To view our just-released video, click here.

For the transcript (edited for clarity) read on ...

Chris Coney:

A couple of episodes ago, when I spoke about liquidity pools, I said I would do an episode on DeFi receipt tokens. So here it is.

Now, when gold was in common circulation as a transactional currency, it transitioned from the exchange of physical coins to the exchange of paper-based receipts for gold deposited with the goldsmith, right? Since these receipts could be redeemed for the physical gold at face value, they were as good as gold, and were worth as much as gold.

The same idea now sort of exists in decentralized finance (DeFi). So, let's take a lending platform as an example, like Aave (AAVE, Tech/Adoption Grade "B").

When I deposit some funds on Aave with the intention of earning interest, I actually surrender custody of my asset to the Aave smart contract. If I were depositing Ethereum (ETH, Tech/Adoption Grade "A"), my deposit transaction would actually send the Ethereum from my wallet to the Aave smart-contract wallet.

Now, it's an autonomous smart contract, meaning there's no third-party risk in terms of a bad actor running away with the funds while they're on deposit. This is where DeFi differs greatly from the gold deposit receipts that I mentioned a minute ago.

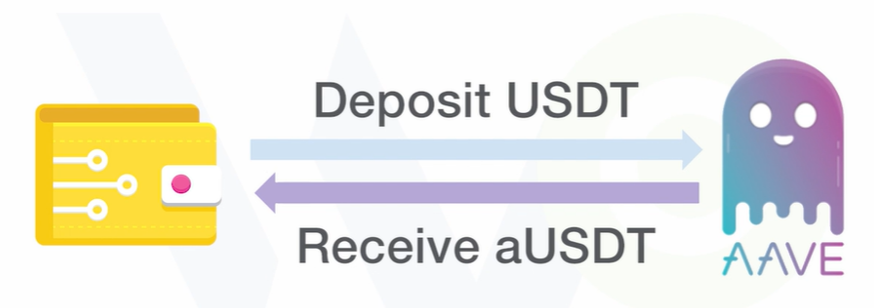

In that same transaction where I make my deposit, the Aave smart contract sends back receipt tokens, enough to match the quantity of the asset that I deposited. Like, if I deposited 1,000 USDT stablecoins in Aave, I would receive 1,000 aUSDT tokens in my wallet at the same time. So that's lowercase "a" in aUSDT. These are my receipt tokens that represent a claim on the deposit that I just made.

And that's also how I get my money back out again: When I submit my withdrawal transaction, I actually send the 1,000 aUSDT to the Aave smart contract and it sends me back the 1,000 native USDT tokens.

And the same goes for every other asset. If I deposit Ethereum, well I get back a token called aWETH. So, it's lowercase "a" again; that's the clue this is a receipt token for Aave, though this same idea also applies to other DeFi apps as well.

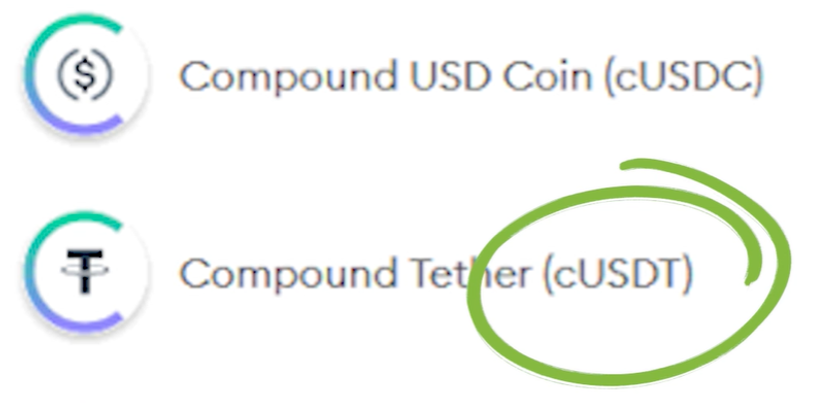

Take Compound (COMP, Unrated), for example. It works just like Aave in the sense that it's a lending and borrowing market, but when you deposit money in the Compound smart contract, you get back a receipt token with a lowercase "c" at the start of the token symbol.

