This Crypto Could Be Your Gateway to the Future of Finance

Imagine a world where your money works for you.

In this world, you’re not just another bank number. You're a co-owner of the financial system.

Sound far-fetched?

Maybe to some. But that’s exactly what Usual Protocol (USUAL, Not Yet Rated) hopes to build.

The Problem: Why Usual Exists

Today’s financial systems often leave regular users on the sidelines.

And sadly, I am not just referring to traditional banks. Many crypto issuers are also guilty of this.

Here’s what’s happening:

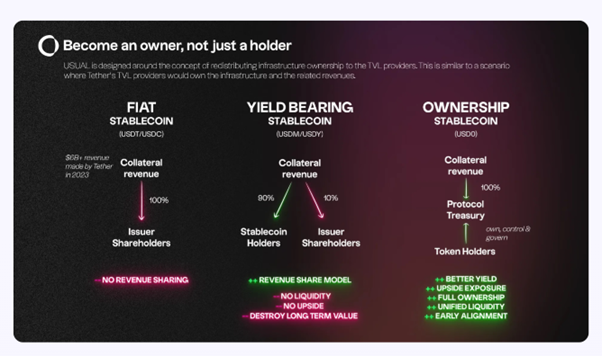

- Profit Hoarding: Some issuers manage large liquidity pools … but don’t share rewards to lenders or liquidity providers. In short, insiders profit while users bear the risks.

- Broken Tokenomics: Many crypto projects issue tokens with no real connection to the value of their systems. This creates rewards that benefit speculators but not everyday users.

- No Access to Growth: Even yield-bearing assets don’t let users share in the system's growth they support.

If you think this is unfair, you’re not alone.

In fact, it flies in the face of crypto’s core goal: Remove the middlemen and allow the average person to benefit from the opportunities banks and financial institutions have kept to themselves.

That’s precisely why Usual Protocol was created.

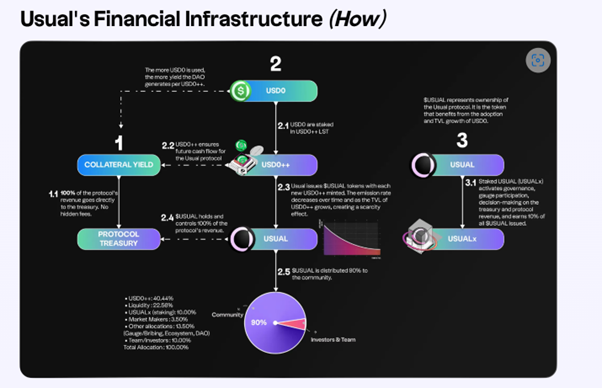

Usual transforms this flawed system by empowering users to become integral stakeholders in the protocol.

Unlike traditional systems where insiders reap the rewards, Usual ensures 90% of the value it generates goes back to the community.

Let’s face it: Taking control of your financial health can be intimidating.

Usual makes it not only simple but also rewarding and fair thanks to three key strengths:

- Transparency: With Usual, everything happens on-chain, meaning you can verify how your money is used.

- Accessibility: You don’t need to be a crypto expert to participate. Usual’s products are designed for ease of use.

- Community Ownership: The protocol’s success is tied to your participation. When you contribute to its growth, you benefit directly.

How It Works

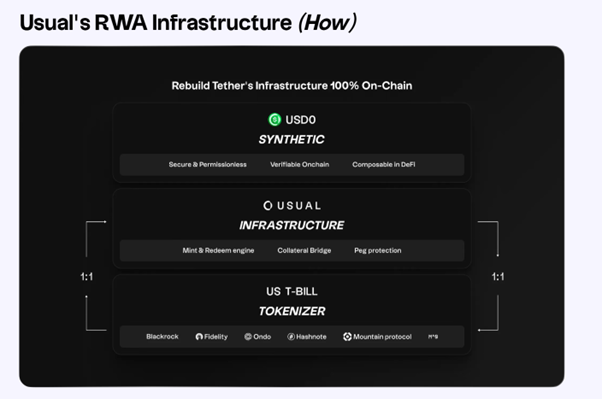

Usual integrates real-world financial assets into the DeFi space through a permissionless stablecoin. Then, it gives users a few ways to benefit.

