Transcript: 1 Tool to Help Apply DCA to DeFi

To view our just released video, click here.

For the transcript (edited for clarity) read on ...

Chris Coney: Dollar cost averaging, or DCA, is a strategy that's quite well-known. And it's something that I covered in the episode on the CeDeFi — that's centralized decentralized finance — cashflow strategy.

Now, the least sophisticated way to do this is to do it manually. The next best way to do this is to automate it using the tools provided by many exchanges that allow you to set up recurring purchases now.

But the ultimate way is to do it on-chain in a decentralized way.

If we could do that, it would also open up the opportunity to apply the DCA strategy into more and more exotic coins. By that I mean coins that can be highly volatile ... and thus would greatly benefit from having that volatility smoothed out by a DCA strategy.

Enter something that I've just discovered called Mean.finance.

Initially, I thought that was "mean" as in, "That place does a mean burger," but then I realized, no, it's "mean" as in "average," since we're talking about dollar cost averaging here.

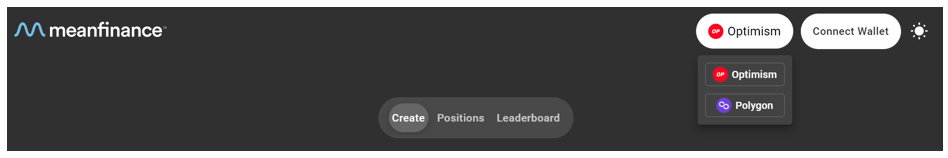

As you can see above, Mean.finance currently works on the Polygon (MATIC, Tech/Adoption Grade "B+") network and Optimism, a Layer-2 scaling solution for the Ethereum (ETH, Tech/Adoption Grade "A") base chain. I'm personally more interested in the Polygon version just because I like that network better. So, that's the one I'll select in this example.

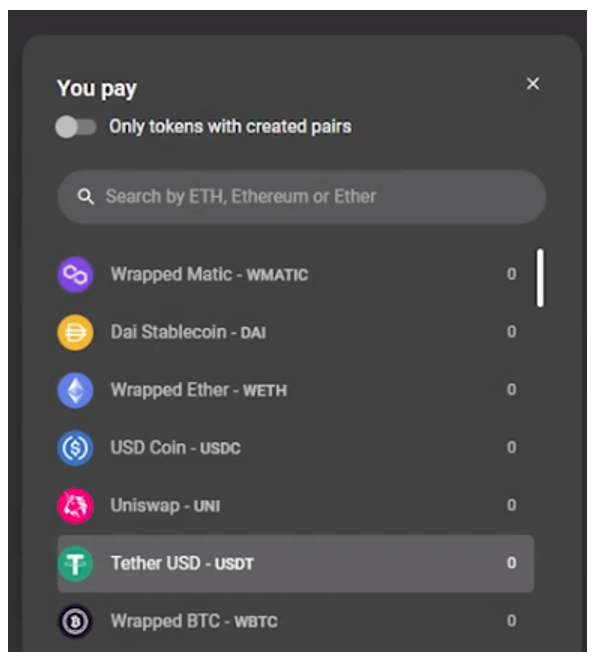

Then, the user interface is very similar to what you may have come to be familiar with from decentralized exchanges like Uniswap (UNI, Tech/Adoption Grade "B"), where you select the asset that you want to pay in.

I'd say that we'll probably do this by selecting some dollar-based stablecoin, like Tether (USDT, Stablecoin) or USD Coin (USDC, Stablecoin).

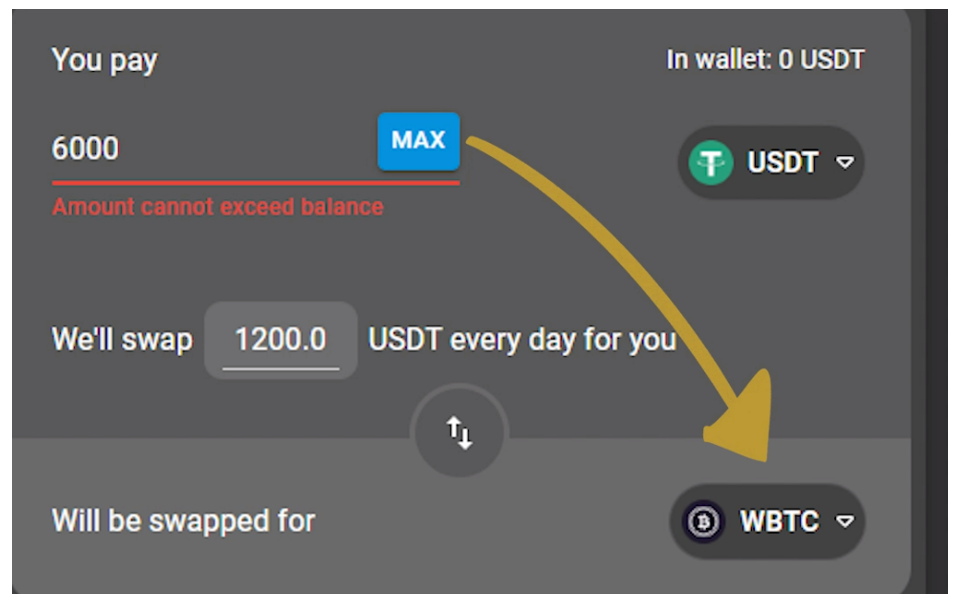

Then you enter the total amount you want to deploy into your target asset over time, let's say 6,000 of your chosen stablecoin. Then you select the target asset you want to dollar-cost average into.

