|

| By Mark Gough |

What a week! And it’s barely halfway over.

Bitcoin (BTC, “A-”) reached a new all-time high north of $125,000 just two days ago. And while it’s holding just under there at the time of writing, the bigger story isn’t the price.

It’s how fast the market structure changed underneath it.

That’s because Wall Street has taken the wheel. It’s now steering the crypto market.

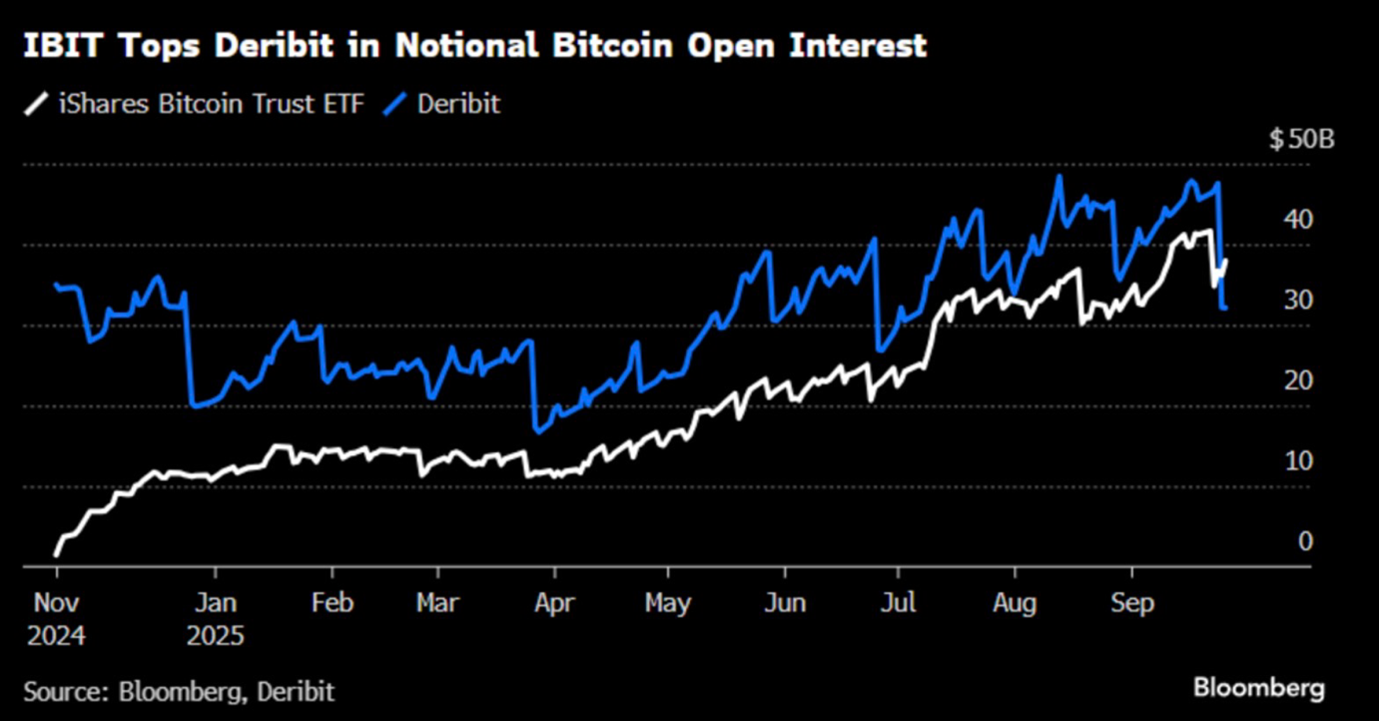

BlackRock’s iShares Bitcoin Trust ETF (IBIT) has overtaken Deribit as the largest Bitcoin options venue in the world, with $38 billion in open interest versus $32 billion.

This marks a significant shift.

Liquidity and influence are moving from offshore crypto-native platforms … to regulated U.S. institutions.

This tells us …

- Institutional derivative flows now shape spot price behavior.

- These are large, strategic allocations — not speculative bets.

- It signals a new level of maturity in Bitcoin’s market structure.

In short, Wall Street is now setting the tempo for price discovery.

And it looks like this trend will continue based on ETF flows.

