|

| By Chris Coney |

In traditional markets, pretty much everyone parks their money in bonds.

After all, bonds are as good as — and perhaps in some ways even better than — cash.

That’s because the bond market is uber liquid, the issuers can’t really go bankrupt, and it earns the risk-free rate while you figure out what to do with it.

But what is the equivalent in crypto, and why would you use it?

Stablecoins with No Yield

Even in DeFi, sometimes the best thing to do with your money is nothing.

In traditional finance, “doing nothing” is equivalent to parking your money in bonds of any given duration.

But what do you do with your money that’s acting as dry powder, waiting to be deployed into an investment in DeFi?

Well, we’ve gone through an era of stablecoin abundance. Right now, there are tons of issuers providing dozens of different stablecoins and using many different approaches.

And for the stablecoins that are backed by real world assets in reserve, the issuer is the one who puts that money into things like bonds and earns the risk-free rate.

But this isn’t going to last forever.

Once stablecoin holders at large become aware of exactly how this works, they are going to be less and less willing to let stablecoin issuers gobble up a 5% yield on their money just to use a stablecoin.

In other words, stablecoins are not a free-to-use product. It might seem that way, but they are not.

Indeed, we pay to use cryptocurrencies like USD Coin (USDC, Stablecoin) by sacrificing the 5% yield we would otherwise get on that money if we put it directly into Treasurys ourselves.

So, from that point of view, USDC has an annual fee of 5%. Essentially, this is paid in the form of opportunity cost.

But I can almost guarantee that no one is thinking about USDC in these terms.

You see, sacrificing a 5% yield to use a stablecoin means they effectively have a negative 5% interest rate.

This means that those stablecoins need to earn at least the equivalent of the bond rate in order to be at par.

And that’s even before we consider whether the rate is beating inflation. If it isn’t, then our money is still in negative yield territory.

All of this is to say that the price of just holding stablecoins in your wallet is significant. As more people discover this, the less they will be willing to stand for it.

The Crypto Risk-Free Rate

It’s a fact that DeFi is competing with TradFi for capital.

So far, DeFi has attracted a whole lot of capital by offering the opportunity for returns and yield that are far better than TradFi by leaps and bounds.

Based on what I wrote above, you could assume that DeFi is falling behind in the competition for dollar-based reserves.

But you’d be wrong.

Let’s take MakerDAO for example. It’s one of the oldest organizations in DeFi, and it’s the issuer of Dai (DAI, Stablecoin).

You see, MakerDAO is a decentralized autonomous organization. So, it’s governed by holders of its MKR token who act as a sort of crowd-based democratic economic committee.

Essentially, MKR token holders propose and vote on policy changes. Then, these changes are enacted and enforced by smart contracts autonomously and transparently.

Now, MakerDAO could also be considered a type of central bank, since it issues its own dollar-based currency, DAI. But the main difference is that this is a digital dollar — not an analog dollar like USD.

Continuing with this analogy, central banks have a base rate. This is basically the interest rate that a central bank like the Federal Reserve charges to lend money to commercial banks.

Well, MakerDAO has the DeFi equivalent of that called the DAI savings rate, or DSR. Except this rate isn’t exclusively available to banks.

Additionally, it’s one of the parameters that the MakerDAO community can set.

So, in DeFi, anyone with a handful of dollars — whether it be a Silicon Valley billionaire or a remote villager in India — can deposit DAI and earn the DAI savings rate.

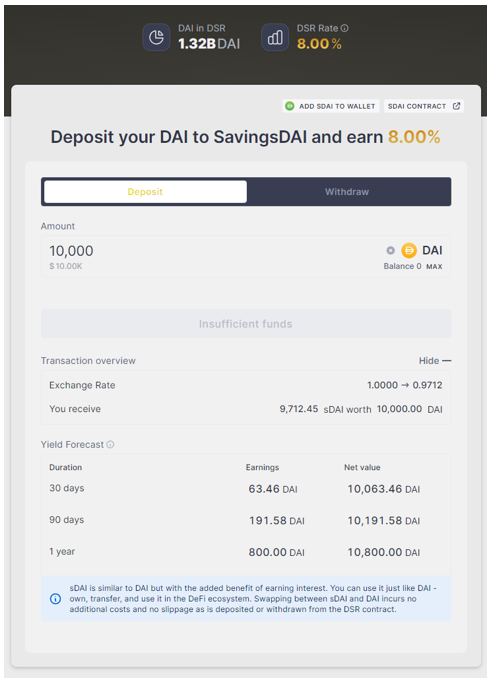

And right now, the DSR is a whopping 8%!

But that’s not all. What’s even more breathtaking about the DSR is its instant access.

Even if you buy a super-short one month U.S. Treasury, the only way to guarantee that you will get all your principal back is to wait until the bond matures. This is because bond values fluctuate while you’re holding them.

But with a DAI deposit, you can withdraw at any time.

How to Get the Crypto Risk-Free Rate

You can access the DSR via the Spark Protocol.

But before you take any action, please be acutely aware that this is purely an educational article.

So, I am not formally recommending that you use the DSR. My main goal is to simply introduce you to different investing avenues that you can pursue if you so choose.

Since there isn’t enough room in this article to explain the risks of Spark Protocol, I encourage you to thoroughly research this platform and understand its risks before going forward with it.

As you can see from the image above, all you have to do is go to Spark Protocol, click on the Deposit tab and then enter the amount you want to deposit. Simple as that.

The deposit button in the screenshot says “insufficient funds” and is greyed out because there was no DAI in the wallet I connected with.

So, if you do this yourself, make sure you have enough DAI in your wallet to complete the transaction.

Now, one other thing you should bear in mind is that just like any central bank base rate, the MakerDAO committee can and will adjust the base rate from time to time.

This means the yield will change, so it won’t be 8% forever.

Conclusion

Believe it or not, some of the money that is deposited into the MakerDAO treasury makes its way into U.S. Treasurys in order to generate some of the DAI savings rate.

So, the trend of putting stablecoin reserves into traditional yield-bearing assets is on the rise.

The subsequent trend — for which MakerDAO is leading the way — is to automatically pass some of that yield on to the holders of those stablecoins to incentivize their usage.

Overall, the competition for stablecoin adoption is heating up, and the battle for supremacy is intensifying.

But that’s all I’ve got for you today. Let me know what you think about the DAI savings rate by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me Chris Coney saying, bye for now.