today turns out to be accurate, it raises a big question:

“How do I make money in crypto markets during Q3 and Q4 2023 if there are likely to be headwinds?”

For week-by-week guidance on that topic, please consider signing up for Crypto Yield Hunter.

For a more general answer to that question, meet me back here next week and I’ll introduce you to the idea of zero-exposure yields.

But that’s all I’ve got for you today. Let me know your thoughts on this current 320-day cycle by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me, Chris Coney, saying bye for now.