|

| By Mark Gough |

For years, crypto purists and maximalists of decentralization dismissed Ripple as the corporate outlier in the digital asset industry. While much of the market chased speculative DeFi yields and short-lived narratives, Ripple Labs pursued a different path.

Instead, it built a regulated, enterprise-grade financial infrastructure.

That strategy has now reached a clear inflection point.

At the tail end of 2025 — a year shaped by the passage of the GENIUS Act and a decisive institutional shift toward compliant digital assets — Ripple secured a $500 million strategic investment led by Citadel Securities and Fortress Investment Group.

That brings the company’s value up to approximately $40 billion.

Which means Ripple should no longer best understood as a crypto startup.

It is increasingly operating as a financial utility, with implications for the XRP Ledger and the XRP token that are structural rather than speculative.

The Great Decoupling

One of the most persistent misconceptions among retail investors is the belief that Ripple’s corporate valuation and XRP’s (XRP, “C+”) market capitalization move in lockstep.

After 2025, that assumption no longer holds.

Citadel and Fortress are not buying XRP exposure in the traditional sense. Rather, they’re buying equity in a company that has spent billions acquiring infrastructure, licenses and institutional relationships required to operate inside the global financial system.

Over the past two years, Ripple has executed an aggressive acquisition strategy totalling more than $4 billion, including two transactions exceeding $1 billion each. These acquisitions span treasury management, payments infrastructure, custody, and prime brokerage.

As Ripple CEO Brad Garlinghouse stated following the investment:

“This investment reflects both Ripple’s incredible momentum and further validation of the market opportunity we’re aggressively pursuing by some of the most trusted financial institutions in the world.”

For XRP holders, the relevance is indirect but important. As Ripple’s enterprise footprint expands, the baseline level of XRP utility rises, even if the token itself is not the primary focus of institutional capital.

The Acquisition Engine

Ripple’s growth is no longer narrative-driven. It is acquisition driven.

In October 2025, Ripple completed its $1 billion acquisition of GTreasury, a global leader in treasury management systems. It processes more than $12.5 trillion in payment volumes, serving clients such as American Airlines, Goodyear, Volvo and other Fortune 500 companies.

The strategic value is straightforward. Ripple has positioned itself directly inside corporate treasury workflows. By integrating blockchain settlement rails into GTreasury, Ripple enables CFOs to move liquidity continuously rather than being constrained by traditional banking hours.

But that’s just one strategic play. Earlier this year, Ripple acquired Hidden Road, now rebranded as Ripple Prime, marking its formal entry into institutional prime brokerage.

Since the acquisition closed, overall business has tripled, and average daily transactions have exceeded 60 million.

More importantly, Ripple Prime is expanding into XRP-collateralized lending, which allows institutional traders to use XRP as regulated collateral.

This creates a form of demand that did not exist in prior market cycles.

But one of the most consequential developments of 2025 occurred much more recently. On Dec. 12, the Office of the Comptroller of the Currency granted conditional approval for Ripple National Trust Bank.

This places Ripple under direct federal supervision alongside traditional trust banks, while maintaining parallel oversight from state regulators such as the New York State Department of Financial Services.

While a divergence from crypto companys’ usual MO, this regulatory structure materially reduces compliance and counterparty risk for banks considering blockchain-based settlement.

Adoption is already emerging: AMINA Bank, formerly SEBA, recently became the first European bank to integrate Ripple Payments, a meaningful validation from one of the world’s more conservative banking regions.

The Balance Sheet Reality

An often-overlooked component of Ripple’s valuation is its asset backing.

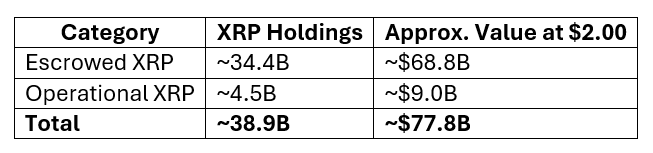

As of December 2025, Ripple holds approximately 39 billion XRP, split between escrowed reserves and operational wallets.

At current prices, Ripple’s digital asset holdings alone approach $78 billion.

This implies that institutional investors are effectively buying the company at a price below its net digital asset value — before assigning value to licenses, recurring software revenue, or acquired subsidiaries.

This balance sheet strength helps explain why founder net worths have risen sharply. And why institutions view Ripple as unusually well capitalized compared to other crypto-native firms.

Institutional Pipelines Are Forming

Demand for Ripple exposure is increasingly appearing through structured vehicles.

On Dec. 15, NASDAQ-listed VivoPower announced plans to originate $300 million in Ripple Labs equity for Lean Ventures, a South Korean asset manager.

The structure creates an indirect pipeline equivalent to roughly $900 million in XRP exposure.

Given South Korea’s historically deep XRP liquidity, this structure allows institutional and accredited investors to gain economic exposure through regulated channels. It reflects a broader trend where capital is moving away from spot markets and toward structured products.

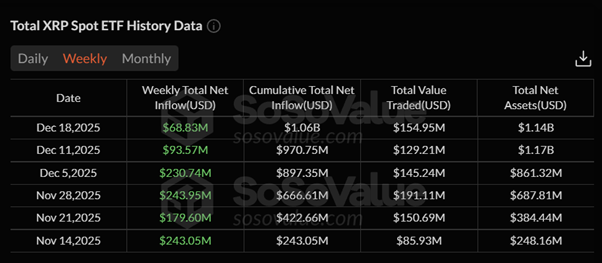

And, while the Citadel-led investment targets Ripple the company, XRP itself is seeing steady institutional demand through regulated spot ETFs.

Since launch, XRP spot ETFs have recorded consistent net inflows, pushing cumulative inflows beyond $1 billion and total net assets to approximately $1.14 billion, or just under 1% of XRP’s circulating market capitalization.

Importantly, these flows have persisted across multiple market conditions, including periods of price consolidation.

Weekly data shows repeated inflows ranging from $70 million to over $240 million, indicating allocation behavior rather than short-term speculation. This suggests XRP is increasingly being treated as a portfolio exposure within regulated vehicles, rather than a purely directional trade.

Defining Risk Levels

Despite improving fundamentals, XRP remains technically constrained.

After peaking near $3.66, price action has entered a corrective phase, with the highlighted resistance trendline acting as near-term resistance.

That means we’ll likely see key support manifest between $1.55 - $1.77, with the lower end of that range as the critical one to watch.

But if XRP can hold this range in the near term and break back above $2.20 later this year, the next resistance level would be around $2.50.

And I believe that is possible. After all, Wall Street is no longer watching from a distance.

Verdict for Weiss Investors

With the SEC no longer blocking its way, Ripple’s competitive landscape has now shifted to Ripple versus legacy payment rails.

By owning treasury systems, prime brokerage infrastructure and a federally regulated trust bank, Ripple has assembled an institutional stack that few digital asset companies can replicate under regulatory scrutiny.

The key takeaway is simple …

This $40 billion valuation reflects confidence in Ripple as financial infrastructure, not a short-term bet on XRP price appreciation.

HODLers should take note.

XRP’s role continues to evolve inside that system. Price volatility will persist, but the long-term direction is now being set by institutional adoption rather than retail speculation.

Wall Street is no longer observing Ripple from a distance.

Capital has already been committed. And that carries long-term implications.

Best,

Mark Gough