ETF Flows Hit Record Highs

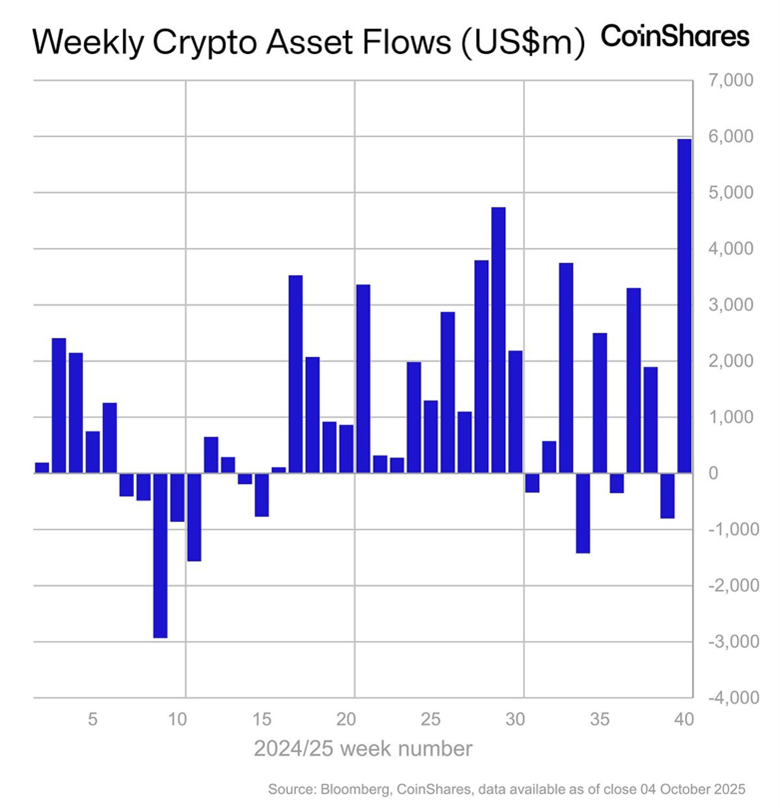

Global crypto ETFs attracted $5.95 billion in net inflows last week — an all-time high, according to CoinShares.

The U.S. led with $5 billion, followed by Switzerland with $563 million and Germany with $312 million, setting new national records.

These flows underscore the accelerating pace of regulated institutional adoption across Western financial hubs.

On Oct. 6, U.S. Bitcoin ETFs alone brought in $1.19 billion, with BlackRock’s IBIT accounting for $970 million. Over the past week, inflows to Bitcoin ETFs hit $3.55 billion.

But it’s not just Bitcoin ETFs getting the attention.

Ethereum (ETH, “A-”), Solana (SOL, “B”) and XRP (XRP, “C+”) ETFs also saw impressive inflows of $1.4 billion, $706 million and $219 million, respectively.

These aren’t retail inflows. They’re structured institutional allocations built into long-term portfolio models.

Even Deutsche Bank now suggests Bitcoin could appear on central bank balance sheets within the decade.

And more altcoins are hopeful to join the fun.

Canary Capital filed final amendments for its Litecoin (LTC, “C+”) and Hedera (HBAR, “B”) ETFs, including finalized tickers and fee structures.

Analysts at Bloomberg say both products look ready for approval once regulators resume operations. In fact, prediction markets give Litecoin ETF a 96% chance of approval by year-end.

This development could attract new attention and capital to even mid-cap projects with clear compliance profiles.

This surge in institutional adoption is fueling demand … as supply tightens.

Exchange Balances Keep Falling

Bitcoin balances on exchanges have dropped to a five-year low, with roughly 7,500 BTC leaving trading platforms daily.

That’s the definition of tightening supply.

ETFs absorb more coins, while long-term holders continue moving assets into cold storage. And every pullback finds immediate buyers — a sign of sustained demand and a shrinking float.

Positioning Outlook

So, where will crypto go with Wall Street in the driver’s seat?

Over the next month, I expect to see ETF demand remain strong.

That should provide balance to any near-term dips to support levels, as upcoming options expirations may drive volatility as Bitcoin consolidates between $117,000 —$130,000.

Further out, I encourage you to listen to Juan Villaverde’s latest crypto briefing.

In it, he introduces his new and improved Crypto Timing Model and its forecast for Q4. And he reveals three cryptos he believes can outperform Bitcoin this cycle.

Crypto is becoming a professional market. Retail-driven cycles are giving way to institutional flows and structured investment frameworks.

Volatility will remain. But it will increasingly be tied to real capital rotation, rather than speculative leverage.

For investors who adapt early, this shift from experimental to institutional is the defining opportunity of this cycle.

To stay ahead of the curve, you’ll want to watch Juan’s briefing sooner rather than later.

Stay sharp,

Mark Gough