What You Need to Know Ahead of the White House Crypto Summit

On March 7, 2025 — this coming Friday — the White House is set to host its inaugural Crypto Summit.

This marks a pivotal moment in the United States' approach to digital assets.

The event underscores a significant policy shift, with President Donald Trump leading discussions on the future of cryptocurrency regulation and innovation.

Events like these can shake up markets. Indeed, just the announcement of this summit has caused a stir.

So today, I want to dive into who will be involved, why this summit is happening and what its intended goals are.

The Crypto Summit Lineup

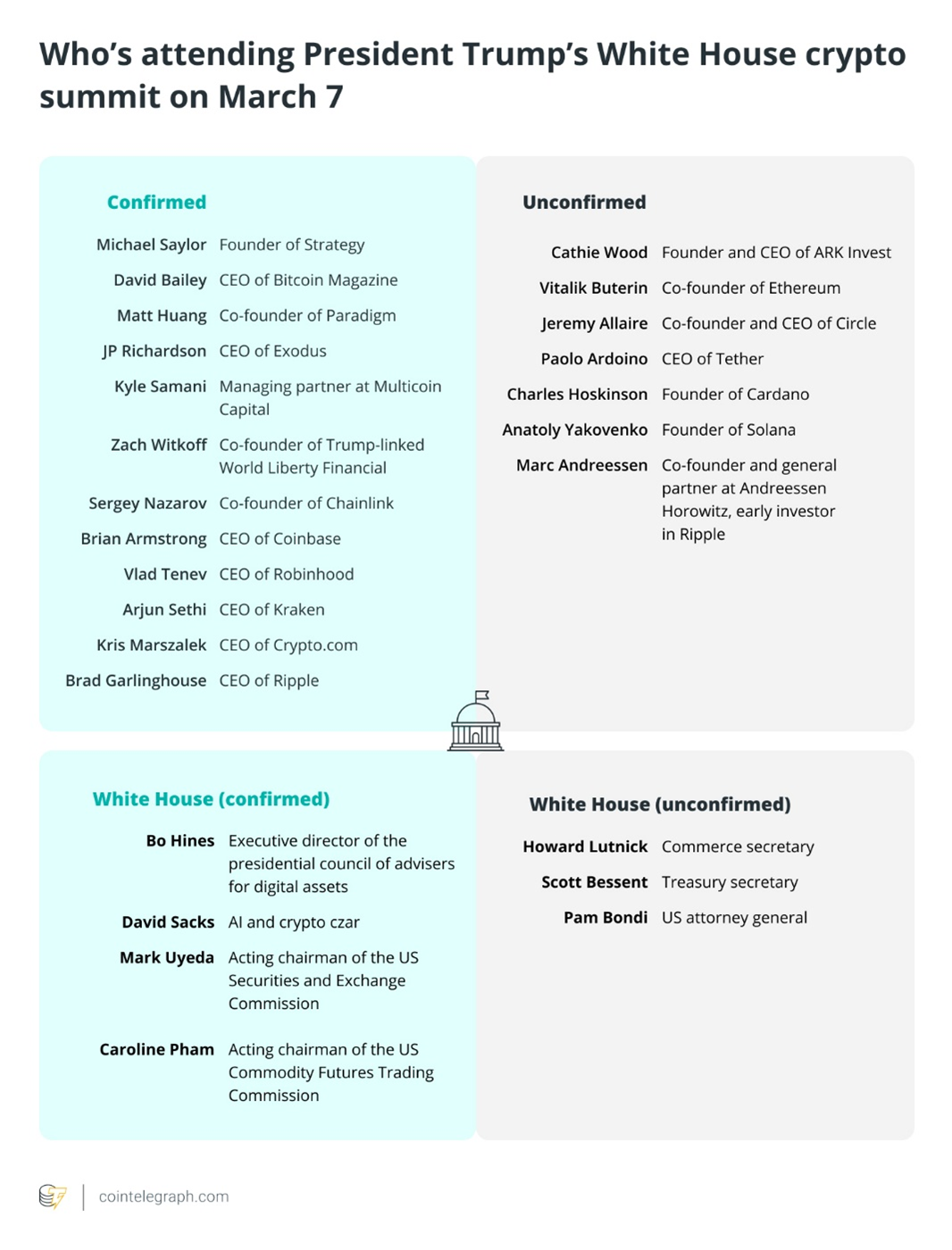

The summit will be chaired by David Sacks, the White House AI and Crypto Czar, alongside Bo Hines, Executive Director of the President's Working Group on Digital Assets.