And the "W" in aWETH signals that this is a wrapped, or non-native, asset. The rest, ETH, just means it's Ethereum used inside of a smart contract, right?

Now, because — like in the days of gold — these receipt tokens effectively have the same value as the asset that they represent, they're useful beyond just acting as a claim on your assets.

Firstly, they can be spent just like the underlying asset. So again, if I have $1,000 aUSDT, I could just send you 100 of those aUSDT tokens. Then if you connect your wallet to the Aave app, you'll see that you would have 100 aUSDT in your Aave account, which you can then withdraw for the real USDT if you want to.

But as soon as I send you those aUSDT, you'll start earning up interest on the 100 aUSDT in Aave because I'm effectively transferring $100 worth of my Aave deposit to you, as that's what the receipt token represents.

Now the benefit here is that you can do that in one transaction. Instead of doing like one transaction for me to withdraw my aUSDT from Aave back into my wallet and then complete another transaction to send it from my wallet to yours, I could just send you some of the receipt tokens.

And there are other uses for these receipts. Basically, anything you could use the underlying asset for — like using it as collateral — can be done.

Say I deposit one ETH into Aave, so I get back one aWETH. I now have one ETH earning interest at the prevailing rate and I could now use that one aWETH as collateral for a loan. I know this would save me a bit of interest on that loan since the interest that I pay will be being slightly subsidized by the interest I'm earning on my deposit.

Now, there are many other ways to use these receipt tokens that I haven't mentioned here, but I think you get the idea. But a very practical reason why I like these receipt tokens is that it makes it easier to track all your assets. It kind of prevents you from forgetting where you put them, and that can be a bit of a challenge sometimes. And this is because when I send, say 1,000 USDT from my MetaMask wallet to the Aave smart contract, the USDT balance in my wallet goes down by 1,000. But then I get 1,000 aUSDT in my wallet immediately afterwards.

So, I know exactly where my assets are at all times. I can't forget that a month ago, I put that 1,000 USDT in Aave, right? You can't forget about it. You've got a representation.

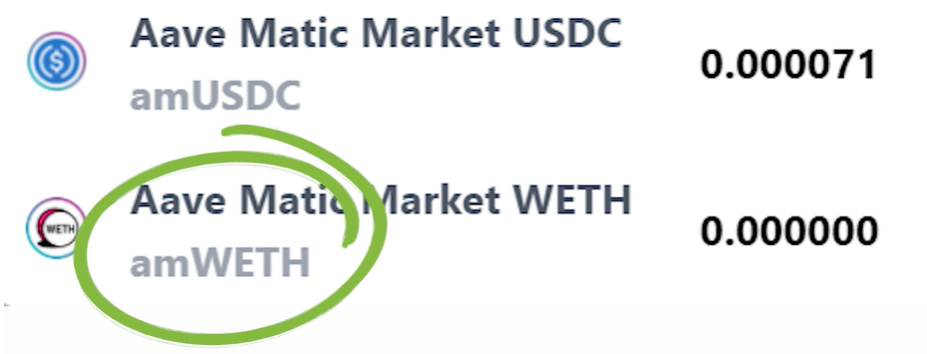

One final note on this, before we close: This whole concept also works on scaling network like Polygon (MATIC, Tech/Adoption Grade "B+"). If I deposit Ethereum into Aave on the Polygon network, I get back a token called amWETH.

So, this is lowercase "a" for Aave, lowercase "m" is MATIC, as in the original name for the Polygon network. And then WETH is wrapped Ethereum.

With this knowledge, if I had Ethereum deposited in Aave across several different wallets, I could consolidate all my balances simply by sending all my amWETH to the same address ... instead of, like I said before, withdrawing from each Aave deposit then sending them all to the centralized wallet.

If I instead just go to each one of my wallets and send the amWETH balance to the wallet I want to consolidate it in, then all my Ethereum would show up in this same Aave accounts since I'm consolidating my Aave balances by consolidating all my amWETH, my receipt tokens, in one place.

Okay, I think that's quite enough of that for now. So now we have this foundational understanding. You're all set up with some prerequisite knowledge that you need for an upcoming episode that I'm going to do on cross-chain swaps.

So, that's all I got for you today. I'll be back next week with another episode. But until then, it's me Chris Coney saying, bye for now.