|

| By Jurica Dujmovic |

As 2024 unfolds, the cryptocurrency landscape is witnessing the rise of a trend that promises to bridge the gap between traditional finance and decentralized finance: real world assets, or RWAs.

This development, while holding significant potential, also brings with it a complex set of opportunities and challenges, especially as industry giants like BlackRock step into the arena.

At its core, the concept of RWAs in crypto involves tokenizing tangible, off-chain assets such as real estate, commodities and securities. These digital tokens represent ownership or rights to those assets so that they can be traded on blockchain platforms.

Related Story: 3 Benefits and 5 Leaders of the Real Estate Tokenization Revolution

The idea is compelling. Imagine being able to own a fraction of a skyscraper or trade portions of gold reserves as easily as you might trade Bitcoin (BTC, “A”).

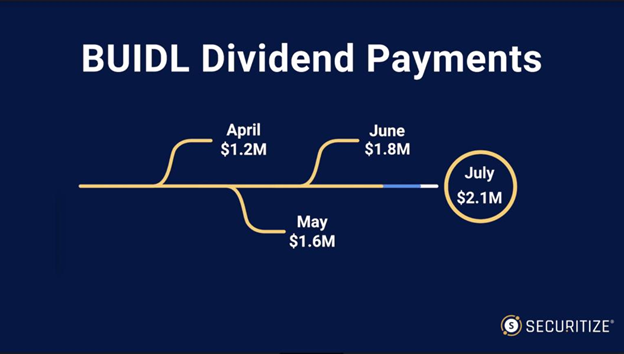

In March 2024, this concept took a giant leap forward when BlackRock (BLK), the world's largest asset manager, launched its United States Dollar Institutional Digital Liquidity Fund (BUIDL) fund. Focusing on tokenized asset investments, the fund has already distributed $7 million in dividends to investors by August 2024, according to digital asset securities firm Securitize.

BlackRock's Global Head of Digital Assets, Mathew McDermott, hailed this as a transformative phase for the crypto industry, signaling a new era where traditional institutions are actively exploring novel investment avenues.

And others are taking note. Goldman Sachs (GS) recently announced plans to introduce three new tokenized products in 2024, though few specifics have been revealed.

However, TradFi’s entry into this space is a double-edged sword. Particularly regarding BlackRock. Its track record in navigating complex regulatory and ethical issues in traditional finance is highly problematic. The company has faced significant criticism for its approach to environmental, social and governance issues and is often accused of greenwashing and inconsistent policies.

For instance, while publicly advocating for climate action, BlackRock has continued to be one of the world's largest investors in fossil fuels. As BlackRock ventures into the RWA space, these ethical contradictions and regulatory challenges are likely to follow, raising serious questions about how the firm will manage the complex landscape of tokenized assets.

But the broader concerns extend beyond just these issues and apply to all TradFi giants. BlackRock's sheer size and influence in global markets have led to accusations of anti-competitive behavior and outsized influence on government policies. Critics argue that allowing such a powerful entity to dominate the nascent RWA market could undermine the decentralized ethos that blockchain technology was meant to foster.

There's a real risk that BlackRock's entry could lead to a concentration of power that mirrors traditional financial markets, potentially stifling innovation and limiting opportunities for smaller, more agile players in the space.

Despite this, the RWA market itself has shown promising growth. Tokenized U.S. Treasurys saw a remarkable 782% increase in 2023, reaching a market value of approximately $931 million.

Though this growth has slowed in 2024, reflecting the evolving nature of the market and the challenges it faces.

The tension between centralized financial giants and decentralization advocates forms the backdrop against which the market's growth and challenges must be understood. As we examine the current state of RWAs, it's crucial to consider both the impressive growth figures and the underlying complexities that could shape the sector's future.

For example, this complex landscape has multiple projects that are vying for position. Each is navigating the delicate balance between innovation and institutional involvement.

