Why the Media Barely Blinked as Bitcoin Broke to New Highs

|

| By Mark Gough |

The silence was deafening.

Over the past week — as prices soared and Bitcoin (BTC, “A”) hit a new all-time high — coverage stayed subdued.

And that’s not just my pro-crypto bias talking.

Just look at past bull markets. New highs were met with fanfare from the mainstream media. In fact, you could even say that blow-off tops were marked by the frenzy of headlines and talking heads chiming in.

So, what’s going on? And why is the media’s silence actually a bullish sign?

A Strong Sign This Bull Isn’t Over

Some say the biggest whales and most powerful market participants shape the media narrative.

From what I’ve seen in past cycles, I agree.

And that means the real frenzy only kicks in when whales are making waves. That is, when they’re ready to exit.

If that’s true, the current quiet at all-time highs is telling.

It means those powerful participants aren’t ready to sell yet. They believe, as our analysis suggests, that there is more upside still to come.

It’s yet another sign in support of our outlook: We haven’t hit the top of this cycle just yet.

So today, I want to unpack the key developments that are driving this quiet-but-powerful surge.

Bitcoin Shatters Records, Surpasses Amazon

Bitcoin’s breakout may have flown under the media radar. But it delivered a brutal wake-up call to traders who thought the No. 1 crypto was down and out.

In just 24 hours, over $500 million in positions were liquidated. More than 120,000 traders were wiped out, including those with $300 million in short positions.

It was a punishing reminder: Underestimate Bitcoin’s momentum at your own risk.

Bitcoin recently surged to an all-time high of $111,782 before stabilizing near $110,992, with current prices hovering around $109,874.

That’s a 60% increase since the November 2024 U.S. election, when Bitcoin traded just under $70,000.

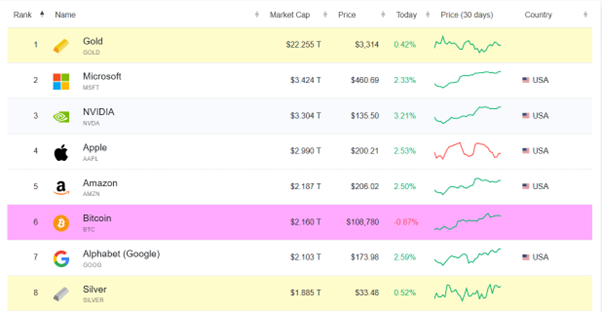

This rally has propelled Bitcoin’s market capitalization to $2.23 trillion, which has allowed it to briefly surpass Amazon and become the fifth-largest asset globally. While Bitcoin is up 18% year to date, Amazon has dropped 6%.

However, Amazon was quickly able to reclaim the No. 5 seat, leaving Bitcoin solidly in sixth.

Gold remains the largest asset class, with a market capitalization of $22.27 trillion, followed by Microsoft, NVIDIA and Apple.

Our cycle target for BTC remains near $150,000. That price would translate into a $3 trillion market, which would be enough to push it past Apple into fourth place, just behind NVIDIA.

But I don’t believe that will be where it stays.

I foresee the trillions in profits generated by gold will eventually rotate into Bitcoin.

What that number ends up being — or how fast it happens — is a timing play, and tough to model.

Gold has gained over $10 trillion in market cap since the November 2022 lows. Even a 10% rotation of that into Bitcoin would bring $2 trillion into the crypto market.

That alone could add $100,000 per BTC, pushing the price into the $200,000—$250,000 range.

That is right in line with Standard Chartered’s prediction that Bitcoin will reach $200,000 by the end of 2025.

At $200,000, Bitcoin would become a $3.5 trillion asset and overtake Microsoft for the No. 2 spot.

I believe that rotation will accelerate once Bitcoin claims the number two spot on the global marketcap leaderboard, just behind gold.

Naturally, however, this bullish market isn’t fueled by just the promise of Bitcoin’s future growth.

There are current developments paving the way, as well.