The event is expected to bring together approximately 20 to 25 prominent figures from the cryptocurrency industry.

The list of confirmed attendees is a who’s who of the crypto industry, including …

- Michael Saylor, cofounder and executive chair of Strategy (MSTR)

- Brian Armstrong, CEO of Coinbase

- Arjun Sethi, Co-CEO of Kraken

- Sergey Nazarov, Cofounder of Chainlink

- Brad Garlinghouse, CEO of Ripple

- Vlad Tenev, CEO of Robinhood

- Matt Huang, Cofounder of Paradigm

- J.P. Richardson, CEO of Exodus

- Kyle Samani, Cofounder of Multicoin Capital

You can see the full list of invitees, both confirmed and unconfirmed, below.

The Agenda: Crypto Regulation, Financial Sovereignty and a National Reserve

This exclusive gathering aims to facilitate in-depth discussions on the integration of digital assets into the U.S. financial system.

Several topics will be on the agenda, including …

- Regulatory Frameworks: Developing clear and comprehensive guidelines to foster innovation while ensuring consumer protection.

- Stablecoin Oversight: Enhancing the oversight of stablecoins to maintain financial stability.

- Central Bank Digital Currencies (CBDCs): Discussing the potential implications of CBDCs and the administration's stance on their development.

- Tax Policies: Exploring the feasibility of tax incentives to encourage broader cryptocurrency adoption.

These discussions aim to balance the promotion of technological advancement with the safeguarding of economic liberty.

But the central focus of the summit — and indeed the cause for so much investor excitement — will be the introduction of a U.S. Crypto Strategic Reserve.

President Trump posted to social media over the weekend that this campaign promise was about to get underway.

He has now, directed the Presidential Working Group on Digital Assets to proceed with plans for a U.S. Crypto Strategic Reserve which could potentially include Bitcoin (BTC, “A”), Ethereum (ETH, “B+”), XRP (XRP, “B-”), Solana (SOL, “B”) and Cardano (ADA, “B+”).

This initiative aligns with the administration's goal to position the U.S. as the "Crypto Capital of the World."

Bitcoin in particular is poised to receive a unique status within this framework.

Commerce Secretary Howard Lutnick noted that while other digital assets will be treated "positively," they will not share the same classification as Bitcoin.

This could indicate a potential government-backed accumulation of BTC.

That alone could reshape the global crypto landscape.

Related Story: Trump Announces Historic Crypto Strategic Reserve

However, specifics regarding funding mechanisms and legislative requirements remain uncertain, suggesting that the implementation of such a reserve could face political and regulatory challenges.

The initial announcement significantly impacted cryptocurrency markets:

Bitcoin's price surged approximately 10% to around $95,000 …

Ethereum saw a 12% increase …

And Solana, XRP and Cardano experienced even more substantial gains of 20%, 30% and over 50%, respectively.

These movements reflect heightened investor optimism regarding the potential institutional adoption of these digital assets.

However, the market has already pared back most of these gains as hype alone wasn’t enough to sustain them.

What We Can Expect

The announcement of the crypto strategic reserve has elicited mixed reactions from experts and industry stakeholders.

Within the crypto space, many believe it to be a bold move toward the integration of digital assets into national financial strategies.

However, others express concerns about the volatility of cryptocurrencies and the potential risks to the broader economy. Economists like Stephen Cecchetti from Brandeis International Business School, for example, have criticized the idea, calling it "absurd" and highlighting its risky nature.

Additionally, there are concerns about potential conflicts of interest, given the Trump family's investments in cryptocurrencies through entities like World Liberty Financial (WLFI, Not Yet Rated).

Related Story: Benefit from the DeFi Project Backed by Trump

As such, I expect we’ll likely see increased volatility on Friday following the summit, much like we saw on Monday following the announcement.

But that’s just the near-term reaction.

The outcomes of this summit could set the tone for future legislation and the integration of cryptocurrencies into the mainstream financial system.

The establishment of a Crypto Strategic Reserve in particular could have profound implications for the acceptance and legitimacy of cryptocurrencies on a global scale.

As such, this summit could be the start of a fundamental shift in how we understand and interact with crypto.

As the summit approaches, stakeholders across the financial spectrum will be watching carefully to see how these discussions will shape the trajectory of digital assets in the United States.

I know I’ll be one of them. And I’ll keep you updated with what my takeaways are next week.

Stay tuned.

Best,

Mark Gough