Here are a few interesting ones that have caught my eye. Not necessarily as investment opportunities. But rather, I believe we’ll be able to learn a lot about the future of the RWA market by the success, or failure, of projects like …

- InvestaX positions itself as a one-stop shop for tokenization needs, operating as a permissionless asset tokenization solution. Licensed by the Monetary Authority of Singapore, InvestaX offers the veneer of regulatory compliance. However, its full know-your-customer/anti-money laundering onboarding process —while potentially reassuring for institutional investors — may raise concerns about privacy and true decentralization among crypto purists.

-

Spydra takes a different approach, focusing on enterprise-level tokenization. Its promise to convert off-chain assets into tokens within minutes is appealing, particularly with regulatory compliance built into the core coding.

Yet, this very feature that makes it attractive to businesses could be seen as antithetical to the ethos of decentralization that underlies much of the crypto world. The integration with traditional systems further blurs the line between the decentralized vision of blockchain and the centralized structures of traditional finance.

-

TokenFi, a project from the Floki Core team, represents an intriguing merger of AI and tokenization. The use of AI simplifies the tokenization process through text prompts. This innovative approach could potentially democratize access to these tools, covering the concerns posed by its competitors.

However, the reliance on AI could introduce new vectors for potential manipulation or bias. And the elimination of coding from the process, while user-friendly, might lead to a lack of transparency or understanding of the underlying mechanisms.

Each of these projects represents a different approach to asset tokenization, with its own set of potential benefits and risks.

InvestaX's regulatory compliance might provide a sense of security, opening the door for more institutional and TradFi investors … but at the cost of true decentralization.

Spydra's enterprise focus could drive adoption … but might prioritize corporate interests over individual users.

And TokenFi's AI integration could simplify the process … but might also obscure it.

It remains to be seen which approach will successfully navigate the regulatory, technological and ethical challenges inherent in bringing real-world assets onto the blockchain. The success or failure of these projects will likely shape the future landscape of tokenized assets. And as such, they could significantly influence the broader adoption of blockchain technology in traditional finance.

However, the fundamental question remains: can these projects truly democratize access to investment opportunities, or will they simply recreate traditional financial structures with a blockchain veneer?

The mainstream adoption of blockchain technology means more overlap between crypto and TradFi. And where these ideologically opposed systems clash, there is sure to be volatility. This evolution – or devolution, depending on one's perspective – challenges us to reassess what "success" in the crypto world truly means.

Are we witnessing the birth of a new, more inclusive financial paradigm, or simply the repackaging of old power structures in blockchain wrapping?

In this way, the progress of the RWA sector can be seen as a microcosm of the wider crypto sector. As we move forward, it will be crucial to scrutinize each development in the RWA space not just for its technical merits or profit potential, but for its broader implications on financial equality, power distribution and individual financial autonomy.

The true test of RWAs will not be in how effectively they mirror traditional assets on the blockchain, but in how they transform our relationship with value and ownership in the digital age.

That’s why I’ll be watching these RWA projects so closely.

I urge you to keep up with me here at Weiss Crypto Daily for the timeliest RWA updates.

Best,

Jurica Dujmovic

P.S. Understanding the complex intersection of opposing markets — and how it impacts your portfolio — can be a dizzying prospect.

But there are investment opportunities that exist outside both the traditional and crypto markets. In fact, my colleague Chris Graebe is an expert in finding such opportunities. And his latest find is one that is shooting for the stars … literally! It could leave Elon Musk’s SpaceX enterprise in the Earth’s dust.

In fact, McKinsey & Co. values this opportunity at over $1.4 trillion.

And very soon, Weiss Members like you can claim an early stake in the company supercharging this trend … BEFORE it ever goes public.

Chris will be giving the details of how this is possible this coming Tuesday, Aug. 13, at 2 p.m. Eastern. In his Summer 2024 Private Investment Summit.

It’s completely free to attend. Just save your seat, then mark your calendar to join him next Tuesday.