To view our just-released video, click here.

For the transcript (edited for clarity) read on ...

Chris Coney: OK, here we go. This is actually take two.

Which of these two weighs more, a ton of bowling balls or a ton of feathers? The answer is they both weigh the same: a ton. But there is this initial tendency — if you don't think about it — to automatically say the bowling balls, because we know individually that bowling balls are more dense. Now, this helps me introduce the concept of unit bias and how it's just as irrational as saying a ton of bowling balls is heavier than a ton of feathers.

Unit bias, in a nutshell, is the tendency to prefer a larger quantity of something despite other more important considerations. For example, would you rather have 100,000 of crypto asset A or 0.5 of crypto asset B? Unit bias is where people have a preference for the 100,000 of crypto asset A — even when I tell you that each unit of crypto asset A is worth only a cent, making the entire stack worth just $1,000.

Crypto asset B in this scenario is Bitcoin (BTC), which you only get 0.5 of instead of 100,000, but that 0.5 Bitcoin right now is worth about $20,000. You would be much better off with that if you could get past the unit bias. Now, that's actually a slightly flawed example because I was offering you those two asset stacks for free, but let's do it another way. You have $10,000 to invest in a crypto asset ...

Which would you rather invest in, crypto asset A, which is trading at 1 cent and you get a million tokens for your $10,000, or would you rather invest in crypto asset B, which is trading at $40,000 and you get 0.25 tokens? If you have unit bias, well, you go for option A. The reason this is irrational is because quantity has nothing to do with the performance of an investment, except for the fact that unit bias itself can be of benefit. But we'll get to that.

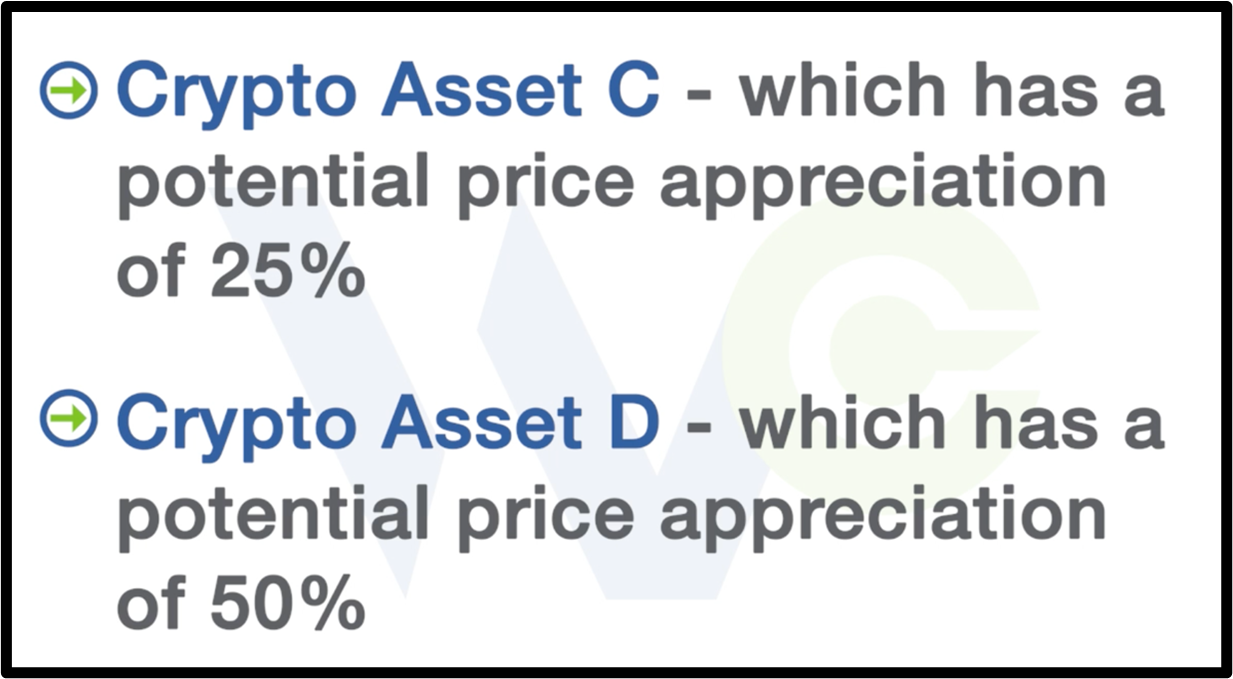

What I care about when investing is the potential for price appreciation. Let's say I offer you two brand-new investments: crypto asset C, which has the potential for a 25% price appreciation, and crypto asset D, which has the potential price appreciation of 50%. Which one would you choose? Crypto asset D, obviously, even if that asset turns out to be Bitcoin and even if you only end up getting 0.25 BTC for your money, like a quarter of a token. You don't care about the quantity.

