When the Rate Cuts Will REALLY Hit Crypto

|

| By Juan Villaverde |

Last week, I mentioned how this past Wednesday’s interest rate cut would be a sell-the-news event.

And so, it was.

The Fed lowered interest rates a quarter point. Bitcoin (BTC, “A-”) initially fell about 1%.

But before midnight on the East Coast, it was back to pre-cut levels.

That said, this rate cut clearly failed to give crypto the shot in the arm investors were hoping for ever since the rally that began in early April ran out of gas.

That happened on Aug. 13, when Bitcoin topped out near $125,000. Moreover, the persistent lack of momentum since then is unmistakably a sign of market weakness.

Naturally, that has a lot of investors concerned.

Indeed, the most frequently asked question I get these days is whether the crypto bull market is alive or dead.

So, let me be clear: I see no signs of a definitive bull market top.

My Crypto Timing Model and historical analysis says the bull market has time to run.

In fact, I believe prices will resume upward momentum as we head toward year-end.

So, what gives? Why the lackluster performance right now?

A lack of liquidity growth.

Fortunately, that will likely change. Though it may take a while to see the impact in the market as we’d like.

Yesterday’s quarter-point interest rate cut by the Federal Reserve is likely the first in a new rate reduction cycle. One the Fed will keep nudging forward to usher in a fresh flood of liquidity that will lift crypto into new cycle highs.

But there is an important caveat to keep in mind: It takes about three months for fresh liquidity to filter through to crypto markets.

So, any decision made by Fed Chair Jerome Powell this week won’t be visible until mid-December.

And between now and then, we’ll likely see more volatility.

In fact, my model has flagged a key low in that period, around Oct. 17.

Bitcoin Verging on Correction

Click to enlarge.

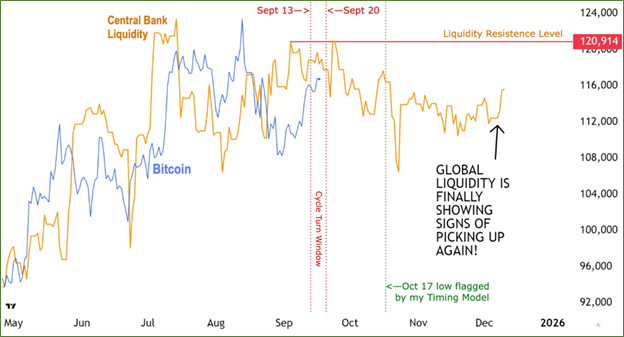

The two red dotted vertical lines mark the Sept. 13 — 20 window when my Crypto Timing Model says crypto is most likely to make a cycle turn.

Bitcoin — and most of crypto — has been moving up into this window. That suggests crypto makes a meaningful high this week.

My model suggests this high will be followed by a down move. One we likely won’t see the bottom of until Oct. 17 (marked by the green dotted vertical line).

Note how close this is to the big yellow down spike in CBL chart. This tells us Bitcoin and crypto are in no rush to go anywhere for now.

But take note also of the black arrow (above).

This is encouraging. After months of sideways churn, liquidity appears to be picking up again.

That points to a hoped-for rally for crypto assets starting the second half of December.

The key to watch? The twin peaks in CBL that are connected by the red horizontal line. This marks a key “resistance level” threshold for liquidity.

Suppose CBL continues to climb in the coming weeks and breaks above this level.

Such a development would indicate liquidity conditions — lackluster as they are now — are set to improve heading into year-end.

If that occurs, it’ll confirm this isn’t the end of the bull market, but merely a pause — a sideways consolidation not unlike what we saw between March and October of last year.

And when that’s done, I expect we’ll see a surge to higher highs as the liquidity injection finally hits crypto.

As investors, this perspective is essential for your strategy. Don’t be disappointed by the slow response.

Use it as an opportunity to get yourself ready for the big run.

Best,

Juan Villaverde