Transcript: Make Money as the Market Moves Sideways

To view our just-released video, click here.

For the transcript (edited for clarity) read on ...

Chris Coney: Many years ago, when I started my training to be a forex trader, I remember some distinctive things that the instructor said to us. He taught us all these trading strategies, which require a currency to be in an uptrend or a downtrend. And then later on, he proceeded to say that markets are only trending 15% of the time, meaning the rest of the time they're moving in a sideways range.

He just taught us a bunch of stuff that could only be applied 15% of the time.

Now, this came back to me recently during the crypto market consolidation. I thought, ‘Well, I'm not prepared to let the market decide when we make money. And I want you to get better returns than the basic lending rates.’

So, I set out experimenting with the aim of developing a strategy that I could give to you to use in these sideways market conditions. And as you can imagine, given the title of this episode, that is what I've done successfully, and I will now impart to you.

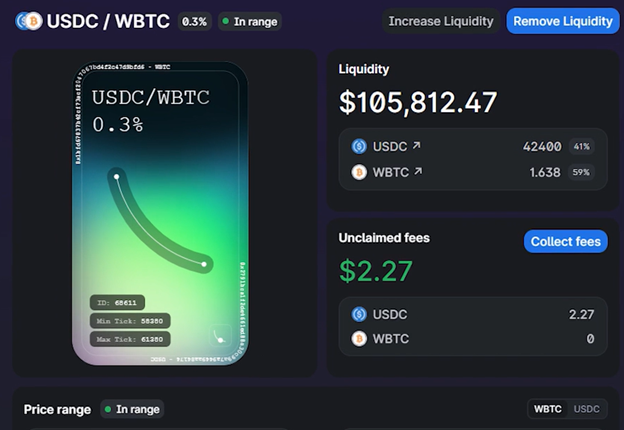

I call this the Uniswap Sideways Market Strategy because it's tailored to the Uniswap decentralized exchange, specifically. Now, at its core, it's a liquidity provider strategy. But I've developed some very specific criteria about how to deploy it and make it work.

Uniswap differs from almost every other decentralized exchange in that you can choose to provide liquidity within a specified price range. I actually don't know of any other platform that does this. This is a Uniswap innovation.

Now, all the other decentralized exchanges that I've ever used, they just take your asset pairs as a deposit and that's it. The liquidity is provided to the entire price range. Because of that, everyone ends up providing liquidity equally and gets an equal share of the fees, depending on the share of the pool that your capital occupies.

Uniswap is a bit more sophisticated than this. It allows you to concentrate your individual liquidity in order to enhance the share of the fees that you get by providing liquidity only when the price is trading within your specified range.

Now, this requires a more sophisticated approach than regular liquidity providing. But if you use the method that I've developed, that should give you the edge. There are three steps.

Step one is to find a trading pair that's moving in a sideways price range. I dare say, even in bull markets and bear markets, you'll be able to find these.

Now, that begs the question: How do I know if a trading pair is in a sideways price range? Well, there are two ways you can work that out. One is just to flip through a number of price charts until you see one that's consolidating sideways. If you want to take decentralized finance — DeFi — investing seriously, you really need to learn or know how to read a chart — a candlestick chart in particular. The second is to read the analysis in any of the Weiss crypto newsletters and look for mentions of assets that are stuck in a sideways range. I'd say you need both.

In my experiments, I've been using Bitcoin (BTC, Tech/Adoption Grade “A-”) and USD Coin (USDC, Stablecoin).

Now, there are so many crypto asset training pairs that at any one time you should be able to find at least one that is stuck in a sideways range. So that's step one.

Step two is to carefully plot the upper and the lower bands of the price range. You’ll want to set this tight enough to maximize fees, but wide enough to capture all the price volatility within that sideways range. We don't want to be rebalancing our asset pairs every five minutes, because that incurs fees that can cause you to lock in impermanent loss.

Impermanent loss is a topic all its own that I need to cover in another episode, so that’ll be for another day.

