On Monday, my colleague Marija Matic mentioned a coin you may not be familiar with, Sui (SUI, Not Yet Rated).

She said it was leading the back of altcoins recovering from the recent correction. Indeed, SUI’s price increased by 159% over the past week!

As Dr. Bruce Ng has suggested before, savvy investors can find intriguing opportunities by looking at projects that show strength in a recovery.

That’s why I want to take a closer look at Sui.

Born from the innovative team behind Meta's cancelled Diem project, Suiis a groundbreaking Layer-1 blockchain platform designed by Sam Blackshear. Its goal is to revolutionize the crypto world with unmatched transaction speeds, low fees and a pioneering asset ownership model.

And so far, it’s on the path to meeting those goals.

Let’s start with transaction speed.

Sui's Narwhal consensus mechanism enables it to process up to 125,000 transactions per second under optimal conditions.

For context, Ethereum (ETH, “A-”) can only do 15 tps and Solana (SOL, “B+”), heralded for its speed, has only hit a max tps of 7,229.

Sui’s high throughput suits high-demand applications like decentralized finance and gaming, like its Sui Play initiative. Leveraging blockchain technology to enhance gameplay and ownership experiences, projects under this initiative include …

- The SuiPlay0x1 Handheld Gaming Console: Expected to be released in 2025, this device supports a variety of games, including those built on the Sui blockchain and PC games from platforms like Steam and the Epic Games Store. This integration allows users to access and manage their Sui assets directly from the device.

- Play Beyond Gaming Development Platform: This is Sui's dedicated space for web3 games. It provides developers with tools to create dynamic, scalable games on the Sui blockchain.

All this speed comes for a relatively inexpensive fee, as well.

Averaging at around $0.0015 per transaction, fees on Sui are very affordable thanks to its efficient network management and scalable infrastructure that adjusts demand-based resources.

SUI also has a unique asset ownership model. Assets can be owned by a single entity or shared among multiple owners. But while assets owned by a single entity can be transferred quickly without consensus, shared assets involve consensus validation.

And it has seen substantial growth recently. Sui now sits 31st in the coinmarketcap rankings, with a circulating marketcap of $2.3 billion.

Its recent price action has also been impressive, as I mentioned earlier. Those two big green spikes at the far right of the chart below? That’s SUI’s price action just from this past week.

Overall, I see four reasons behind SUI’s recent surge …

1. Influential Whale and Institutional Activity

Grayscale recently announced a SUI trust, boosting the project's profile and appeal. However, Grayscale has accumulated less than $1 million in said fund, which means it’s only a piece of this puzzle.

Instead, influential whales have been making substantial over-the-counter (OTC) bids, which has significantly impacted SUI's price. This buying pressure suggests confidence in SUI's long-term potential.

2. Excellent Tokenomics

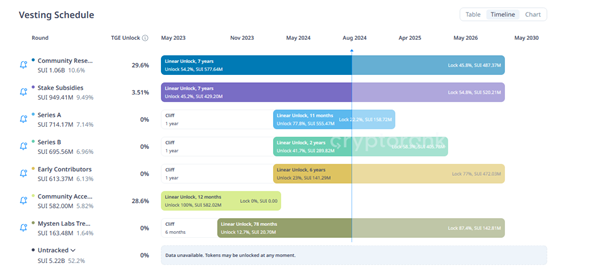

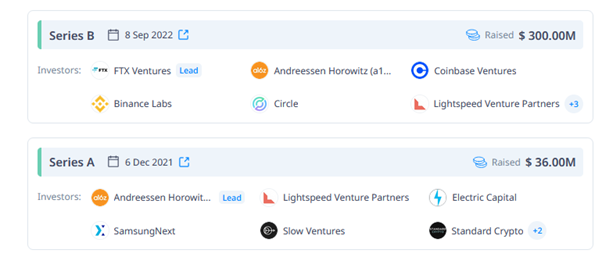

SUI's tokenomics are designed to ensure long-term value. With 52% of the supply allocated to be released after 2030, 16.6% held by investors and 6% held by the team, the structure supports sustainable growth.

3. Vesting Schedule

The team and investor vesting started in May 2024, with around $80 million worth of tokens unlocked monthly.

And despite the potential sell pressure, SUI's four Tier 1 venture capital backers have shown a strong commitment to holding their positions.

4. Positive Sentiment and Market Position

SUI has been gaining popularity, especially as it captures interest from the meme space previously dominated by Solana.

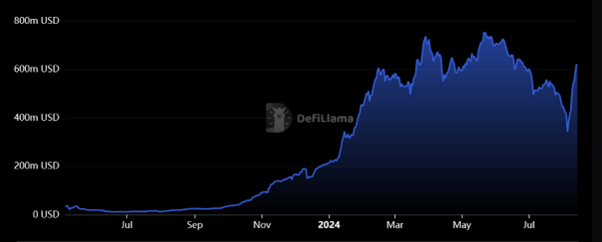

Its TVL, or total value locked, saw a sharp increase recently, as you can see below.

This is primarily due to the inflow of stablecoins, which is expected to significantly benefit the SUI ecosystem in the coming months.

And I believe it still has far to go. That’s because Sui also boasts an impressive market cap-to-TVL ratio, which indicates how undervalued the chain might be to its actual activity.

With a market cap to TVL ratio significantly lower than other top blockchains, SUI appears undervalued, indicating further growth potential.

Future Outlook

Looking ahead, SUI is poised for further growth. It could reach a price target of $10 in the long term and $2-to-$3 in the medium term if the current demand and market sentiment persist.

With SUI’s current price near 89 cents, those targets could represent solid gains.

The platform's scalability, low fees and innovative features will likely attract more developers and users, further solidifying its position in the blockchain ecosystem.

But the biggest indicator that this is a project to watch is Sui’s rapid ascent in this market. That underscores its potential as a leading blockchain platform. With its high transaction speeds, low fees and innovative asset management, SUI is well-positioned to meet the needs of contemporary digital applications.

This combination of technical prowess and market momentum makes SUI a project worth watching in the evolving landscape of blockchain technology.

Savvy investors may want to keep an eye on Sui for their trading or investment portfolios.

Best,

Mark Gough

P.S. At Weiss Ratings, our goal is to bring your attention to the best opportunities we can find in every market, from TradFi to crypto. That’s why I want to make sure you’re aware that on the TradFi side, my colleague Chris Graebe has just found an incredible opportunity that’ll blow you away.

That’s not just hype. McKinsey & Co. values this opportunity at over $1.4 trillion.

And soon, Weiss Members like you can claim an early stake in the company supercharging this trend … BEFORE it ever goes public.

To learn more, click here.