The Solution to the Current Fiscal Equation Is Crypto

|

| By Juan Villaverde |

Welcome to "Fiscal Math," a class in which the U.S. apparently hasn’t been paying attention.

See, the U.S. has decided that the math of balancing its budget is too hard. Instead, it borrows money like there’s a sale at the debt store to pay back what it owes.

Over the past three years, America’s deficit skyrocketed to about $9 trillion. More than half — 60% to be exact — came from the Federal Reserve’s overzealous printing press.

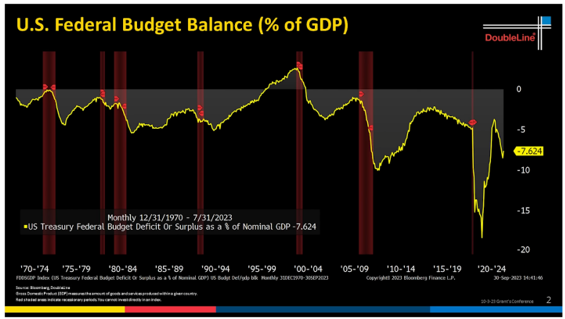

So, what’s the problem? Well, let’s start with the chart below …

As you can see, the 21st century started off pretty well, with the U.S. enjoying a surplus.

But that didn't last long.

Note the red shaded areas. Those mark recessions. And usually, the U.S. tightens its belt during these times.

The most recent one hit in 2020, sparked by the Covid-19 outbreak and subsequent lockdowns. And we all know Uncle Sam did the exact opposite of tightening the belt then. Indeed, printing soared through the roof as the U.S. desperately tried to keep its economy going.

Now, the current deficit is lounging comfortably at nearly 8% of GDP … which is coincidentally the same as the economic “growth” in 2023.

Meaning, if not for government generosity, it seems like the U.S. economy would be playing dead.

Indeed, about 40% of our deficit is just the interest payments on the money the U.S. has borrowed. That debt-to-GDP ratio is unsustainable.

Argentina did something similar. It ran its printing presses into the ground and guess what? It’s now struggling through out-of-control inflation that averages at 122%.

I can already hear your response: “But that was Argentina. That can’t happen in the U.S.!” And I understand why many people believe that.

After all, it’s hard not to considering the U.S. dollar’s position as the global currency. If you print the world’s money, you have a bit more leeway with the rules, right?

Maybe. But we’re reaching the limit of that leeway.

See, the U.S. debt market is like a bug looking for a windshield.

The debt size is bloated with interest payments, and that’s without considering the additional spending spurred by potential wars in Eastern Europe and the Middle East.

So, we can’t keep running the printing press and borrowing or else interest payments will balloon even further. But that puts the bond market in a bind.

The anomalous decline in Treasurys we’ve seen in recent months is less about the U.S. economy and more about an oversupply of bonds … with fewer and fewer takers.

As a consequence, the bond market is under so much duress that it’s starting to crack under the strain as willing buyers dwindle.

Even in the face of two geopolitical conflicts that had investors running to gold as a safe haven investment, Treasurys uncharacteristically lagged.

This all adds up to one conclusion: The U.S. is in a sticky situation.

Without the Fed printing money to buy bonds, Uncle Sam won’t have the necessary funds that are needed now. But if it does print, we’ll all be trapped in a rigged game of Monopoly where no one wins, and the only prize is massive inflation. But that isn’t the end of this calculation ...

Enter Bitcoin and gold, the cool kids at the safe haven party.

This past month, gold rallied an incredible 7.3% to close at $1,983 an ounce. That marked its strongest October since 1978, when it jumped 11.7%.

Not one to be outdone, Bitcoin soared 27%. Even when rumors of a Bitcoin ETF approval were debunked, Bitcoin stayed high. Instead of following a typical “buy the rumor, sell the news” pattern, Bitcoin was just a straight “buy.”

That’s because when you’re looking for shelter from the U.S.’ bad fiscal math, the answer is best found in an asset that the U.S. government can’t control.

And it’s bigger than just Bitcoin.

Just this week, rumors started circulating about an upcoming Ethereum Spot ETF, which brought the world’s second-largest cryptocurrency into the party as well! And my colleague Marija Matić has already told you about the top-performing altcoins that are getting in on the action, as well.

That’s because more and more investors are crunching the numbers themselves. They see the opportunity inherent in a decentralized financial system that exists out of Uncle Sam’s reach.

The savviest among them are already adjusting their own calculations to shift their wealth from sovereign debt markets into gold and crypto.

The U.S. government may have failed fiscal math, but you don’t have to flunk out in solidarity.

To that end, I suggest you utilize the tools available to you right here on our Weiss Ratings website to help you identify which crypto investments are right for you.

Those tools include our Weiss crypto ratings, your customizable watch and alert lists and, of course, your Weiss Crypto Daily issues to keep you informed of everything that’s happening in the markets.

If you’re looking for even more guidance, I suggest checking out my Weiss Crypto Investor newsletter. In it, I target the most promising long-term crypto investments and use my proprietary Crypto Timing Model to send members specific “buy” and “sell” recommendations, so they never miss an opportunity.

You can find more information here.

Best,

Juan