|

| By Juan Villaverde |

If you’ve been around the blockchain before, you’ve likely heard of altcoin season.

But if this is your first crypto bull market, you’re in for a wild ride.

Typically in crypto, Bitcoin (BTC, “A-”) leads the way.

When BTC rallies, the broad market tends to follow. And when it corrects, altcoins — that is, crypto assets other than BTC — fall as well. Harder, in many cases.

But that changes at a specific point in the bull market when liquidity begins to flow out from Bitcoin.

First, it lands in Ethereum (ETH, “A-”), the second largest crypto by market cap. Then, it moves on to other blue-chip cryptos. Eventually, it finds its way to smaller, more speculative plays.

Bitcoin isn’t correcting in this period. But it is no longer leading the market.

In the past, we’ve seen some altcoins surge past BTC by hundreds of percentage points — even thousands in select cases — when altcoin season hit its peak.

That’s why it gets people so excited.

Own crypto apart from Bitcoin? With the right coins, you could pile up 3x, 5x, 10x in short order. Gains that are nearly impossible to find outside crypto.

Since altcoin season is by far the most lucrative time to be invested in crypto, the obvious question is this: When can we see the next one?

This brings us to Ethereum. Which is, in my opinion, the key to when altcoin season will take off in earnest.

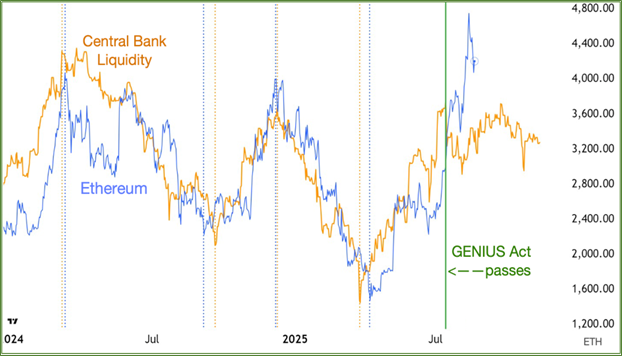

Central Bank Liquidity (CBL) and Ethereum

This is my favorite chart in crypto right now.

The orange vertical dotted lines mark CBL highs and lows. While the blue vertical dotted lines mark 320-day-cycle highs and lows on ETH.

Notice how closely they match up.

Indeed, the correlation between CBL and Ethereum prices is also striking — much stronger than with Bitcoin.

Unlike Bitcoin, as CBL made lower highs and lower lows, so too has Ethereum. That is, until the mid-July passing of the GENIUS Act (marked by the green vertical line).

Let’s zoom in.

Ethereum Surges as CBL Flatlines

Notice that after July 14 (marked by the green vertical line), Ethereum has surged higher, even as liquidity flatlined.

What’s causing this divergence?

Answer: The GENIUS Act, which formally added stablecoins to the global dollar system, giving them Washington’s seal of approval.

This unleashed massive institutional investment flows into Ethereum — where most stablecoins trade. That was enough to push it and decouple from CBL for the first time since 2022.

We saw something similar with Bitcoin, you may recall. It decoupled from liquidity on speculation (and later confirmation) of spot ETF approval. That’s what sparked the current bull market.

So, the question now is this: Is the same thing happening to Ethereum?

In other words, will Ethereum surge past its all-time high of $5,000 despite flatlining liquidity?

Recent price action certainly suggests it will.

This is why I said last week: If we are going to see a big altcoin season, this is when it would happen.

But before you break out the champagne, you need to keep some context in mind:

- Ethereum hit a new all-time high. Now it needs to hold it. Earlier this week, ETH touched just above its previous record high. This is an encouraging sign, but the market needs more. We need to see Ethereum confidently close above that level for a few days. A spillover effect — where other alts begin to run — would likely only occur if ETH makes a decisive move above its all-time high.

-

Altcoin seasons don’t take off without a liquidity surge. At least, we’ve never seen one with liquidity flatlining or falling. And I doubt we ever will.

That’s because altcoin seasons require two things: surging liquidity and a strong catalyst.

In 2020, we had both. Central banks pumped trillions into the global economy and provided liquidity … as the DeFi revolution (decentralized exchanges, automated lending pools, yield farming, etc.) provided the catalyst.

Today, we have a catalyst: the GENIUS Act, Ethereum ETFs and the recent surge of TradFi companies loading their treasuries with select altcoins.

But no liquidity surge yet.

- Spillover onto most alts may be limited. This is an institutional bull market, driven by institutional capital. Pouring first into Bitcoin, and now Ethereum. That means the main beneficiaries are likely to be assets institutions can actually own. And only a tiny handful of altcoins qualify as institutional grade.

- Institutions don’t FOMO. Retail investors fueled past altcoin seasons by throwing money at anything even remotely connected to crypto. Institutions, the so-called smart money, don’t behave that way.

Accordingly, whatever altcoin season we get this time will likely be more surgical and targeted.

That means I expect it will narrowly focus on specific coins with real-world utility that Wall Street believes have staying power.

So, what exactly … does all this add up to?

Well, we’re already seeing early signs of a rotation into altcoins. Most notably, Ethereum has begun to break away from liquidity trends for the first time since this bull market began.

That’s huge.

There are already a few coins pushing past Bitcoin. But keep in mind that central bank liquidity is still flatlining. That’s eventually going to constrain ETH’s rally. Unless, of course, CBL starts going up again.

Beyond that, this next altcoin season will likely be focused on projects with working products and real-world use cases.

That rules out memecoins and the vast majority of “vaporware” coins.

Because of this, it’s entirely possible it’s so contained it barely registers on traditional metrics. Like total altcoin market cap, or the altcoin-to-Bitcoin ratio.

In other words, it might be almost invisible … unless you know exactly where to look.

For that, I suggest you RSVP for our urgent crypto briefing tomorrow, Sept. 2, at 2 p.m. Eastern.

In it, Weiss Ratings founder Dr. Martin Weiss and crypto expert Mark Gough will show you how to position yourself to catch this wave … before the Fed's decision on Sept. 17 potentially accelerates this entire rotation.

Registration closes tonight. So be sure to save your seat now.

Best,

Juan Villaverde