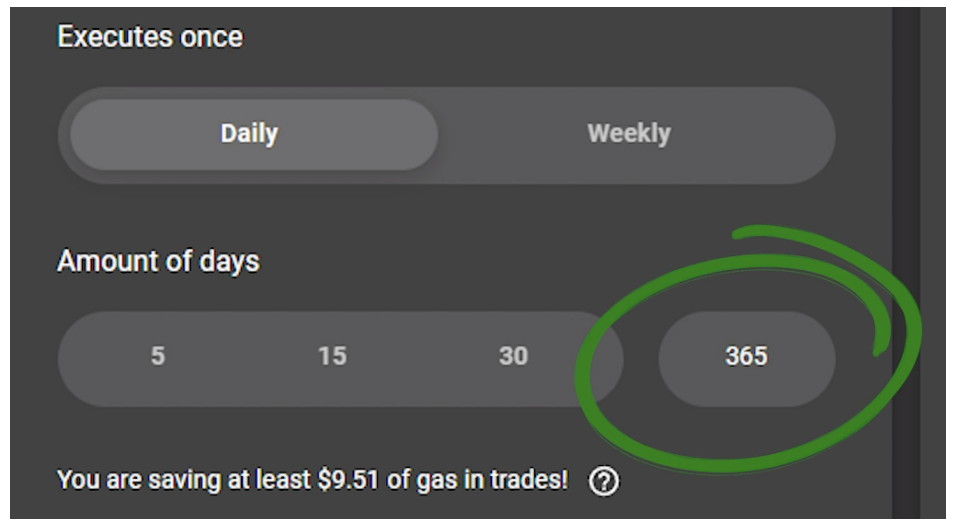

Then you select to buy daily or weekly and how many days you want to spread your investment across. So, let's say 365 days for this example.

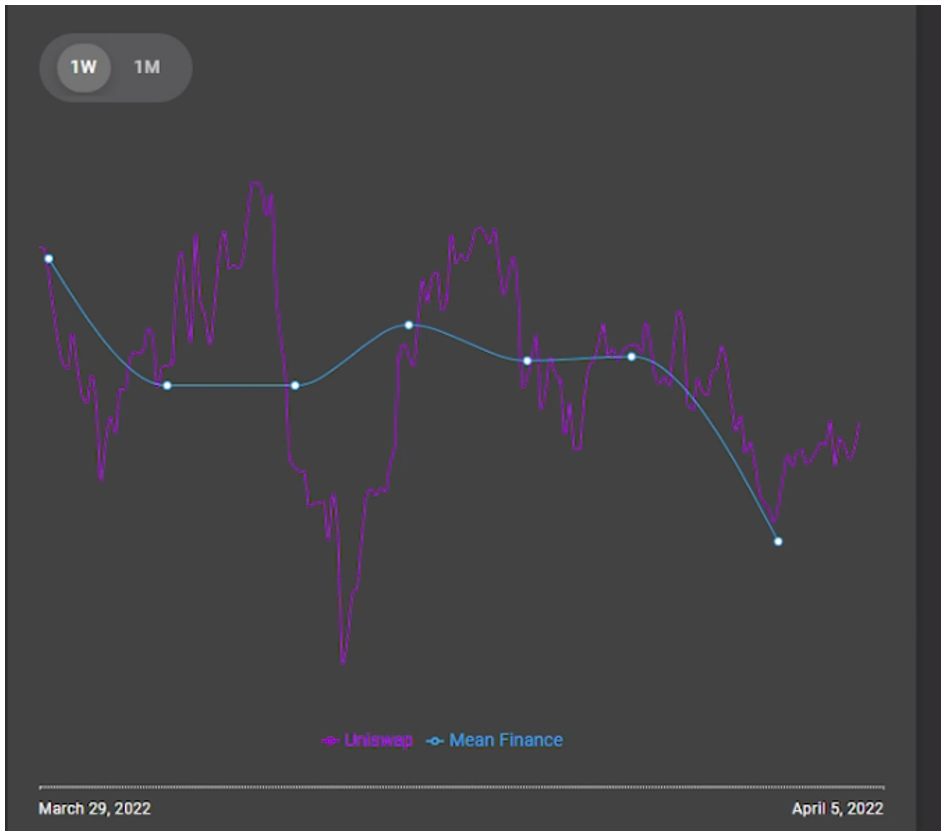

So, this would deploy $6,000 of capital — represented by stablecoins — into your chosen asset over the course of a year. Then, if they have enough data, the app draws a chart showing how Mean.Finance is going to smooth out the volatility for you.

And that's it. You just set it and forget it.

That's all I've got for you today. I'll be back next week with another episode. But until then, it's me, Chris Coney saying, bye for now.

P.S. — Want to learn more about the world of decentralized finance and the opportunities you can find within it from Chris Coney?

Then you're in luck!

Chris has crafted a DeFi MasterClass to demystify this exciting new frontier of finance and give you direction on where you should get started, outlining a few different investment strategies. You can learn more about the three goals of this masterclass here.