|

| By Chris Coney |

So far, DeFi has been focused on assets that are natively digital, such as digital currencies, artwork and governance tokens.

However, there is a great deal of the financial world that is natively physical but requires digital platforms for financialization.

That is why for a while now, a trend has been coming to DeFi called real world assets, or RWAs.

Non-fungible tokens are a prime example of an RWA. In fact, I foresee a day when the title for every house is an NFT.

As soon as we tokenize an asset like a house, all the benefits of DeFi and the blockchain open up.

And there are a ton of other RWAs that will be tokenized in the future.

Today, I am going to introduce one you can use right away.

Invoice Discounting

Also sometimes called invoice factoring, this is a service that is typically taken advantage of in the business-to-business sector.

To understand what I mean, let’s say a clothing retailer in the U.K. orders $50,000 worth of product from a manufacturer in India.

The manufacturer then issues an invoice for $50,000.

Rather than wait 30 days for the customer to settle the invoice, the Indian manufacturer receives 85% of the invoice value upfront from a third party — the invoice discounting company.

When the clothing retailer in the U.K. settles the invoice 30 days later, the money goes to the invoice discounting company.

Then, that company passes the remaining 15% on to the manufacturer minus their fees.

So, the invoice discounting company is effectively lending the manufacturer money and taking the invoice debt on as collateral.

With this arrangement, the manufacturer can keep its company cash flow in good order.

And the invoice discounting company can charge interest on what is essentially a short-term loan.

This setup is a triple win because:

1. The U.K. clothing retailer has 30 days to settle the invoice, during which time it may have even sold half the goods.

2. The Indian manufacturer receives most of its money upfront.

3. The invoice discounting company earns a yield on its cash reserves by issuing a loan and using the invoice as collateral.

Decentralized Liquidity

DeFi effectively brings together a global pool of liquidity on a set of low-friction networks.

This capital can then go wherever it is best rewarded.

In the same way that Uniswap (UNI, “B”) is an exchange with none of its own liquidity, Polytrade (TRADE, Not Yet Rated) is an invoice discounting service with none of its own liquidity.

On Polytrade, you and I as investors are offered the opportunity to provide the capital to lend to invoice discounting clients.

And we can earn the interest that is charged to them.

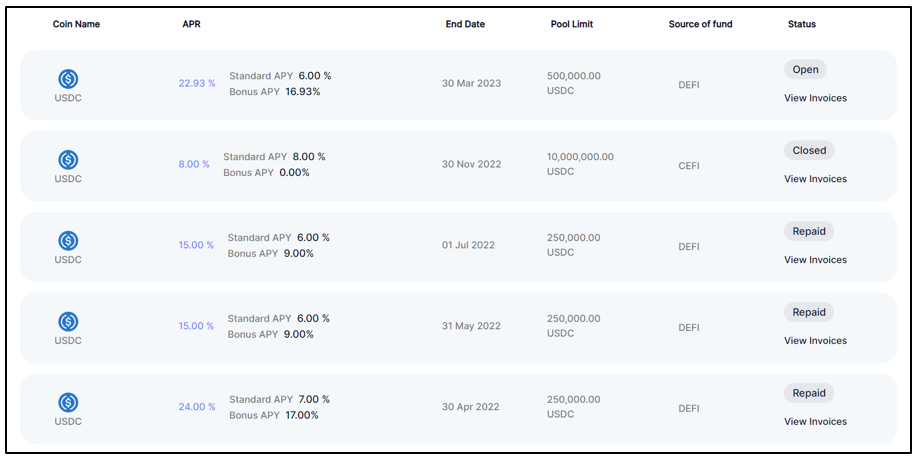

At the time of writing, Polytrade reports an annual percentage yield of 23.42% on USD Coin (USDC).