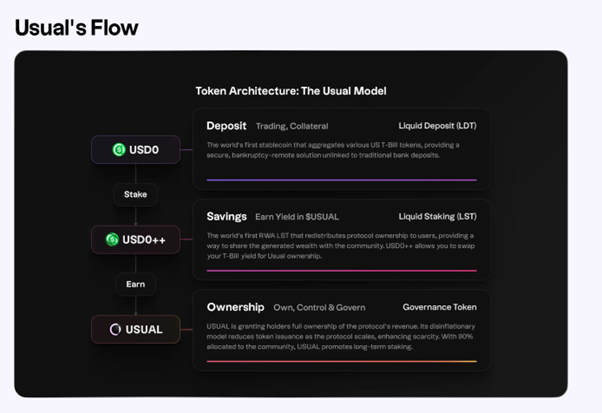

To do this, it uses three coins:

- USD0. Usual’s stablecoin that is backed by real-world assets like U.S. Treasury Bills.

- USD0++: This is a liquid staking token, received when users stake their USD0.

- USUAL: As a governance token, USUAL gives you a stake in the protocol’s success, much like owning shares in a company. As Usual grows, so too does the value of your USUAL token.

Let me break down the process:

Users buy Usual’s stablecoin, USD0. As I mentioned, it is fully backed and always collateralized, so its value remains stable.

In fact, owning USD0 means users can indirectly benefit from assets like U.S. Treasury Bills, as real-world assets like T-bills make up USD0’s reserve.

Talk about giving your dollar more power!

And that’s only the start.

Users can also stake their USD0.

Think of staking on Usual like opening a savings account for real-world assets, but with a four-year lock-up.

This helps secure future revenue for the Usual. In return, you receive two coins.

First is the USD0++ liquid staking token. It remains transferrable while your USD0 is locked up. The amount of USD0++ you receive is equal to the amount of USD0 you deposit.

Second is your reward for staking, paid in Usual’s governance token, USUAL. Its value is tied to Usual’s revenue model. Essentially, it gives you a stake in the long-term growth and success of Usual.

In the end, both parties win. Usual uses the staking rewards to incentivize the growth and adoption of USD0 and ensure liquidity for the long term.

And, as the protocol grows, fewer USUAL tokens will be issued, boosting the value of existing tokens for stakers.

Market Performance

Usual isn’t just spouting ideals. It’s making real waves in the decentralized finance, or DeFi, sector.

At the time of writing, its price sits near 86 cents.

That may not seem like much, but it’s the result of a remarkable 156.88% growth in its overall value since its launch.

With a market cap of $288.94 million, the protocol has captured significant attention in the crypto community, reinforcing its potential as a leading player in the stablecoin and RWA-backed DeFi ecosystem.

The 24-hour trading volume of $108.1 million is even more compelling. It reflects strong interest and active participation by users.

This meteoric rise is proof of the power of community-driven finance.

By prioritizing transparency and value sharing, Usual is cementing its place as a standout in the evolving world of decentralized finance.

What’s Next

Currently, Usual is in its first phase and is focused on growing its total value locked (TVL), which is a measure of liquidity locked within the system.

The goal? To lay a solid foundation for new products and services that will democratize access to finance.

By early 2025, Usual plans to roll out more aggressive liquidity products tailored to market conditions.

These should provide even more opportunities for users to grow their assets while aligning with the platform’s mission of empowering the community.

Usual Protocol is still very new. Which means it is riskier than a more established crypto project.

But I believe if you’re on the hunt for big growth opportunities or are excited about the democratization of the financial markets — as many crypto enthusiasts are! — you’ll want to keep this one on your watchlist.

It still has to prove itself in this crazy market. But I believe Usual may offer an unusual opportunity many investors would be hard pressed to ignore.

And if you’re interested in learning about other exciting growth opportunities, I suggest you check out my colleague Juan Villaverde’s latest briefing.

He and Dr. Bruce Ng have a strategy to target specifically smaller crypto projects that have the right mix of fundamental strength, tokenomics and community support to go the distance.

Not only that, they believe the coins they’ve narrowed in on have the potential to outperform Bitcoin and many other leading cryptos in this bull market’s next leg up.

In this briefing, Juan breaks down his strategy to Weiss Ratings founder Dr. Martin Weiss. And he’ll tell you how you can learn about the growth opportunities he believes you should get into now.

This is your last chance to watch list briefing. It’s going offline at 12 midnight tonight, so be sure to watch it before then!

Best,

Mark Gough