Back in May, I wrote about the real-world asset (RWA) revolution.

I said then that tokenizing RWAs could unlock trillions in value. That’s because they can bridge the gap between traditional finance (TradFi) and decentralized finance (DeFi).

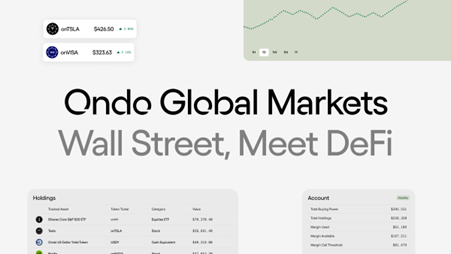

And at the forefront of this revolution is Ondo Global Markets (ONDO, Not Yet Rated).

Though the digitization of traditional securities — such as stocks, bonds and ETFs — and bringing them on-chain, Ondo’s goal is to simplify investing for retail investors.

And in doing so, it could be creating Wall Street 2.0.

It wants to enhance the accessibility, liquidity and efficiency of global markets.

The Problem with Traditional Markets

Launched just last year, the ONDO token initially traded near 21 cents.

In the time since, it’s soared about 5x!

It currently trades near $1.31.

What’s driving this demand?

The inefficiencies of the traditional investing landscape. Or, as I’ll call it, Wall Street 1.0.

These include …

-

High costs: Traditional brokers often charge excessive fees for trading, custody and transfers. These costs can erode returns over time, particularly for smaller investors.

If you’ve ever been frustrated by hidden fees or steep commission charges, know you’re not alone.

-

Limited access: Many global investors struggle to access high-quality U.S. securities due to regulatory restrictions and geographic barriers.

Even if you have a brokerage account, purchasing popular assets like Apple (AAPL) or Meta (META) isn’t always straightforward if you’re outside the U.S.

- Set schedules: Traditional markets operate on fixed schedules and settlement times can delay transactions. That means unless you’re available between 9:30 a.m. and 4 p.m. Eastern, you could miss out on opportunities.

- Platform lock-in: Most traditional investors stick to one platform because moving assets between accounts or using them as collateral is a slow, cumbersome process for many. That’s because each platform has its own rules, custodial procedures and transfer restrictions.

Tokenizing RWAs could address these challenges by making traditional assets more fluid and usable within DeFi.

After all, the DeFi markets never close and are accessible from most places. And cross-chain interoperability is growing ever more robust to connect more networks than ever before.

Not to mention all the money and time you can save by maintaining custody of your own assets and choosing which network to transact on based on gas fees.

Wall Street 2.0: The Future of Finance

Ondo wants to push the RWA revolution even further by tokenizing U.S. securities with full 1:1 backing.

That means an underlying security fully backs each token on the Ondo GM platform.

This legal and compliant framework ensures that token holders have direct exposure to the stability and liquidity of real-world assets but with the convenience and accessibility of DeFi.

In short, I believe Ondo GM will do for securities what stablecoins did for U.S. dollars.

It’s easy to see how retail investors like you and I can benefit from Wall Street 2.0.

But the big fish that will fuel this revolution are the institutions.

Banks, asset managers and fintech firms constantly seek ways to reduce operational costs and expand market access.

By integrating Ondo GM’s tokenized securities, they can tap into a global market without the overhead of legacy systems. This efficiency means they can serve a broader client base while keeping costs in check.

And their adoption of RWA solutions like Ondo could bring about Wall Street 2.0.

This DeFi development represents the next evolution of financial markets.

It is where traditional systems converge with blockchain technology to create a more accessible, efficient and inclusive ecosystem.

This new paradigm empowers institutions and individuals to transact, invest and build financial products with unprecedented speed, transparency and flexibility.

And in doing so, it democratizes access to economic opportunities and lowers barriers to entry.

This is much more than just a technical upgrade. It’s a fundamental transformation of the financial ecosystem.

Despite making U.S. securities accessible beyond U.S. borders, Ondo’s RWA services are not available to U.S. residents.

But its token, ONDO, is available on both Coinbase and Kraken for those in the U.S. looking for exposure.

As Ondo continues to break down the barriers of traditional finance, I plan to keep an eye on how it brings Wall Street to the blockchain.

This could transform the way we invest, one token at a time.

And could represent an intriguing investment opportunity itself.

Best,

Mark Gough