|

| By Sean Brodrick |

The market has zigzagged lower for over a week now. There’s probably further to go. I’m not a doom-meister.

There is something very important you should be doing now, something you should buy and something you should plan on buying very soon.

To me, the reason for the pullback is simple and threefold.

Reason No. 1 for the Pullback: Earnings

You may have seen the babble-heads on TV chattering about how S&P 500 earnings are improving. For the most part, it is actually the estimates that are improving, up from previous dire levels.

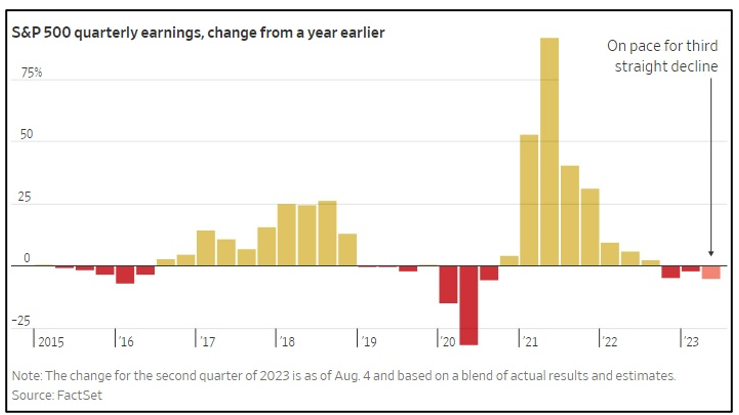

In fact, if earnings for this quarter come in where they are currently forecast, it will be the third quarter in a row of year-over-year earnings decline in the S&P 500, as this chart from the Factset and The Wall Street Journal shows.

If earnings are going down, it’s just logic that share prices will follow.

Reason No. 2 for the Pullback: Too Much, Too Soon!

The other reason stocks are selling off is that they’ve already enjoyed a fantastic run. The S&P 500 is up more than 17% since the start of the year. The Nasdaq-100 is up nearly 40%!

Nothing goes in a straight line. Some giveback is normal and necessary. And as we can see from this chart, the S&P 500, as tracked by the SPDR S&P 500 ETF Trust (SPY), is in a short-term downtrend.

You can see that the S&P 500 peaked out a little over a week ago, and then started tumbling. The Force Index, my favorite momentum indicator, turned negative. The S&P’s next level of support is the 50-day moving average.

Bears will tell you that the S&P 500 is going all the way to the May lows, then lower. While I’m looking for lower prices short term, I think the bears are wrong, as they’ve been wrong all year.

Reason No. 3 for the Pullback: Fear Itself!

The third reason the market is selling off is that ol’ bugaboo that has frightened traders all year — fear of a recession. This time, it’s not a U.S. recession. It’s fear of a global recession.

I’ll give you three talking points the bears are using:

- Microchip Technology (MCHP) — which sells the basic chips that go into products in nearly every sector — reported great earnings last week, but also warned that it sees weakness in China and Europe.

- Maersk Shipping — the world’s second-largest shipping company — reported a sharp fall in second-quarter earnings on the back of plunging container rates. That’s no surprise as supply chain SNAFUs straighten out. But the company also warned of more weakness in the third quarter.

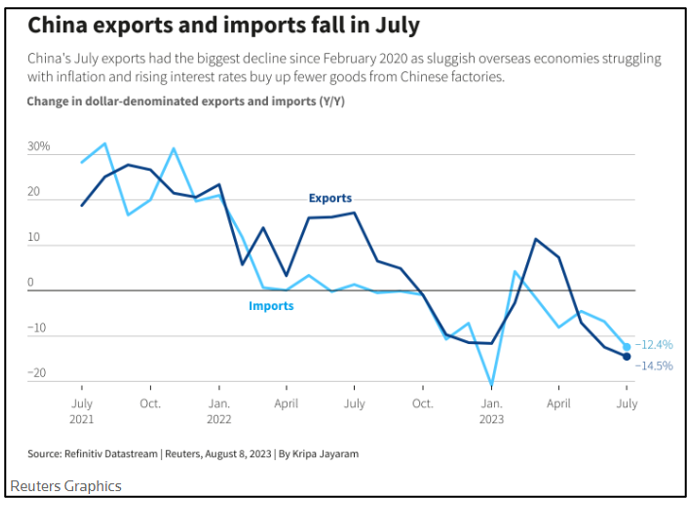

- And yesterday, China reported that its imports and exports both plunged in July, as this chart from Reuters shows.