The Bad News

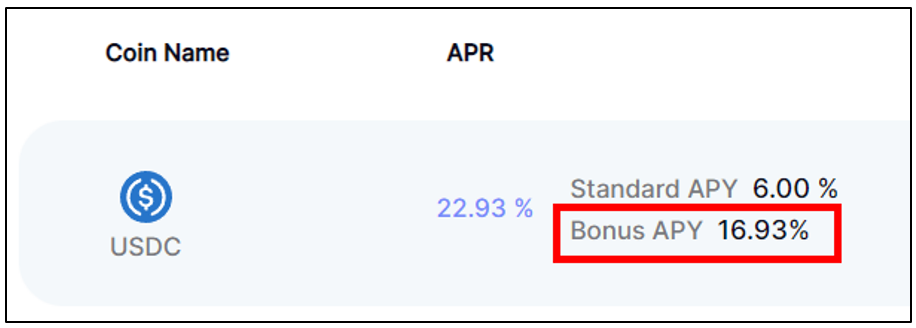

The first catch here is that — again at the time of writing — three quarters of the yield are being quoted as "Bonus APY.”

That means you will receive 75% of the yield in the platform's TRADE token.

Currently, TRADE ranks 861 in the world by market cap and has a daily trading volume of around million.

Now, this is a good thing. If you wanted to bank the entire yield in a dollar-based asset, you could immediately and manually swap the yield you earn in TRADE tokens into USDC.

However, the second catch is a bit trickier.

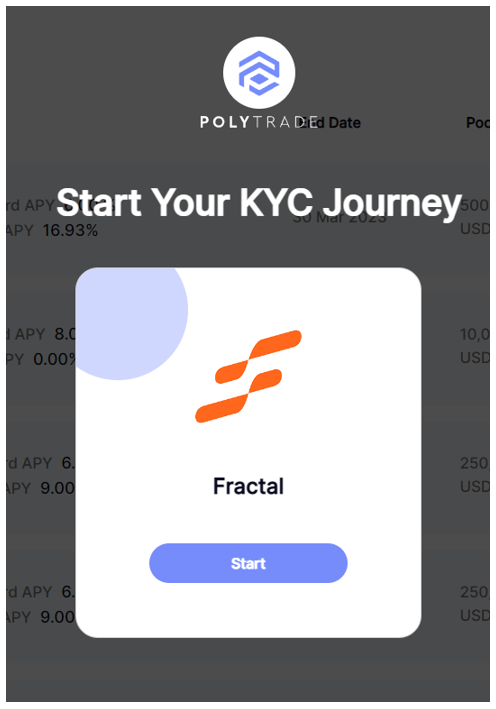

Polytrade is one of the first DeFi platforms I have written about in this newsletter that requires you to reveal your identity.

That’s right. In order to use the platform, you must go through a Know Your Customer ID verification process.

The reason I see that as a negative is because it immediately cuts off billions of people from this opportunity.

Personally, the big appeal of DeFi is that it levels the playing field and creates equality of opportunity.

If a DeFi platform offers a 23% yield like this one, then someone in a developing country should be able to invest 00 to make $23 a year right alongside someone investing 00,000 to make $23,000 a year.

The whole point of DeFi is that it is a transcendent infrastructure that is not based on personhood, but on possession of a private key.

It is the private key that determines custody of the assets. And in turn, it is the possession of the private key that determines ownership.

As soon as KYC is involved, all the countries with subpar government ID systems are excluded, which leaves many people out in the cold.

Conclusion

As unfortunate as this is, we should not throw the baby out with the bathwater.

Even if this platform is inaccessible to some people, there are many, many other opportunities in DeFi that they can access.

Furthermore, there is nothing preventing a rival invoice discounting platform from popping up — one without a KYC requirement.

If platforms like ClearPool can have an anonymous group of investors lending USDC, then we can have an invoice discounting platform that does the same.

Perhaps this is something ClearPool themselves could add on as a service, since it is closely related to what they are already doing.

But that is all I have got for you today. Feel free to share your thoughts on invoice discounting by tweeting @WeissCrypto.

I will catch you here next week with another update.