Regulatory Frameworks Expand Across the Globe

Crypto is no longer a dirty word for regulators and legislators. In fact, the call for increased clarity has rung out in almost every corner of the world.

The EU, for example, recently implemented its Markets in Crypto-Assets Regulation (MiCAR) framework.

Germany currently leads the EU in MiCAR licensing, representing 36% of all regulated providers. One of the most notable is Trade Republic. Germany’s MiCAR approval makes it one of the first fully licensed banks in the EU to offer crypto services to its 4 million users.

Meanwhile, Bitstamp — which was acquired by Robinhood in 2024 — received its Crypto Asset Service Provider (CASP) license from Luxembourg’s CSSF. It is now able to execute pan-European operations including custody, trading and order execution.

Not to be left out, Hong Kong has finalized its Stablecoin Bill.

This long-awaited piece of legislation establishes a licensing regime for fiat-referenced stablecoin issuers.

Overseen by the Hong Kong Monetary Authority (HKMA), the framework includes requirements for reserves, redemption and anti-money laundering compliance. The regulation applies to all stablecoins referencing the Hong Kong dollar, regardless of their country of issuance.

Finally, the U.S. has begun to make its own regulatory moves, as well.

In a landmark moment for crypto legislation, the U.S. Senate voted 66—32 to advance the GENIUS Act, the first comprehensive federal framework for stablecoins.

With over $200 billion in stablecoins circulating in the market, the GENIUS Act aims to bring clarity and structure through requirements for reserves, audits, disclosures and law enforcement compliance.

Backed by 16 Democrats, including Senators Cory Booker and Adam Schiff, the bill overcame a potential filibuster with bipartisan support.

Next, it will head to the Senate floor for a vote.

White House crypto czar David Sacks projects the bill could unlock “trillions in demand” for U.S. Treasurys.

In addition, the Securities and Exchange Commission — which has not been the most welcoming to crypto projects in the past — will host a conference on Emerging Trends in Asset Management on June 5.

The event signals increasing regulatory attention on tokenized finance and next-generation asset management.Among the key topics will be digital assets and tokenization.

SEC Commissioner Hester Peirce will participate, alongside panelists from BlackRock, Franklin Templeton, Fidelity and other major institutions.

Blockchain Infrastructure Partnerships Expand

Big things are happening on the blockchain, too.

For example, Solana (SOL, “B”), which has been a darling of this bull market, recently teamed up with enterprise blockchain provider R3.

R3’s Corda platform secures over $10 billion in institutional assets. This partnership with Solana will allow it to integrate real-world assets on public blockchains.

Private transactions on Corda will now be validated on the Solana mainnet to merge the speed of DeFi with the compliance of TradFi.

Solana Foundation President Lily Liu has joined R3’s Board of Directors to strengthen the alliance.

Also following the RWA narrative is Kraken.

The centralized exchange announced it will launch a new platform, xStocks, developed by Backed Finance. The goal? Bring DeFi freedom to stocks.

On xStocks, traders can buy and swap tokenized versions of more than 50 U.S. stocks and ETFs — such as Apple, Tesla, Nvidia and more — at any time, from anywhere.

And each token will be backed by real shares held by Backed Finance.

Final Thoughts

From regulatory breakthroughs to rapid technological integration, the global digital asset ecosystem is entering a new era.

I believe it is one that will be defined by legitimacy and scale.

With Bitcoin surpassing Amazon in market value and regulators stepping in with long-overdue clarity, the convergence of traditional finance and blockchain is gaining unstoppable momentum.

As Bitcoin becomes embedded in institutional frameworks and policy moves align with innovation, the definition of a “safe asset” may soon include code, not just gold.

This future is already on the way. And now is the time to prepare for it.

That’s why we plan to host a special Crypto All-Access Summit on Tuesday, June 3, at 2 p.m. Eastern.

In it, we’ll break down everything you need to know to prepare to ride the rapidly evolving crypto market.

And this summit is completely free to Weiss members. Just be sure to save your seat here.

Best,

Mark Gough