What you really care about is by what percentage your capital appreciated after you invested it. But that's the rational investor's approach. The fact of the matter is that unit bias exists. Even if we don't have it ourselves, well, we need to be aware of it because we can actually take advantage of it knowing that other people do have unit bias. If we know that unit bias is a thing, we can take it into consideration when selecting crypto assets to invest in.

If an asset has a large circulating supply and a low individual token price, we can ‘tick the box’ to say that asset has unit bias on its side. Let's take a look at real-world example, where unit bias was actually to the detriment of a crypto asset. I'm talking about the QUICK (QUICK) token that is associated with the QuickSwap decentralized exchange. Now, Quick started trading on Binance on the 30th of August 2021. It closed its first day of trading at $768 per token.

Now, the token price was in the hundreds of dollars because the maximum supplier of QUICK is only 1 million tokens. I mean, Bitcoin's 21 million, so it's vastly less than that. Now I didn't buy any on the first day, but I did buy a bunch when it was trading at $798 — and the current market price of QUICK is about $225. I'm about 71% down there. The current theory as to why this token has taken such a beating and fallen so hard is because of unit bias.

People see the $225 coin price and say, "No, thanks. I'd rather buy something like Shiba Inu," which has a maximum supply of 589 trillion coins and an individual unit price of 0.00002378 cents — so a fraction of a fraction of a cent. If you spent $1 on Shiba Inu, you'd get 42,150 coins for just spending a dollar. The QuickSwap community put it to a vote ... they asked token holders to vote. Should QuickSwap do a token split to make QUICK more appealing?

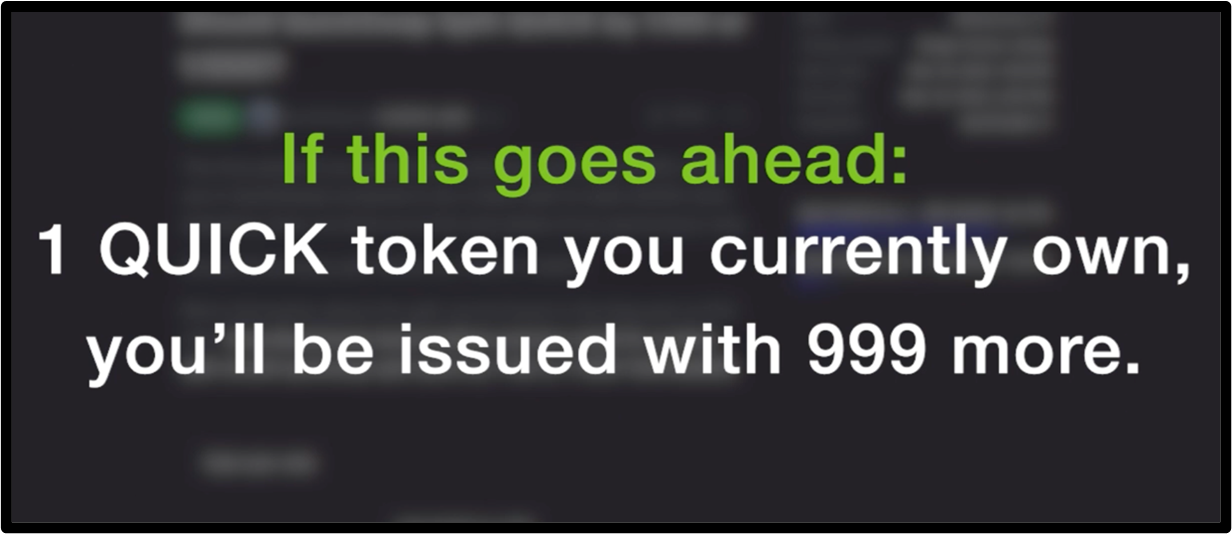

Now, the vote was to ask, in principle, if the maximum token supply of QUICK should be increased in order to bring the market price down. Whatever the split was, existing token holders would be issued with the same percentage of the circulating supply. So that if you held 1% of all the QUICK before the split, you'd hold 1% of all the QUICK after the split. It's just like a stock split. Now, this vote has already passed, with 93% of token holders voting yes, we should do a token split.

Now, there's a second vote that's ongoing that’s about to close, actually. This one is, should QuickSwap split the QUICK token 100-to-1 or 1,000-to-1? And right now, 84% of token holders think we should do a 1,000-to-1 split. That's what I have personally voted for as a QUICK token holder. So that means if this goes ahead, for every one QUICK token you currently own, you'd be issued with 999 more. But of course, there will be 1,000 more tokens in circulation.

Your capital should be worth the same. It'll just bring the QUICK token price closer to other popular decentralized finance (DeFi) coins that people frequently invest in. There we go. Unit bias, a strange old phenomenon, which is quite irrational, but quite understandable at the same time. The next time you're assessing a crypto asset investment, consider unit bias and how that affects its potential for price appreciation.

That's all I've got for you today. I'll be back next week with another episode. Until then, it's me, Chris Coney, saying bye for now.