|

| By Jurica Dujmovic |

For most of crypto's history, humans have been the main characters.

We speculate, panic, fall in love with narratives and rotate capital accordingly.

Even when we automated trading strategies, the story stayed the same …

Machines were tools. Humans were decision-makers.

That's changing faster than most investors realize.

So much so it has become one of the defining conversations at the World Economic Forum in Davos, Switzerland this week.

What's quietly emerging is a new class of economic actor.

One that traditional finance has no framework for: AI agents that are native crypto users.

Not interfaces.

Not assistants.

Actual participants that hold wallets, sign transactions, pay for services, earn revenue and interact with smart contracts continuously without human oversight.

Related story: AI’s Plateau Is Just a Launching Pad for Next-Gen AI Agents

And here's the kicker: they're also reading sentiment now.

That last part matters, but not in the way you think.

From Tools to Economic Actors

On Ethereum (ETH, “B+”), Solana (SOL, “B-”) or Cosmos (ATOM, “C”)-based chains, an AI agent can already do something no traditional financial system would allow without layers of legal fiction:

- Hold and control capital autonomously

- Execute trades without human approval

- Pay for inference, storage or APIs

- Earn fees through arbitrage or yield strategies

- Reinvest profits programmatically

We still talk about crypto as if humans are the only users.

But increasingly, the blockspace is being consumed by software acting on its own behalf.

Traditional finance can't accommodate this.

Bank accounts require legal identity. Payments require intermediaries. Continuous micro-transactions are economically impractical.

Crypto removes all three constraints. And creates a financial system that software can use directly.

What This Means for Your Portfolio

Human-driven markets are cyclical and emotional. AI-driven markets are structural and persistent.

Once an agent is deployed, it doesn't exit because vibes changed. It leaves because execution degraded or costs increased.

Related story: Swift Payment Settlements Are Just Where Stablecoins Will Start

That creates baseline demand. Not narrative-driven demand.

Agents consume blockspace, pay fees, arbitrage inefficiencies. They do it constantly.

This looks less like speculation and more like industrial usage. And markets eventually reprice assets that produce predictable cash flows.

The Sentiment Paradox

Now, you might be thinking: Agents are ingesting sentiment data now.

Doesn't that make AI agents just as narrative-driven as humans?

Not quite.

Yes, AI agents increasingly consume social signals: Twitter velocity, Telegram chatter, narrative momentum, news clustering. APIs and data providers now structure sentiment so it can be consumed programmatically.

But this doesn't make agents emotional.

It makes human emotion machine-readable.

And that distinction is everything.

Agents don't believe narratives. What they do is price the probability that others will believe those narratives temporarily.

Sentiment becomes just another data feed, no different than price oracles or volatility indices.

Agents don't care about vibes. They care about how long vibes will move markets.

When narratives become extractable resources, things get interesting. Humans experience narratives emotionally. Agents experience them statistically. They enter, scale and exit without attachment.

That turns crypto's cultural layer into raw material.

Memes become volatility engines. Communities become signal generators. Attention becomes another input variable. Narratives stop being identities and start being harvestable inefficiencies.

Retail chases stories. Agents harvest the lag between story formation and price realization.

The result isn't less speculation. It's automated speculation.

Faster Reflexivity, Harsher Markets

Crypto has always been reflexive: prices move narratives, narratives move prices. Agents accelerate that feedback loop.

Once sentiment is vectorized and streamed in real-time, reflexivity compresses. Arbitrage windows shrink. Momentum accelerates and collapses faster.

That creates sharper cycles and less tolerance for bad protocol design.

Protocols that rely on slow governance, vague incentives or narrative loyalty get punished quickly. What survives are networks with:

- Deterministic execution

- Low latency

- Predictable costs

That's why "boring" infrastructure keeps winning.

Execution layers, MEV-aware systems, oracles, settlement-heavy protocols quietly outperform attention-driven experiments.

Agents don't care why a chain settles value, only that it does so reliably.

Crucially, this doesn't bring back TradFi constraints.

Even sentiment-aware agents still can't open bank accounts, navigate compliance workflows, or sign legal contracts.

They still need permissionless wallets, programmable money and continuous settlement.

Crypto remains the only viable financial substrate for non-human economic actors.

The Valuation Blind Spot

Most investors still use metrics designed for humans: wallet counts, daily active users, community growth.

AI agents distort all of them.

A single agent can control dozens of wallets, generate thousands of transactions and recycle capital endlessly.

Participation metrics lose meaning. Fee generation matters more than user counts.

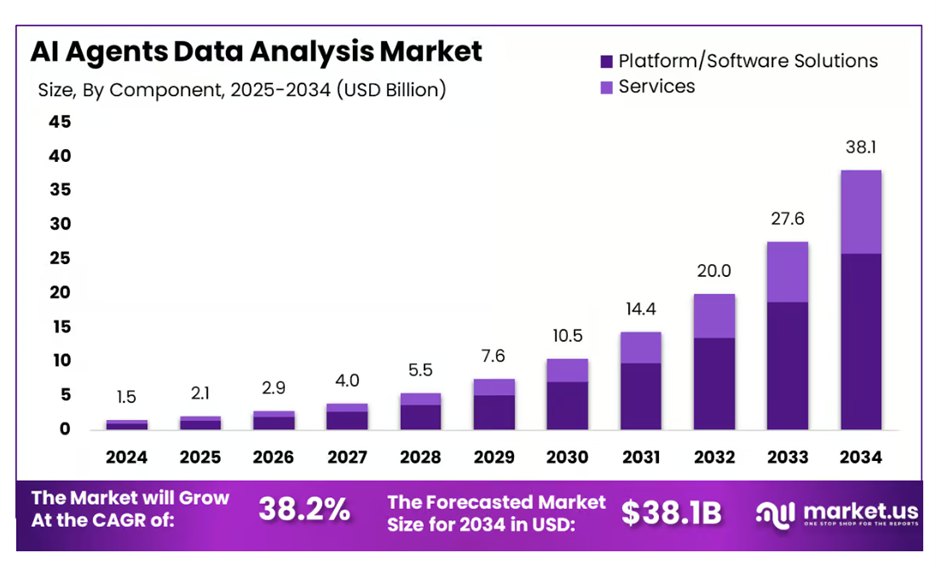

And this trend will only continue. AI in general is expected to grow at a CAGR of 28.45% through 2030.

That would result in a market volume of $826.70 billion in just six years!

AI agents in particular? They’re expected to grow at a CAGR of 38.2% by 2034. That would bring the valuation to over $38 billion.

The protocols that win in an agent-heavy world won't necessarily look exciting on Twitter.

They'll look reliable. They'll quietly monetize machine-to-machine activity.

And by the time the narrative catches up, the repricing will have already happened.

The Bottom Line

Crypto isn't just being used by people anymore. It's being used by software that never sleeps, never believes and never hesitates.

Related story: 3 Forces That Will Unite AI Agents and Stablecoins

For investors willing to look past surface narratives, that's where the structural edge is forming.

Quietly, systematically and without asking for permission.

That’s why going forward, I’ll be asking a new critical question when choosing what goes into my portfolio …

“Is this protocol or project optimized for AI agents? Or will it be left behind by one that is?”

Hopefully, it’s a factor you consider for your investments as well.

Best,

Jurica Dujmovic