15 Current ‘A’-Team Stocks ... and Our MVP Pick

|

| By Gavin Magor |

Negative news may sell, but we like to keep this issue optimistic and ready to take advantage of whatever market we have at hand.

If nothing else, expect a few British jokes.

One thing is for certain: Whatever your investing goals may be, checking a stock’s Weiss rating is one of the wisest moves an investor can make.

Why? Because the stock market is so vast, so unpredictable and for many stocks, so uncharted, that having an unbiased grade becomes pivotal.

Fortunately, the Weiss ratings are always there to lend a helping hand.

And today, I want to take a look at all of the current “A”-rated stocks within our database, because there are currently a lot of “A”-rated names: 15 to be precise.

Let’s get started …

Straight ‘As’ for These Stocks

After going through a rigorous test with a massive bias for safety, typically only a select few meet the criteria to be given an “A” grade.

To our 100% independent criteria, a stock meets an “A” by “having an excellent track record for providing strong performance with minimal risk, and it is trading at a price that represents good value relative to the company’s earnings prospects.”

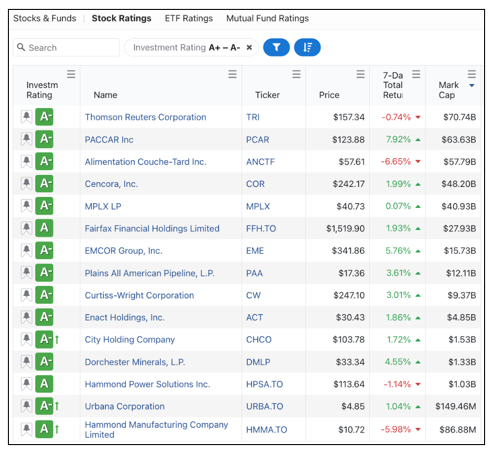

After a few easy steps of filtering for “Investment Rating” of “A+” to “A-” on the Weiss stock ratings page, here’s what populated:

I then sorted by market capitalization, highest to lowest.

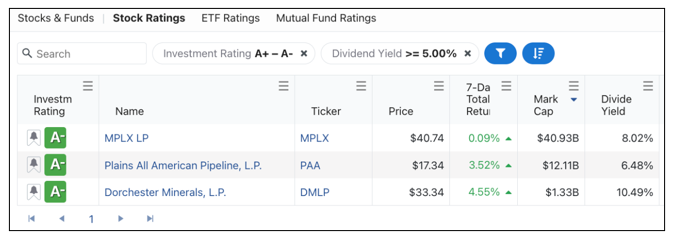

And to take my criteria search a step further, I limited down the names to those with a dividend currently yielding above 5%.

Here’s what populated:

There are a number of reasons investors could want to seek stocks with a higher dividend.

One big reason at the moment is that the Federal Reserve is anticipated to begin cutting interest rates sometime this summer, and investors may need to find other areas to find income.

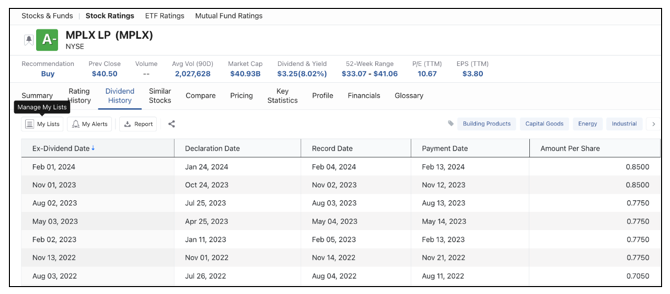

Out of the three above-listed names, I want to focus on MPLX (MPLX) because of its longest tenure as an “A”-rated name, its 8.02% yield and the fact that shares are up 10.84% to start the year.

MPLX is a diversified, large-cap master limited partnership formed by Marathon Petroleum Corporation (MPC) that owns and operates midstream energy infrastructure and logistics assets and provides fuels distribution services.

Financially, the company appears very sound and has seen growth in EBITDA and cash flow.

And in addition to that high yield, the company has actually increased its dividend payout the past two financial quarters:

Among other things our ratings liked about this stock, in some of its most recent ratings upgrades, we saw earnings per share increase, EBIT go up and the quick ratio increased.

If you’re looking for an energy name with a high yield, this is certainly a name I would consider.

But that is just the tip of the iceberg when it comes to the Weiss stock ratings and what you could be searching for.

You can search sectors, ratings factors, look at balance sheets, research industries, moving averages and so much more.

This is a very exciting time for the stock market. There are certainly major reasons for investors to be cautious with inflation still hot, the Fed walking on a tightrope when it comes to its interest rate moves and the fact that it is an election year in the U.S.

But no matter the uncertainty, the Weiss ratings offers investors a rational opinion akin to a sailor using a compass in rough seas trying to find their home port.

With Weiss Ratings incredible and easy-to-use tools, your best investment horizon is still ahead.

Cheers!

Gavin Magor

With PJ Amirata