So, that’s the 1-2-3 of the bears’ outlook. Now, why am I not buying the doom and gloom da bears are selling?

Stimulus to the Rescue, and Commodities will Rebound!

First, anyone who thinks China is going to sit on its hands and watch its economy implode has another thing coming. Of course the leadership in Beijing is going to unleash a flood of stimulus.

When China pumps stimulus, as it has in the past, this usually lights a fire under commodities.

Second, America has already opened its own floodgate of stimulus. I’m talking about the $280 billion CHIPS and Science Act, which encourages building new semiconductor chip plants … as well as the $740 billion Inflation Reduction Act, which targeted green energy and climate spending.

At the same time, we’re getting $1.2 trillion in the Infrastructure Investment and Jobs Act.

Add it all up, and construction of all types is booming in America.

In fact, construction spending on U.S. factories more than doubled over the past year, hitting an annual rate of nearly $200 billion in May, according to the U.S. Census Bureau.

I probably don’t need to tell you that’s bullish for commodities as well.

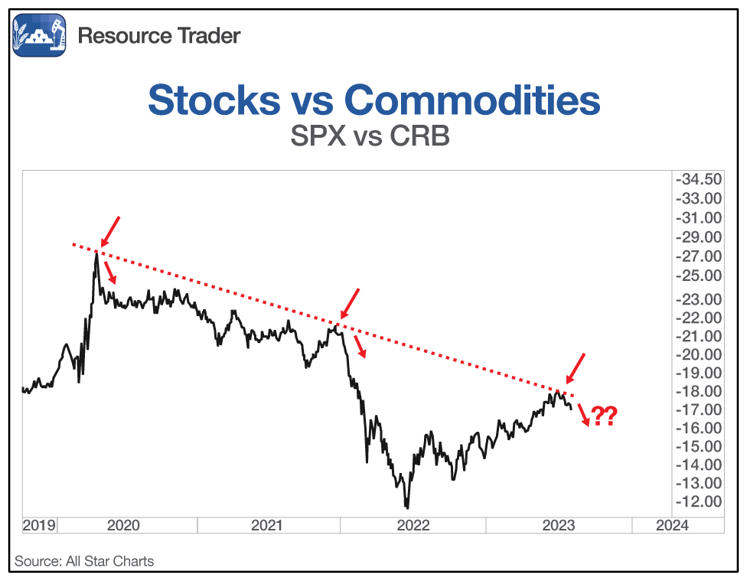

Now, let’s look at one more chart, one I shared with my Resource Trader Members on Tuesday. It shows the ratio of the S&P 500 divided by commodities (as tracked by the CRB Index).

That rally in the first part of the year made stocks expensive to commodities. And it brought this ratio of stocks-to-commodities right up to overhead resistance. It could resolve in a few ways …

- Stocks could get cheaper.

- Commodities could get more expensive.

- Both could go higher … or lower … but commodities would outperform.

I’m feeling pretty good that we’ll see an oil rally in the coming months. There are many reasons.

Basically, oil demand is rising, and the Strategic Petroleum Reserve is running on empty. Thanks to the big sell-off in the SPR last year and this year, the U.S. government is now left with a petroleum reserve sufficient for only 16 days! The safety cushion is nearly gone.

3 Things You Should Be Doing

If you saw the warning signs as I did, you spent the past couple weeks grabbing fistfuls of gains. That’s what we did in Resource Trader and Supercycle Investor.

Did you skip that step in your own portfolio? Don’t worry. As I said, a market rebound is coming eventually.

The second thing we did is add leveraged inverse funds in each publication. These funds go up as the market goes down. If you didn’t do that, there’s still time.

There is still time to buy inverse funds. But these are extremely speculative. If you buy one, be sure you know what you are doing. These kinds of funds are for very short-term trades only.

The third thing you do in a pullback is make your shopping lists.

I recommend you put oil stocks on that list. I expect oil to be one of the leading commodities in the second half of the year. The potential profits in select stocks will be big. Heck, they might be downright glorious.

So, don’t let this sell-off ruin your mood. Use it wisely. Take what gains you can, hedge if you want to and, most importantly, put your shopping list together … a commodity-heavy list for the rebound to come.

All the best,

Sean

P.S. There’s a fourth way to cushion and even profit off sell-offs. In fact, it is the only solution we see to “America’s Great Income Emergency.” View this presentation for more.