|

| By Alex Benfield |

Jim Cramer — the host of Mad Money on CNBC — is one of the most well-known financial talking heads.

Before his stint in the limelight, he was an investment banker with Goldman Sachs (GS) in the 1980s. Then, he started his own hedge fund, making millions of dollars a year for more than two decades.

To the layperson, he’s a guy who looks and sounds like he knows what he’s talking about; the kind of guy from whom you can take advice.

So, it’s noteworthy that this past Monday, Cramer urged investors to exit crypto by saying, “It’s never too late to sell.”

But just because he’s famous, doesn’t make him right.

In fact, he’s had a few big errors in the past, like suggesting people get out of Netflix … in 2012, just six months after the streaming giant soared 175%. Or the time he recommended Bear Stearns in 2008 … a few weeks before its collapse.

A 2009 Penn State study concluded that Cramer’s “average stock recommendations are neither extraordinarily good nor unusually bad.” But that didn’t stop those in the know from making the Cramer Effect — when the market moves decidedly against Cramer’s recommendations — into a long-running finance joke.

To us, his idea to exit crypto is going to be another Cramer Effect situation.

Lately, we’ve been on the lookout for the signs we need to confirm a bear market bottom. As I’ve said over the past few weeks, the current sentiment is overly bearish for the crypto market, leading me to believe we’re witnessing a capitulation moment.

This is one of the most telling bottom signals of each market cycle.

After all, things always seem darkest before dawn.

Don’t let a talking head talk you out of crypto. Not now, when all signs are pointing to a bottom.

Next week, the Consumer Price Index numbers will be released, as well as the Federal Open Market Committee meeting minutes. This could lead to another potential increase of the Federal Funds rate.

Those two events will likely reintroduce volatility back into the crypto market, so we’re hoping for lower inflation and a lower rate increase.

Keep in mind that while nerve-wracking, volatility isn’t inherently bad. If it can shake up the market leaders and reignite momentum, it’ll be a step in the right direction.

For now, Bitcoin (BTC, Tech/Adoption Grade “A-”) has climbed back up to just under $17,000 after hitting a low of about $15,500 on Nov. 21. It’s been moving sideways for a week now.

The next key level to watch for on Bitcoin’s chart is $17,500, which represents the June low. BTC needs to reclaim that level to hold off fears of a further drop.

On the downside, $16,200 looks like a key support level. So, it’ll be crucial for BTC to hold above that.

Here’s BTC in U.S. dollar terms via Coinbase:

Click here to view full-sized image.

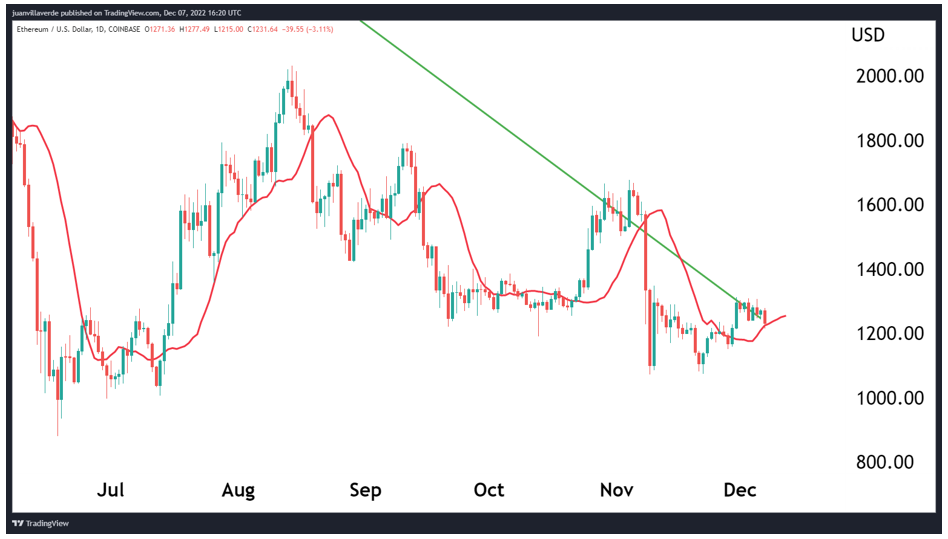

In comparison, Ethereum’s (ETH, Tech/Adoption Grade “B”) chart looks similar. Although, as usual, it’s more volatile than BTC.

ETH hit a low of about $1,075 on Nov. 9 and then retested that level on Nov. 21. Since then, it’s been trading between that low and about $1,300 over the course of this past month.

However, that’s still far higher than its June low of $885. ETH currently appears to be in a trading range between $1,200 to $1,350, so we’d like to see it climb above $1,350 to fend off the bears for now.

Here’s ETH in U.S. dollar terms via Coinbase:

Click here to view full-sized image.

What’s Next

If I had to guess how the next few days will shake out, I’d expect the market to continue to stay neutral like it has over this past week.

Sometimes no action is the best action, and after the craziness of the FTX saga, we welcome the quiet. We’re also still closely watching the charts to determine whether the worst is behind us and if this bear market is coming to a close.

But rest assured, better days are ahead.

Best,

Alex