In my experiment, I selected an upper price band that I determined to be a good level of resistance, according to technical analysis, and I selected a lower band that I determined to be a good level of support according to my technical chart analysis.

The stronger those support and resistance levels, the longer the price is likely to stay within that range earning fees. And this is another reason why I say you should, ideally, know how to read a chart — identifying support and resistance levels is the key component to this strategy.

In my Bitcoin/USDC experiment, I ended up settling on an upper band of $46,000 and a lower band of $34,000. And if you’ve been keeping up with our Weiss Daily Crypto issues, then you’ll know those are the key support/resistance levels we’ve identified for Bitcoin as it traded within that range since the post-November sell-off.

Then, I drew colored lines on my chart to visualize this range that I would be providing liquidity in. That way, whenever I open my chart on any given day, I can see if I'm still in the money.

Step three is to carefully time your entry. By that, I mean timing when you deploy your assets into your chosen liquidity pool. In my strategy, I recommend you deploy your capital when the price is right in the middle of your chosen range ... or as close to the middle as you can get it. That way, you should get an equal amount of each asset into the pool.

If the price is already in the upper or lower half of your chosen price range, then Uniswap is going to want uneven amounts for your trading pair. This happens because as the price moves up and down, the scales of your liquidity pool are tipping one way and the other, since the balance of your assets tips in the opposite direction to the price.

That's why you get paid for providing liquidity. Now, while compressing your capital into a narrow range is more profitable, it does mean that if the price gets to your lower band, then the balance of your assets at that point will be 100% and 0%.

How would that happen? Well, let's say I started with $100,000 in USDC, and I managed to deploy this strategy at the perfect mid-price point in my range. I would swap $50,000 into BTC, then deposit my assets into the liquidity pool. On day one, I have my assets split 50-50, because the current price is the same distance away from my upper band as the lower band because I entered right in the middle.

Now, if Bitcoin then goes down over the next several days to a price of $34,000, then it will have reached my lower band, where 100% of my assets would be in Bitcoin, and none in USDC. And by the same token, the upper band is the price at which 100% of my assets would be in USDC and none in BTC.

If we have selected our liquidity range correctly, the upper and lower bands should be as far as the price goes before it turns around and goes back the other way.

The most profitable scenario for us would be if the asset pair just continually bounces from one end of our range to the other, because we would profit from that volatility. And that's actually part of selecting the pair — it should already be bouncing within a price range. That way, we just capture that and hope it continues.

If price ever goes outside of our bands, we stop earning fees. Because at that point, we're all in one asset or the other and, therefore, are not providing liquidity on both sides, which is a requirement for earning rewards.

Once step three is complete, then it's just a case of waiting, monitoring and tracking.

Now, the next thing to remember is that the rewards for being a liquidity provider come from the trading volume — they depend on how much capital is traded on your chosen asset pair within your chosen price band.

Uniswap very kindly displays the rewards in real time within the interface, and it allows you to claim them whenever you want.

Now, I suggest you do all this Uniswap liquidity pool stuff on the Polygon (MATIC, Tech/Adoption Grade “B+”) version of Uniswap. That's just in order to keep fees down, and then make the transactions quick and reliable.

And depending on how much capital you're deploying, I recommend claiming your fees once per day to lock them in. If you want to compound your returns, then you can add those fees back into the liquidity pool. That step doesn't have to be every day. You can if you want, or you can harvest your fees and compound them once a week if you haven't got time.

Truthfully, you can redeploy your fees back into the liquidity pool at any time. When it comes to reinvesting your fees, you don't really need to wait until the price is in the middle of your range. In my strategy, you only need to do that with your initial capital deployment. When you're reinvesting your fees, just let Uniswap distort the balance of liquidity that you're adding, and then just leave the rest of the other asset in your wallet for later.

When you try out all the various things in this video, you’ll have another added layer of clarity and depth in navigating the DeFi space and earning money in any market.

But that's all I've got for you today. I'll be back next week with another episode. But until then, it's me, Chris Coney, saying bye for now.