|

| By Chris Coney |

Open-source software is the bedrock of DeFi.

By its very nature, DeFi is inherently trustless. And the only way to achieve this level of trust is to publish your precious source code, or intellectual property.

With the code out in the open, anyone can verify exactly what a certain DeFi app does, how it behaves and what it can do with your money.

The problem with this approach is that after expending tons of resources to perfect a product, now you essentially have to reveal your secret sauce to the whole world.

Once you do that, what’s stopping someone from taking a copy of the code and setting up a competing product at zero cost?

Well, not much. In fact, SushiSwap did exactly this with Uniswap (UNI, “B”) version 2.

Chef Nomi — the anonymous creator of SushiSwap — simply cloned the Uniswap V2 code, launched SushiSwap as a rival service and began sucking out Uniswap’s user base.

That’s why this act is sometimes referred to as a “vampire attack,” since it can drain the original product of its customers.

And Chef Nomi was able to do this because the Uniswap V2 code was released under General Public License software terms.

Licensing

Intent on avoiding a repeat of this, when Uniswap launched version 3 of its product, it chose to release under Business Source License terms.

This license protected the code under copyright law and restricted the unauthorized commercial use of its source code for two years.

However, after the two-year term of the BSL expired, the license automatically converted into a GPL from there on.

Regardless, this two-year time span gave Uniswap and its ecosystem of developers time to establish a foothold using the new technology before any copycats could spring up and eat their lunch.

An Eternity in Crypto

With how rapidly the DeFi space evolves, two years is almost an eternity.

The Uniswap developers likely knew that technology would advance during that time, and thus Uniswap V3 would unlikely still be considered cutting edge after two years.

Additionally, I have no doubt in my mind that the moment the clock started on this two-year license, Uniswap was already hard at work on its next product.

The Clock Strikes Zero

As of April 1, 2023, the BSL for Uniswap V3 has expired.

At that point, the doors were suddenly flung wide open to anyone and everyone.

So, if someone wanted to grab a copy of the code and launch a Uniswap V3 clone, they could do so with no negative repercussions.

Conclusion

Now that the Uniswap V3 code is in free-for-all mode, we can expect to see any number of clones popping up.

And they will likely use the same strategy as the original SushiSwap model.

By offering their own proprietary tokens as additional incentives, these clones will aim to lure users and liquidity providers away from Uniswap.

That was how SushiSwap was able to siphon off around 55% of the liquidity from Uniswap V2 soon after it launched.

These days, what protects Uniswap to a certain extent is what I call “network effects.”

Uniswap is now a core piece of backbone infrastructure powering many swap features you see inside wallets and other DeFi apps.

On the Ethereum (ETH, “B”) mainnet, Uniswap has a whopping $3.49 billion of liquidity. SushiSwap’s liquidity pales in comparison at $343.76 million.

In fact, Uniswap’s liquidity was a factor when I chose it for several yield farming opportunities. Using DeFi, I’ve been able to help my Crypto Yield Hunter Members earn yields no matter what the broad crypto market is doing.

In fact, one of our lower-risk positions offers an 18% APY. That’s twice the yield currently available on high-yield junk bonds — without the risk of failures and defaults. And that’s just the tip of the iceberg.

If you want to learn more about how I find these opportunities, I suggest you sign up for my Superyield Conference, to be held this coming Tuesday, May 9, at 2 p.m. Eastern.

Even better, it’s completely free to attend. So, I expect to see you there!

But let’s get back to the topic at hand ...

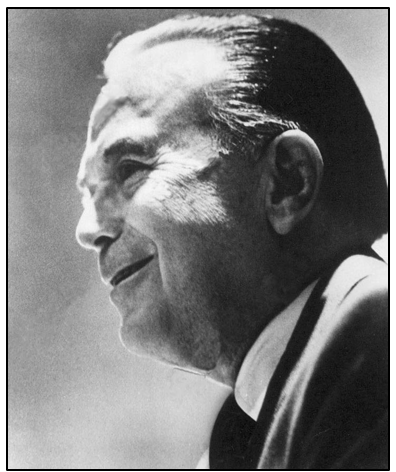

Observing the dynamics of the Uniswap licensing situation reminds me of a response that Ray Kroc gave to an interview question some time ago.

Ray is the man largely responsible for turning McDonald’s into one of the most successful fast-food corporations in the world.

Click here to see full-sized image.

When asked how he felt about every rival burger restaurant systematically copying every new thing that McDonald’s did, Ray confidently replied:

“We can innovate faster than they can copy.”

But that’s all I’ve got for you today. Let me know what you think about SushiSwap and any other Uniswap clones you have come across by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me Chris Coney saying, bye for now.