This Rising Crypto Star Is Shining Even Brighter

|

| By Marija Matic |

Sui (SUI, Not Yet Rated) has rapidly emerged as a noteworthy player in the blockchain domain. In particular, it’s shining bright in the decentralized finance, or DeFi, sector.

My colleague Mark Gough introduced this new star to our Weiss Crypto Daily readers just last month. And its remarkable growth in value and the surge in investor interest means it’s time to take another look at its burgeoning potential.

Over the past week, Sui saw an impressive 17% rise in value. Remember, the broad market hasn’t had the best performance, so this is especially noteworthy.

The fervor around Sui has propelled open interest to exceed $287 million. And its total value locked — which measures the liquidity locked on a platform and also serves as an indicator of user engagement and overall health — more than doubled from $342.82 million in August to $704.42 million at the time of writing.

As a result, Sui has cemented its place as the 10th largest blockchain network by TVL.

To recap, Sui is positioned as a potent challenger to Solana (SOL, “B”) — the Layer-1 darling of this bull cycle.

Solana’s popularity is in part due to its fast and cheap transactions.

Ethereum (ETH, “A-”) — the No. 1 smart-contract platform — can process only 15 transactions per second (tps). But Solana has hit a max of 7,229 tps and for a fraction of what Ethereum charges in gas fees.

But Sui blows them both out of the water. It claims an unparalleled throughput capacity of 297,000 transactions per second, though this still needs to be tested by real-world users.

This permissionless blockchain is designed for instant settlements and high throughput, catering to the demands of the new wave of latency-sensitive decentralized applications.

And as DeFi grows and more people actively trade and transact, that speed will be a critical factor when developers and users decide which blockchain suits their needs.

Sui's DeFi Landscape: A Growing Ecosystem

And Sui is ready for this growth thanks to its Move programming language. This distinctive, Rust-based language — conceptualized initially for Facebook's Diem blockchain — facilitates a platform-agnostic environment.

In plain English, it broadens the utility and integration of common libraries and tools. Not only does that make creating on Sui easier for developers. It also nurtures a unified community across diverse blockchain frameworks.

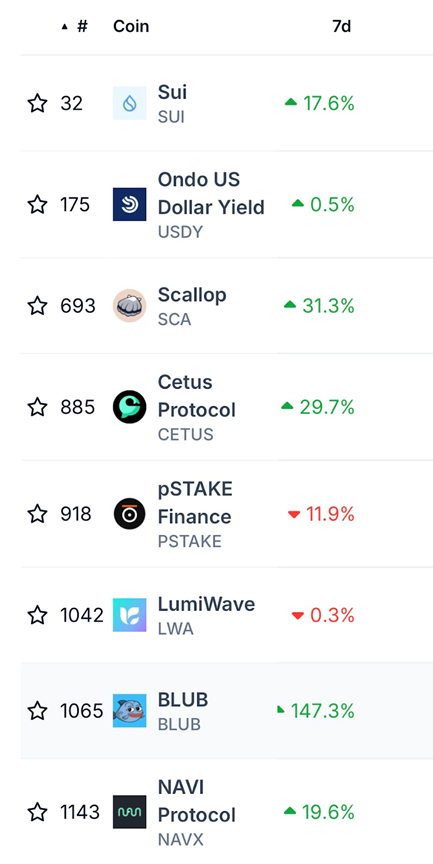

Indeed, Sui's ecosystem is already rapidly expanding, with DeFi projects playing a pivotal role. These projects have demonstrated strong performance over the past week, showcasing the growing popularity of Sui's ecosystem:

These new DeFi projects on Sui can offer even more opportunities for investors. And money markets have emerged as the most active protocols.

Three that have caught my attention are …

- Navi Protocol (NAVX, Not Yet Rated): This leading money market boasts a TVL of $261.6 million, and it offers an APY of 10.72% for lending USD Coin (USDC, Stablecoin). Navi's unique features include leveraged positions through automatic leverage vaults and an isolation market for listing new assets.

- Project Scallop (SCA, Not Yet Rated): With a TVL of $125.52 million, Scallop offers a base APY of 11.76% for lending Tether (USDT, Stablecoin). Its native token, SCA, is witnessing a fresh surge in interest.

- Suilend: Another prominent lending platform, Suilend has seen its TVL increase by nearly 50% in just one month, reaching $116.95 million.

Beyond lending platforms, I also want to highlight Cetus Protocol (CETUS, Not Yet Rated). This thriving decentralized exchange has useful tools such as limit orders and dollar-cost averaging. With over $111 million in liquidity and $10 billion in cumulative volume, Cetus has established itself as a key player in the Sui ecosystem.

Looking forward, derivative DEXs, options and real-world asset services are starting to take shape on Sui. While they are still in their early stages, their emergence indicates a fertile ground for financial services on the Sui blockchain.

The cherry on top of all Sui’s growth and potential is the fact that its utility extends beyond the crypto industry.

For instance, 3DOS — a manufacturer of 3D printing devices — has chosen Sui to build the world's largest peer-to-peer 3D printing network. This is thanks to Sui’s quick throughput and lower transaction costs.

3DOS decentralizes manufacturing. That means anyone can send a product design to an idle manufacturer anywhere around the globe. By decentralizing manufacturing, they aim to create a global network of on-demand, local 3D printing services.

Sui's swift growth trajectory, coupled with its ability to serve real-world applications, positions it as a formidable player in the blockchain domain.

With its high processing capability, evolving DeFi ecosystem and expanding real-world applications, Sui is well positioned to attract more developers and investors, affirming its stature as an influential blockchain network, worth having on the radar of investors.

Investors interested in growth opportunities should consider keeping Sui — and the growing number of DeFi projects built on it — on their watchlist.

Best,

Marija Matić