|

| By Bruce Ng |

The market is recovering. My colleague Marija Matić highlighted the crypto sector’s recent strength yesterday.

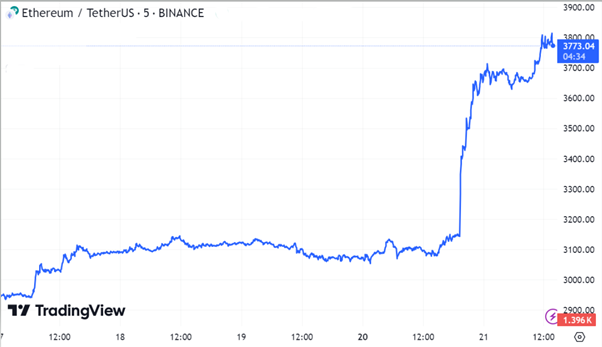

But after that issue went live, Ethereum (ETH, “A-”) made its own impressive move higher, gaining 19% on the day:

This spike is likely due to the ETH ETF approval decision, which is due in two days. While the uncertainty that Marija described is still in the air, the Securities and Exchange Commission tipped its hand yesterday when it asked aspiring ETF exchanges to update their 19b-4 filings ahead of a key deadline this week.

That gave investors a little more optimism to hold onto, hence the rally.

Whatever the decision is on Thursday, I don’t think it’ll take much to keep the upward momentum going.

Now that the market is moving in a bullish direction, I’m looking ahead. And while ETH’s recent strength is heartening, I don’t think it’ll be the big winner among altcoins. Rather, the sector that has been leading the altcoin market will likely continue in that role.

I’m talking about memecoins.

These cryptos are not just a fad. They are some of the longest lasting types of altcoins.

Just look at Dogecoin (DOGE, “C+”). It launched in 2014 and has gone through three bull and bear cycles.

Or Shiba Inu (SHIB, “C+”), which launched in 2021 and it has the 13th largest market cap in all of crypto.

While it’s true that most memecoins don’t survive their first bear market, the best memecoins that survive are here to stay.

Remember, memecoins are more volatile than most other crypto projects. That’s because they don’t have any underlying fundamental value supporting the trading price. But that also means there’s no ceiling on how high they can go if they take off.

If you have a higher risk/reward tolerance, memecoins could be an exciting way to ride this bull market for even bigger gains.

So, how can you identify memecoins with multi-cycle staying power?

By looking for these four criteria.

Criteria 1: Fair Initial Token Distribution

A good memecoin needs a fair distribution right from the get-go.

This means that no single entity owns a large percentage of the supply, a requirement that is particularly crucial as it climbs up the market ranks to the $100 million mark.

Why? Because without a fair distribution, developers and insiders are the ones holding the majority of the tokens … and can manipulate the underlying price should they choose to “jeet” or sell their entire share.

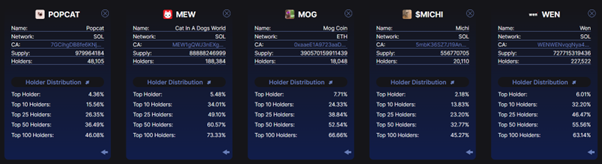

Just take a look at the token distributions for some cat memecoins below:

Can you tell which coins have the fairest distributions?

Hint: The ones where the top holders have the lowest percentages are the fairest.

A fair token distribution means there is a lesser chance that big whales can manipulate the price. So, this means fewer pump and dumps and more organic price discovery by the free market.

Criteria 2: Support from Key Opinion Leaders

All cryptos thrive on attention. After all, if no one talks about your coin, it doesn’t get bought no matter how fundamentally good it is.

But since memecoins don’t have underlying fundamental value, they live or die based on how popular they get and how committed a community they can build.

Naturally, it’s a big boost when key opinion leaders on X, formerly Twitter, support and promote certain memecoins. Social media is where the game of attention is garnered and played.

And the established knowledge and position these influencers have in the community means they are experts at creating hype for any project they talk about to their large followings.

Below is a list with examples of a few key opinion leaders:

- Andrew Kang, CEO of venture capital firm Mechanism Capital and a DeFi pioneer. He has 240,000 followers on X.

- Arthur Hayes, founder of BitMEX, one of the largest crypto exchanges. He has 499,000 followers on X.

- Ansem, a top Solana influencer with a history of promoting winning picks on the network. He has a following of 370,000 on X.

- GCR, a legendary yet anonymous crypto trader whose record has garnered a devoted following of 430,000 on X. They got the majority of their calls correct from 2020-2024 and are the buyer of the Achi NFT at $4.3 million.

A memecoin that can attract the support of individuals like these will see stupendous gains in price.

Criteria 3: Community Fanaticism

But the support of a handful of key opinion leaders would be a temporary boon if not for the communities built around each memecoin project.

In fact, certain coins have achieved cult-like status, where investors are likely to hold from cycle to cycle. They are also fanatical in that they will bash any critics of their coin. Chainlink (LINK, “B+”), for example, has its LINK Marines and Solana (SOL, “B”) has the Soylana Manlets.

Not all communities come with catchy group names. But that doesn’t mean they aren’t just as strong a force. Cardano (ADA, “B”) holders for instance have the top average holding times on Coinbase.

And who can forget the way DOGE supporters rally around the smallest posts from Elon Musk each time he mentions DOGE.

Having a fanatical, almost cult-like community means that your memecoin has a strong holder base that is unlikely to sell even in bear market scenarios. This community is also very willing to market their coin by spamming messages on social media and raid popular channels.

Criteria 4: Meme Virality

Finally, one of the most important criteria is the quality of the meme itself.

A good meme, one that is likely to go viral must be easy to understand and portable. By that I mean it can easily be adjusted or personalized to be posted to people’s social media accounts while still being a clear example of the base meme.

Take dogwifhat (WIF, “E+”) as an example.

The premise — a dog with a hat — is super simple and instantly recognizable. And, since you can customize the hats, it is also portable.

Portability is one feature that enables a meme to go viral.

I should mention that WIF fits the other three criteria, as well. So, it’s no wonder it is one of the top-performing memecoins at the moment.

Since the dawn of the internet, memes have pervaded our collective zeitgeist. While the flavor of the week will change, memes as a social and cultural construct have proven their persistence.

And for the first time in history, crypto technology allows us to quantify the quality of a meme in the form of the market cap of a corresponding memecoin.

And just like the memes they’re based on, memecoins as a sector are likely here to stay, as well. In fact, I think they will be the best performing altcoin class this cycle.

But only the cream of the crop will last from cycle to cycle.

Use these four criteria to help you separate them from the memes that’ll fizzle out.

And if you’re interested in learning what memecoins my colleague Juan Villaverde has in mind for his Weiss Crypto Investor Members, click here.

Best,

Dr. Bruce Ng