|

| By Chris Coney |

Recently, it seems like everything is a sound bite, a fifteen-second TikTok clip or a ten-word headline.

Now, the problem with these crumbs of information is that while you may feel like you’re absorbing a ton of information, in reality, they only provide you a fragmented picture.

That’s because often, these snappy headlines and short clips are missing important details.

I think I understand the root of the problem, though. People simply don’t have the time for quality nowadays — principally because of factors like inflation and loss of purchasing power — and instead go for quantity.

In fact, I saw a tweet recently from someone who had done an analysis of Wall Street compensation going back to 2005.

The data showed that not even Wall Street pay had kept up with inflation, leading one to wonder how Main Street is supposed to cope.

So, with less and less free time on their hands, it’s no wonder many people prefer quicker, more convenient sources to get their news.

However, the worse this gets, the more trust is being placed in these headlines and sound bites. And it can be dangerous to rely solely on this type of content to draw attention to what is important.

How This Relates to BlackRock’s Bitcoin ETF

It’s said that a lie can make its way around the world before the truth has even got its shoes on.

This is definitely something I have experienced since beginning my research into crypto in 2015.

It costs little energy for someone to create a lie … but an enormous amount of energy to find out the truth.

That means researchers such as me can find it difficult to debunk the lies as fast as they are being created.

Now, these aren’t necessarily outright lies. I just mean anything that isn’t completely accurate.

For example, the crypto community was recently excited about a new exchange-traded fund application from the world's largest asset management company, BlackRock (BLK).

Given BlackRock’s size and influence, many believe its application is more likely to succeed, even though so many other companies have been turned down before.

However, according to my research, what BlackRock has filed for is not an ETF but a Bitcoin (BTC, “A-”) trust.

BlackRock vs. Grayscale

Historically, the closest we have gotten to a Bitcoin ETF is the Grayscale Bitcoin Trust (GBTC).

Here, you can buy shares in the trust and hold it in your traditional finance portfolio in order to get exposure to Bitcoin. Grayscale then takes care of the purchase and sale of the Bitcoin held in the trust and backs the shares.

In my personal experience analyzing the price action of GBTC, it seems very loosely pegged to the underlying price of Bitcoin.

By that I mean GBTC tends to overshoot the price of BTC both to the upside and the downside.

So, GBTC typically becomes overvalued in a bull market and undervalued in a bear market.

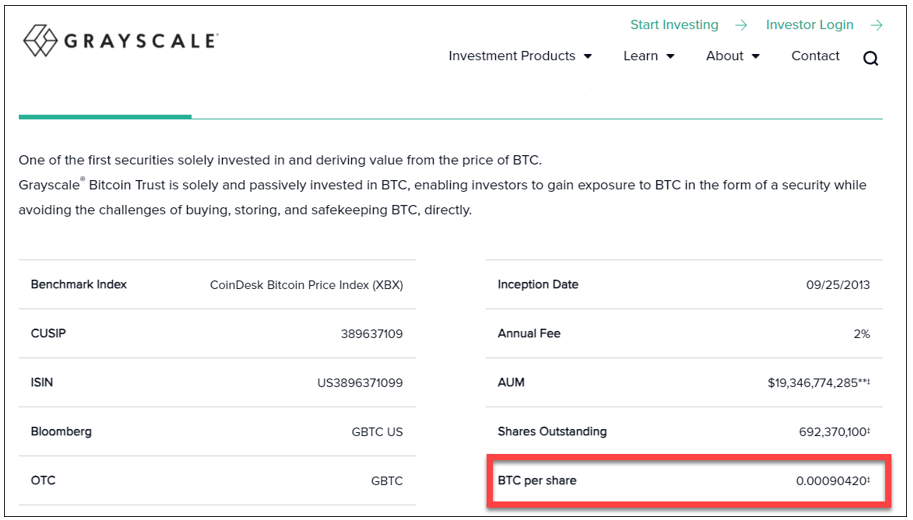

At the time of writing, a share in GBTC is worth 0.00090420 BTC.

Based on the market price of BTC at the time of writing, 0.00090420 BTC is worth $27.41.

And what is GBTC trading at? A measly $19.19.

Without a doubt, GBTC is currently undervalued compared to BTC.

In fact, right now, BTC is trading at a price 42.83% higher than GBTC.

Put another way, GBTC is trading at a 29.98% discount compared to BTC.

In my opinion, the difference here is price discovery.

You see, GBTC is not an exchange-traded product. It trades over the counter.

By contrast, shares in the BlackRock Bitcoin Trust will be listed on Nasdaq, making them much more accessible and liquid.

Redemptions Allowed

One of the odd things about the Grayscale Bitcoin Trust since its inception is that the Bitcoin it holds cannot be withdrawn by its shareholders.

Now, BTC in the BlackRock Trust will go one step further but won’t go all the way: BlackRock will allow Bitcoin held in the trust to be withdrawn … but only by registered broker dealers.

Retail investors are still out of luck and will not be allowed to redeem the BTC into their own private wallets.

However, the benefit of this redemption mechanism should fix the problem I illustrated above where the price of GBTC goes way out of sync with BTC.

So, the fact that the BlackRock Trust’s shares will trade on Nasdaq — combined with the ability for brokers to redeem the Bitcoin — means there is a profit incentive to close any price differential between BTC and the BlackRock Trust’s share price.

Conclusion

At face value, the approval of BlackRock’s Bitcoin Trust looks incredibly bullish for Bitcoin.

It finally connects traditional finance liquidity (via the Nasdaq) to the Bitcoin spot market.

Looking forward, I anticipate that the trading volume for BTC will increase significantly once BlackRock’s Trust launches. This bodes incredibly well for subscribers to my Crypto Yield Hunter newsletter.

And here’s a jaw-dropping fact: Blackrock will not be holding and securing the Bitcoin held in its trust.

Interestingly, it has hired Coinbase (COIN) for that task … even though it is currently involved in legal wranglings with the U.S. Securities and Exchange Commission over regulatory compliance.

The question I want to leave you with is this: If Blackrock were concerned about the SEC sinking Coinbase, would they have entrusted Coinbase with such an important task?

But that’s all I’ve got for you today. Let me know your answer to my question above and any other thoughts you have on the BlackRock Bitcoin Trust by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me Chris Coney saying, bye for now.